Trump Media & Technology Group (DJT -1.98%), or TMTG, is the owner of Truth Social. The social media platform created by former President Donald J. Trump went public in 2024 after completing its business combination with a special purpose acquisition company (SPAC).

Given Trump's involvement and his running for office again, TMTG is a popular stock. This enthusiasm for the company likely has many of the former president's fans wondering whether it's a good investment. Here's everything you need to know about how to invest in stocks like Truth Social, including how it completed an initial public offering (IPO).

IPO

How to invest

How to buy stock in Truth Social

Now that Truth Social's parent company, TMTG, has completed its business combination with Digital World Acquisition Corp, anyone can buy shares in the company. However, you'll need to take a few steps before buying its stock. This four-step guide will show you how to add the social media stock to your portfolio:

Social Media

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You shouldn't invest money you can't afford to lose, such as your emergency fund or the money you're saving for a down payment on a car or new house.

You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Buy & Hold Strategy

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, review its balance sheet, find out how it makes money, and consider other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

As noted, an important part of investment research is looking at a company's competitors. Here are three publicly traded Truth Social competitors that investors should also thoroughly research before investing in the social media company's stock:

1. Meta Platforms (Facebook)

Meta Platforms (META -1.73%) is the world's biggest social media company. Meta owns four of the seven largest social media platforms by monthly active users (Facebook, WhatsApp, Instagram, and Facebook Messenger), led by Facebook at 3 billion.

The social media giant generated a staggering $39 billion in revenue during the second quarter of 2024 (mostly from advertising) and was highly profitable ($13.5 billion of net income).

2. Reddit

Reddit (RDDT 4.27%) went public shortly before Truth Social. It's a much larger platform with about 342 million unique weekly active users. The company generated $281 million in revenue in the second quarter of 2024 (up 54% year over year). However, it was not yet profitable, posting a $10.1 million loss in the period (though that's an improvement from $41 million in the second quarter of 2023).

3. Pinterest

Pinterest (PINS -0.41%) ranked as the 15th-largest social media platform in mid-2024, with about 518 million monthly active users. The platform generated more than $853.7 billion in revenue during the second quarter of 2024 (up 21% year over year). It was also modestly profitable: $9 million of net income in the quarter compared to an almost $35 million loss in the prior-year period).

Monthly Active Users (MAUs)

