Taiwan Semiconductor (TSM 1.32%) is a leading semiconductor manufacturing company based in Taiwan. In 1987, it created the industry's Dedicated IC Foundry business model. Instead of developing its own semiconductors, Taiwan Semiconductor manufactures them for others.

In 2023, the company produced almost 11,900 different products using 288 distinct process technologies. It manufactures semiconductors for companies in the computing, smartphone, Internet of Things (IoT), automotive, artificial intelligence (AI), and consumer electronics industries.

Taiwan Semiconductor is investing to expand its semiconductor manufacturing capacity. It's building new fabrication plants to produce state-of-the-art semiconductors to support its customers' growing needs.

The company's growth has many people interested in learning how to invest in its stock. Here's a step-by-step guide to investing in the semiconductor stock and some factors to consider before adding it to your portfolio.

Stock

How to buy

How to buy Taiwan Semiconductor stock

Even though Taiwan Semiconductor is a foreign company, it's still relatively easy to buy shares of the semiconductor maker. Its American depository receipts (ADRs) trade on the New York Stock Exchange (NYSE) under the stock ticker TSM. Here's a step-by-step guide on how to add the company to your portfolio.

Step 1. Open a brokerage account

You'll need to open and fund a brokerage account before buying shares of any company. If you don't have one yet, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2. Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. A good rule of thumb is that you shouldn't invest money you might need over the next three to five years, such as your emergency fund. You'll then want to figure out how to allocate that money.

The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. You don't have to get there all at once. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3. Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Taiwan Semiconductor stock.

Step 4. Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (TSM for Taiwan Semiconductor).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Here's a screenshot of an order page from the five-star rated Fidelity Investment's trading platform:

Once you complete the order page, click to submit your trade and become a Taiwan Semiconductor shareholder.

Should I invest?

Should I invest in Taiwan Semiconductor?

Investors need to spend time researching a stock before buying shares. Hopefully, this due diligence will increase your belief that the shares are a good long-term investment. However, you might discover something about a company you don't like, causing you to pass on buying the stock. To help you on your research journey, here are some factors that might lead you to invest in Taiwan Semiconductor:

- You like Taiwan Semiconductor's business model of being a contract manufacturer instead of a developer of semiconductors.

- Buying shares would increase your portfolio's diversification by adding more international exposure.

- You're comfortable with the geopolitical risk of investing in a company based in Taiwan.

- You think Taiwan Semiconductor can grow its revenue and earnings at above-average rates in the future.

- You believe Taiwan Semiconductor's stock can outperform the S&P 500 over the next three to five years.

- You're seeking dividend income and are OK with the foreign exchange risk of investing in Taiwan Semiconductor's stock.

On the other hand, here are some reasons you might not want to buy shares of Taiwan Semiconductor:

- You don't understand what Taiwan Semiconductor does or how it makes money.

- You're concerned about the future of Taiwan.

- You're not sure Taiwan Semiconductor can be a market-beating stock over the long term.

- You're not convinced that Taiwan Semiconductor's investments to increase its capacity will grow shareholder value.

- You'd prefer not to invest in a company headquartered outside the U.S.

- While you desire dividend income, you're concerned about the foreign exchange risk that could cause the payout to fluctuate.

- You're not sure whether the additional geopolitical and foreign exchange risks are worth the reward potential Taiwan Semiconductor stock offers investors.

- You're concerned about growing competition from companies like Intel (INTC 2.41%).

Profitability

Is Taiwan Semiconductor profitable?

Reviewing a company's profitability is an important part of the research process. Investors will want to see that it's profitable or on the path to profitability. They will also want a clear vision for profit growth in the future because profit growth has historically played a key role in driving a stock's price higher over the long term.

Gross Profit

Taiwan Semiconductor is a profitable company. It reported more than $20 billion in revenue during the second quarter of 2024, up nearly 33% from the prior-year period. Meanwhile, the company delivered a strong net profit margin of 36.8%. It also has a history of producing positive free cash flow. The company uses its cash flow to make new investments and pay dividends.

For example, in late 2023, it bought a 10% interest in Intel's IMS Nanofabrication business for more than $400 million. It also invested about $100 million into the initial public offering (IPO) of Arm Holdings (ARM 0.04%). Taiwan Semiconductor also continues to invest in expanding its semiconductor manufacturing capacity. These investments should help grow its revenue and profitability in the future.

Dividends

Does Taiwan Semiconductor pay a dividend?

