Broadcom (AVGO 1.13%) has grown into one of the world's largest technology companies. It develops and sells semiconductors and infrastructure software solutions, and its products are crucial to the digital economy.

Both businesses are benefiting from strong growth tailwinds. Its semiconductor segment is capitalizing on robust demand from the increasing adoption of artificial intelligence (AI). In addition, the company's late-2023 acquisition of VMWare is driving accelerating revenue growth for its infrastructure software segment. These growth catalysts have driven its stock price to new heights.

Semiconductor

Broadcom could have a lot more growth ahead, and this upside potential has many investors interested in buying its stock. Here's everything you need to know about Broadcom and how to add the semiconductor stock to your portfolio.

How to buy

How to buy Broadcom stock

Anyone can buy shares of Broadcom, which trades on the Nasdaq Stock Exchange under the stock ticker AVGO. However, you'll need to take a few steps before you buy the semiconductor stock. This four-step guide will show you how to invest in stocks and add the technology infrastructure company to your portfolio.

Stock

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, its balance sheet, how it makes money, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Broadcom stock.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (AVGO for Broadcom).

- Whether you want to place a limit order or a market order. (The Motley Fool recommends using a market order because it guarantees you buy shares immediately at market price.)

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become a Broadcom shareholder.

Should I invest?

Should I invest in Broadcom?

Investing is personal. You want to build a portfolio that reflects your values, risk tolerance, and return objectives -- not every stock will be right for your situation. With that in mind, here are some reasons you might want to invest in Broadcom:

- You're excited about Broadcom's future, especially how AI could accelerate demand for semiconductors in data centers.

- Buying Broadcom stock would help diversify your portfolio.

- You think Broadcom's acquisition of VMWare will create significant shareholder value in the coming years.

- You believe Broadcom trades at a relatively attractive valuation, given its growth prospects.

- You want to invest in companies that pay a growing dividend.

- You believe Broadcom can continue delivering market-crushing total returns.

On the other hand, here are some reasons Broadcom might not be the best fit for your portfolio:

- You're unsure what Broadcom does or how it makes money.

- You already own several semiconductor and infrastructure software companies.

- Broadcom doesn't offer a dividend yield that is high enough for your needs.

- You're seeking a company much earlier in its growth cycle than Broadcom.

- You're concerned that the VMWare deal might not create value for shareholders.

- You're unsure whether AI will live up to its current hype.

Profitability

Is Broadcom profitable?

Profits are the lifeblood of any company. They're crucial to its success and help drive the long-term performance of its stock. Investors should take time to thoroughly research a company's profitability before buying shares. They should see whether it's growing its earnings or at least on the road to making money.

Broadcom is an immensely profitable company. In its 2023 fiscal year, the semiconductor and infrastructure software solutions provider grew its revenue by 8% to a record $35.8 billion.

It also achieved an adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin of 65% and generated $17.6 billion of free cash flow (an impressive 49% of its revenue). Its net income was $14.1 billion (up 22.5% year over year), while its adjusted EBITDA grew 10.4% to $23.2 billion.

The company expects fiscal 2024 to be even better. It sees revenue reaching $50 billion and delivering $30 billion of adjusted EBITDA. The company anticipates its needle-moving acquisition of VMWare and AI-driven semiconductor sales to drive another record year of revenue and profitability.

Dividends

Does Broadcom pay a dividend?

Broadcom pays a quarterly dividend. As of mid-2024, the semiconductor company paid a quarterly dividend of $5.25 per share ($21 annually). With its share price in the $1,300s in mid-2024, Broadcom's dividend yield was 1.6%. That was slightly above the 1.4% dividend yield posted by the S&P 500.

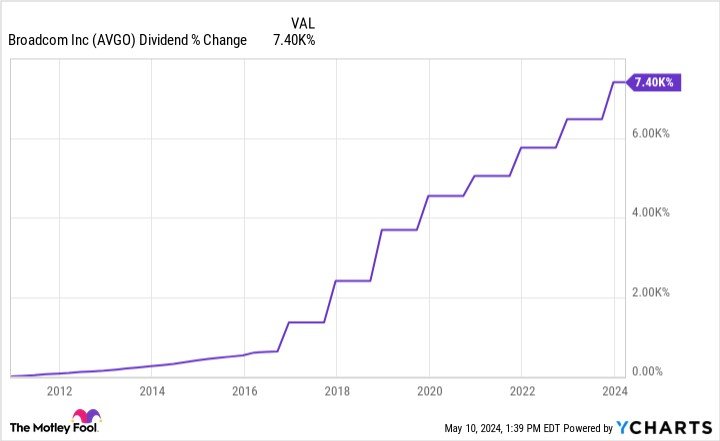

The company has an excellent track record of increasing its dividend. It raised its payout by 14% for its 2024 fiscal year, its 13th consecutive annual increase since it started paying dividends in its 2011 fiscal year. Broadcom has significantly boosted its payout over that period:

With a solid dividend yield and an excellent record of increasing its dividend, Broadcom is an appealing option for those seeking a rising income stream.

