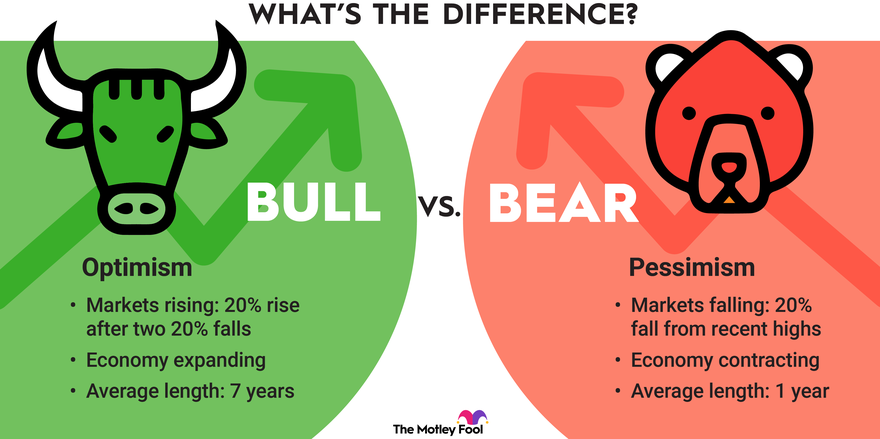

A bull market is occurring when the economy is expanding and the stock market is gaining value; a bear market is in effect when the economy is shrinking. Let's take a closer look at these two types of markets and their relevance for your investing strategy.

What is a bull market?

What is a bull market?

According to the formal definition, a bull market takes effect when stock prices have broadly increased by at least 20% since the last market downturn. Bull market conditions can last for decades, and many successful investors have bet very wrongly by trying to predict the end of a bull market.

The U.S. stock market was in a bullish mode after recovering from the 2008-09 financial crisis until pandemic-related uncertainty caused a market crash in 2020. The chart below shows that, aside from minor market corrections, a bull market persisted for more than a decade.

The bear market in 2020 lasted only 33 days, far less than the average historical bear market duration. The S&P 500 index as we know it was created in 1923, but back then it only included 233 companies. The 500 company threshold was introduced in 1957.

The S&P 500 has experienced 29 bear markets since the late 1920s, and stock values have diminished by an average of around 35% in each of those periods. It's also worth noting that in that same time frame of almost a century, there have been 27 bull markets.

These periods almost always follow a bear market, as stocks have a steady history of rising with the passage of time. Moreover, stock values have increased by more than 100% on average in each of those bull markets.

Bear markets appear on average every 3.5 or so years. The good news is that bull markets tend to last considerably longer than bear markets. Case in point: The historical average length of a bear market is 289 days, compared to the average length of a bull market, which is 965 days.

What does this tell investors? If you're investing in stocks for the long term, you will encounter both bull and bear markets on a fairly regular basis. However, if you stay invested through those peaks and valleys, history has shown that you can benefit from significant upside over the long run.

The stock market has not only recovered from every single bear market but has habitually outpaced its prior returns in the bull periods that follow.

What is a bear market?

What is a bear market?

A bear market is defined as starting when stock prices broadly decline by 20% and keep trending lower. Bear markets are characterized by people losing their jobs, gross domestic product (GDP) declining, and the stock market losing significant value. Bear markets almost never last as long as bull markets and can create buying opportunities for investors.

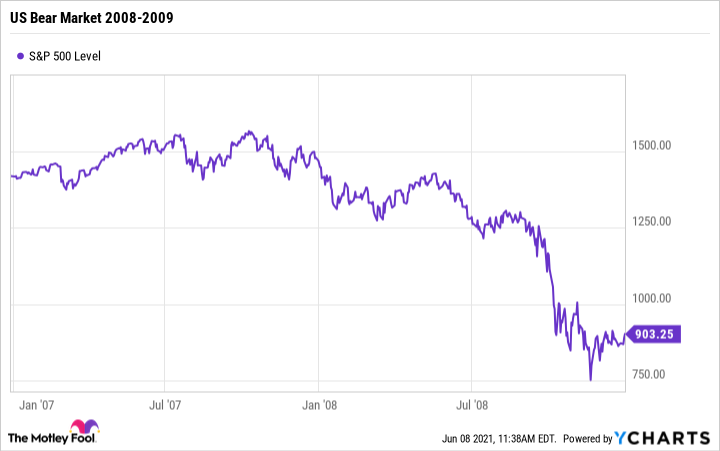

The infamous 2008 bear market began during the crash of the housing sector, as made apparent by the chart below:

The most recent bear market occurred in 2022, following the very short bear market of 2020. The 2022 bear market lasted approximately nine months, from January 2022 to mid-October 2022, when the S&P 500 hit its low point for the year. Looking at each of the major indices in the U.S., the Dow Jones Industrial Average entered a bull market in November 2022, followed by the Nasdaq Composite Index in May 2023 and the S&P 500 in June 2023.

The chart below illustrates the performance of these three major indexes from the time the bear market began in early 2022 to the time of this article.

How they differ

How do bull markets and bear markets differ?

If you want to know whether a bull or bear market is in effect, pay attention to these factors:

Stock market performance

Stock prices are rising in a bull market and declining in a bear market. The stock market under bullish conditions is consistently gaining value, even with some brief market corrections. The stock market under bearish conditions is losing value or holding steady at depressed prices.

Change in GDP

Rising GDP denotes a bull market, while falling GDP correlates with a bear market. GDP increases when companies' revenues increase and employee pay rises, which enables increased consumer spending. GDP decreases when companies' sales are sluggish and wages are stagnant or declining.

Bear markets are closely linked with economic recessions and depressions. Recessions are formally declared when GDP decreases for two consecutive quarters, while depressions occur when GDP decreases by 10% or more and the downturn lasts for at least two years.

Unemployment rate changes

A declining unemployment rate is consistent with a bull market, while a rising unemployment rate occurs during a bear market. During bull markets, businesses are expanding and hiring, but they may be forced to lower their head counts during bear markets. A rising unemployment rate tends to prolong a bear market since fewer people are earning wages, which results in reduced revenue for many companies.

Rate of inflation

Price inflation may be a problem when the economy is booming, although inflation during a bear market can still occur. High demand for products and services in bull markets can cause prices to rise, and shrinking demand in bear markets can trigger deflation.

Prevailing interest rates

Low interest rates typically accompany bull markets, while high interest rates are associated with bear markets. Low interest rates make it more affordable for businesses to borrow money and grow, while high interest rates tend to slow companies' expansions.

Related investing topics

How should you invest?

How should you invest in a bull vs. bear market?

Growth stocks in bull markets tend to perform well, while value stocks are usually better buys in bear markets. Value stocks are generally less popular in bull markets based on the perception that when the economy is growing, "undervalued" stocks must be cheap for a reason.

How you invest in stocks in bull and bear markets depends mainly on your time horizon. If you do not need the money for decades, then it matters little whether the market is currently bullish or bearish. As a buy-and-hold investor, you probably shouldn't change your investing strategy based on prevailing market conditions.

The stock market can be bearish even while bull markets are occurring in other asset classes and vice versa. If the stock market is bullish and you're concerned about price inflation, then allocating a portion of your portfolio to gold or real estate may be a smart choice. If the stock market is bearish, then you can consider increasing your portfolio's allocation to bonds or even converting a portion of your portfolio into cash. You can also consider geographically diversifying your holdings to benefit from bull markets occurring in other regions of the world.

Regardless of the current state of the stock market, it's important to stay focused on the long-term prospects of the companies in which you are invested. Companies with great business fundamentals are likely to produce significant returns for your portfolio over time.