Taiwan Semiconductor makes dividend payments to its investors. The company declares dividend payments based on the New Taiwan dollar (NT), Taiwan's official currency. However, it pays dividends to American depositary receipt (ADR) holders in U.S. dollars.

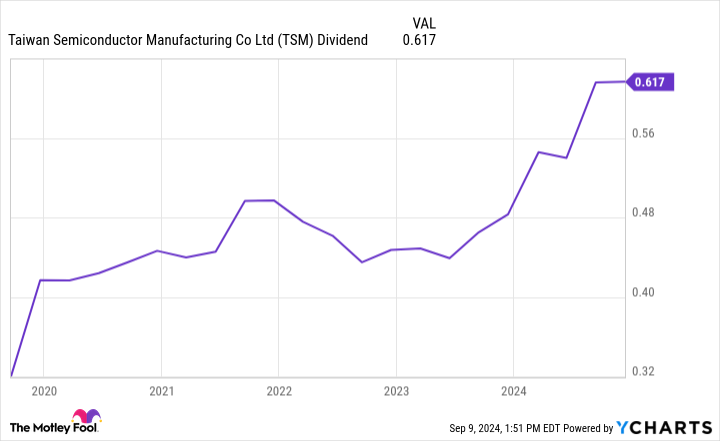

Taiwan Semiconductor has routinely increased its dividend over the years. For example, it declared a dividend of 4.00 New Taiwan dollars per share ($0.63 per ADR) for the second quarter of 2024, up from NT3.50 per share ($0.55 per ADR) in the prior-year period. However, actual dividend payments received by ADR holders tend to fluctuate due to changes in the exchange rate between the NT and U.S. dollars:

That foreign exchange risk is something investors need to be aware of since it could cause dividend payments received to fluctuate from quarter to quarter.

ETF options

ETFs with exposure to Taiwan Semiconductor

Lots of investors prefer to invest passively as opposed to directly owning stocks they must actively manage. They can easily do that through exchange-traded funds (ETFs).

Exchange-Traded Fund (ETF)

Several ETFs hold shares of Taiwan Semiconductor. Three ETFs with large allocations to the semiconductor stock in mid-2024 were:

- VanEck Semiconductor ETF (NYSEMKT:SMH): This ETF aims to track the performance of companies involved in semiconductor production and equipment. Taiwan Semiconductor was its second-largest holding in mid-2024, at 14.3% of its assets. The fund had a 0.35% ETF expense ratio.

- First Trust S-Network Future Vehicles & Technology ETF (NYSEMKT:CARZ): This fund invests in companies engaged in electric and autonomous vehicle manufacturing or provides materials or technologies for the future of vehicles. Taiwan Semiconductor was the fund's fourth-largest holding in mid-2024, at 4.5% of its assets. The fund had a 0.7% expense ratio.

- Invesco PHLX Semiconductor ETF (NYSEMKT:SOXQ): This ETF tracks semiconductor stocks. Taiwan Semiconductor was its fourth-largest holding in mid-2024, at 4.7% of its assets. The fund had a 0.19% total expense ratio.

Stock splits

Will Taiwan Semiconductor stock split?

Taiwan Semiconductor didn't have an upcoming stock split on the calendar as of mid-2024. The company hasn't completed a stock split in its history. Instead, the semiconductor company has routinely paid some or all of its dividends in stock, with the stock dividend payments acting like mini stock splits. Taiwan Semiconductor paid its last stock dividend in 2009.

Related investing topics

The bottom line on Taiwan Semiconductor

Taiwan Semiconductor has been a trailblazer in the semiconductor industry since its founding in 1987. It has grown into a leading contract manufacturer in the industry and expects to continue growing as it expands its capacity and makes additional investments.

However, the company has some unique risks. As a Taiwan-based company, it faces geopolitical and foreign exchange risks. Investors need to consider these factors carefully before buying shares.

FAQ

Investing in Taiwan Semiconductor FAQ

How can I buy stock in Taiwan Semiconductor?

You can buy stock in Taiwan Semiconductor in any regular brokerage account or stock trading platform. The Taiwan-based company's American depositary receipts (ADRs) trade on the New York Stock Exchange under the stock ticker TSM.

Is Taiwan Semiconductor publicly traded?

Taiwan Semiconductor is a publicly traded company that trades on the New York Stock Exchange under the ticker TSM.

Who are the biggest investors in Taiwan Semiconductor?

As of mid-2024, the three biggest investors in Taiwan Semiconductor were Fidelity (1%), Sanders Capital (0.8%), and Capital World Investors (0.8%).