ETF options

ETFs with exposure to Broadcom

Not everyone wants to actively manage a portfolio of hand-selected stocks. People who prefer a more passive approach can invest in exchange-traded funds (ETFs). ETFs enable anyone to invest in a company passively through a thematic fund or broad market index.

Broadcom is a widely held stock. As of mid-2024, 422 ETFs held 79.4 million shares of the technology infrastructure company. The Vanguard Total Stock Market ETF (VTI 1.14%) was the biggest holder, holding 13.9 million shares. However, the broad market ETF had a rather small allocation, at 1.1%. Investors seeking an ETF with a higher allocation to Broadcom could consider the following alternatives:

- Invesco QQQ Trust (QQQ 0.87%): The fund tracks the Nasdaq-100 Index. Broadcom was its sixth-largest holding in mid-2024 (4.4% allocation). The fund charges a 0.2% ETF expense ratio.

- Amplify Cybersecurity ETF (HACK 1.06%): This ETF, focused on cybersecurity stocks, had 24 holdings in mid-2024. Broadcom was its largest holding, accounting for 10% of its net assets. The ETF had a 0.6% expense ratio.

- First Trust Nasdaq Semiconductor ETF (FTXL 1.93%): This ETF focuses on semiconductor stocks listed on the Nasdaq. In mid-2024, it had 31 holdings, of which Broadcom was its fourth-largest, at 8% of its net assets. The fund has a 0.6% expense ratio.

Stock splits

Will Broadcom stock split?

Broadcom didn't have an upcoming stock split as of mid-2024. The technology infrastructure company had never split its stock because Avago Technologies acquired Broadcom (and took on its name) in 2015.

Avago Technologies also hadn't split its stock before acquiring Broadcom. However, the original Broadcom had split its stock three times: a 2-for-1 split in 1999, a 2-for-1 split in 2020, and a 3-for-2 split in 2006.

Broadcom is an excellent candidate for a stock split in mid-2024. Its share price is well over $1,000 a share, making it less accessible to beginning investors and employees, so it wouldn't be surprising to see the company split its stock.

Related investing topics

The bottom line on Broadcom

Broadcom is a leading global technology company. Its semiconductor business is benefitting from AI-powered demand, while its infrastructure software solutions segment is getting an acquisition-driven boost from VMWare.

These catalysts should enable the company to grow its earnings and dividends at above-average rates, which could enable Broadcom to continue producing strong total returns. These factors make it a potentially appealing investment opportunity.

FAQ

Investing in Broadcom FAQ

How do I buy Broadcom stock?

You can buy Broadcom stock in any brokerage account. If you don't have one, here are some top-rated brokers and online trading platforms. Once you've opened and funded a brokerage account, you'll open up the order page and fill out all the fields, including:

- The number of shares you want to buy or the amount you want to invest in fractional shares (if your broker allows fractional shares)

- Broadcom's stock ticker symbol (AVGO)

- Order type (market or limit)

Once you've finished, double-check the order page to ensure everything is correct. Then, submit your order to become a Broadcom shareholder.

Is Broadcom a good stock to buy right now?

Broadcom could be a good stock to buy right now. As of mid-2024, the semiconductor and infrastructure software solutions company traded at more than $1,300 per share. Despite that high share price, it had a fairly reasonable valuation of 28 times its forward price-to-earnings (PE) ratio.

While that was a bit higher than the broader market indexes (the Nasdaq-100's forward PE ratio was around 26 times, and the S&P 500's was less than 21 times), it wasn't too high for a company growing as fast as Broadcom. It was benefitting from dual tailwinds (AI-powered semiconductor demand growth and its VMWare acquisition).

Those catalysts could continue to send shares higher. However, more value-conscious investors might want to wait for a lower share price to buy shares.

Is Broadcom publicly traded?

Broadcom is a publicly traded semiconductor company that trades on the Nasdaq exchange under the stock ticker AVGO.

What is the stock ticker for Broadcom?

Broadcom trades on the Nasdaq exchange under the stock ticker AVGO.

![Trump at White House podium. Official White House Photo by D. Myles Cullen. [MConverter.eu]](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F801349%2Ftrump-at-white-house-podium-official-white-house-photo-by-d-myles-cullen-mconvertereu.jpg&op=resize&w=184&h=104)