Step 4: Place an order

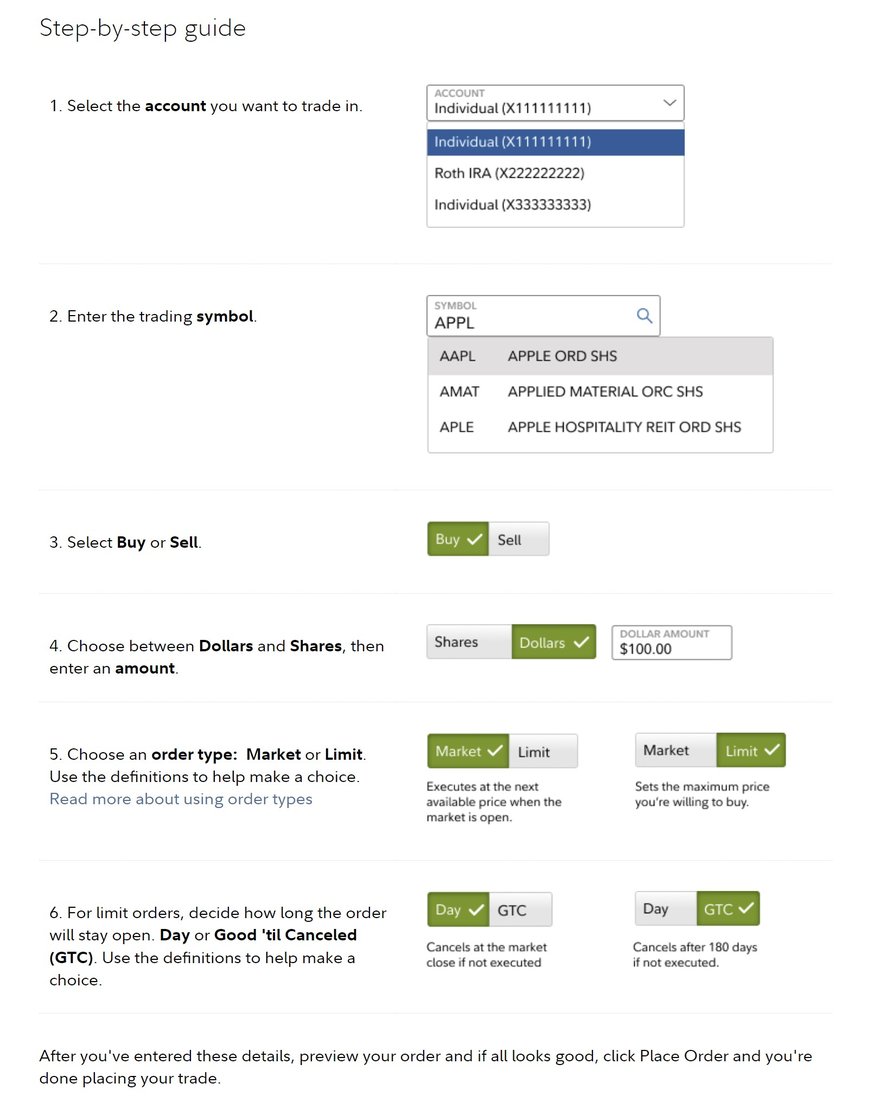

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (DJT for Trump Media and Technology Group).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become a shareholder of the former president's Truth Social.

Profitability

Is Truth Social profitable?

Researching a company's profitability is a crucial step before buying its stock because profit growth tends to drive stock price performance over the long term. Ideally, you'll want to see a company delivering growing profitability -- or at least on the path toward making money.

As of late 2024, TMTG wasn't profitable yet. Its focus was on long-term product development rather than generating revenue. As a result, it booked only $837,000 in revenue during the second quarter of 2024, mostly from advertising. It also recorded $2.3 million of interest income from its cash balance.

Meanwhile, the company posted an operating loss of $16.4 million based on generally accepted accounting principles (GAAP). About half of that loss was related to its merger with Digital World Acquisition.

Despite its limited revenue and large losses, the company expects to have enough capital to continue operating for the foreseeable future. The merger with Digital World infused the company with cash (it had $344 million at the end of the second quarter). That will give it the funds to operate and invest in building products (including its live-TV streaming initiative, Truth+) to drive long-term growth. TMTG has started rolling out its TV streaming service, including releasing it on iOS, Android, and the Web in recent months.

However, the company will eventually need to generate significant revenue and profits to fund its operations and justify its lofty post-IPO valuation. If it doesn't, shares could lose much of their value.

Dividends

Does Truth Social pay a dividend?

Truth Social's owner didn't pay a dividend as of late 2024. The company was still in the early stages of generating revenue and was not yet profitable. Given the lack of revenue and earnings and the need to invest in building out new products, the company likely won't start paying dividends anytime soon.

Should I invest?

Should I invest in Truth Social?

You'll need to determine whether Truth Social is the right investment for your situation. Here are some factors to consider that might lead you to buy its stock:

- You are a big fan of Trump.

- You believe his social media platform will see tremendous user, revenue, and earnings growth in the future.

- You're an active user of Truth Social and prefer it to other social media platforms.

- You understand the risks of investing in IPO stocks, including the fact that they can be very volatile.

- You believe that if Trump is elected again, it will significantly boost his social media platform.

- You are comfortable with Truth Social's valuation and believe it can grow into its lofty post-IPO value.

- You think Trump's conviction and the attempt on his life will boost his re-election prospects and Truth Social's growth.

On the other hand, here are some reasons you might opt against investing in Truth Social:

- Trump's values don't align with yours.

- You don't use Truth Social.

- You're concerned about the company's lofty valuation.

- You're worried that Trump's political views could scare advertisers away from the platform.

- You're concerned a Trump election loss could hurt Truth Social's valuation and growth prospects.

- You're worried that Trump's conviction could have a negative impact on Truth Social's growth.

- You're concerned there might be another assassination attempt against Trump in the future.

- You think many potential users and advertisers will opt for the much larger X platform that Elon Musk owns.

- You're concerned that Trump might lose interest in Truth Social if he becomes president again.

- You're worried that Trump's close relationship with Elon Musk might cause him to use X instead of Truth Social in the future.

ETF options

ETFs with exposure to Truth Social

Many people would rather be passive investors than actively invest in specific companies. Exchange-traded funds (ETFs) make that easy. Many ETFs enable you to gain passive exposure to a company or theme.

As a newer public company, TMTG was just starting to make its way into ETFs. As of late 2024, 36 ETFs held 2.5 million shares of Trump Media stock, according to ETF.com. The biggest holder was Schwab U.S. Small-Cap ETF (SCHA 1.05%) at 329,390 shares. However, it has a tiny allocation to the social media stock at 0.06%.

Meanwhile, Global X Social Media ETF (NYSEMKT:SOCL), a fund focused on companies that operate social media platforms, had a higher allocation at 0.6%. Given the relatively low allocations, ETFs likely aren't the best way to gain passive exposure to Trump's Truth Social platform.

Stock splits

Will Truth Social's stock split?

As of late 2024, TMTG didn't have an upcoming stock split on the calendar. The company had only recently gone public via a merger with a SPAC. Meanwhile, it traded at an accessible stock price for most investors (less than $30 a share in late 2024), so it likely won't need to split its stock anytime soon.

Related investing topics

The bottom line on Truth Social

Truth Social's parent has been a popular stock since it went public, driven by its growth potential and the link to the former president. Given that Trump is running for president again, the platform could become even more popular.

However, given the controversy surrounding Trump, the platform might not be the best investment option for many people. It has a very high valuation compared to the current size of its user base and its revenue. It's also still losing money, so you must carefully consider the risks before investing in its stock.

FAQ

Investing in Truth Social FAQ

What is the stock symbol for Truth Social?

Truth Social's parent company, Trump Media & Technology Group, trades on the Nasdaq exchange under the stock ticker DJT, the initials of former President Donald J. Trump.

Is Truth Social a publicly traded company?

Truth Social is a publicly traded company. In March 2024, Trump Media & Technology Group completed its business combination with Digital World Acquisition Company. As a result of the transaction, Truth Social now trades publicly under the stock ticker DJT.

How many users are on Truth Social?

Truth Social doesn't publicly disclose its user numbers. However, according to CNBC, the social media platform had about 4 million active users in mid-2024.

Is Truth Social free?

Truth Social is a free app available in many app stores. The company generates revenue from selling advertising.

How do I buy DJT stock?

You can buy Trump Media & Technology Group, or DJT, stock in any brokerage account. To do so, go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The stock ticker (DJT for Trump Media and Technology Group)

- The order type: a limit order or a market order

Double-check your order page and then click to submit your trade.

Where does Truth Social stock trade?

Truth Social is part of Trump Media & Technology Group, a publicly traded company that trades on the Nasdaq Stock Exchange under the ticker DJT. You can trade Truth Social stock in any brokerage account. If you don't have one yet, here are some of the best-rated brokers and trading platforms.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Matt DiLallo has positions in Meta Platforms and Pinterest. The Motley Fool has positions in and recommends Meta Platforms, Pinterest, and Vanguard Index Funds - Vanguard Small-Cap ETF. The Motley Fool has a disclosure policy.