The Federal National Mortgage Association (FNMA), or Fannie Mae (FNMA 1.51%) as it's known, is a government-sponsored company formed in 1938 to help support the housing market. The company provides liquidity and support to the mortgage market. Fannie Mae buys mortgages from lenders that conform to its specifications, providing them with cash to fund more loans. It either holds the mortgages in its investment portfolio or packages them together into mortgage-backed securities (MBS) that it sells to investors.

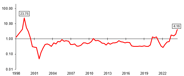

Congress created Fannie Mae during the Great Depression. It would go on to become a private shareholder-owned company in 1968. However, it ran into trouble during the Great Recession. As a result, the federal government stepped back in and placed it under the conservatorship of the Federal Housing Finance Agency (FHFA) in 2008. While that government intervention led the New York Stock Exchange to remove Fannie Mae's listing, it's still a publicly traded company on the OTC markets.

Here's everything you need to know about investing in Fannie Mae.

How to invest

How to buy Fannie Mae stock

Since Fannie Mae is still a publicly traded company, anyone can buy shares of the mortgage financier. However, because it no longer trades on a major stock market exchange, you'd need to have an account with a broker or trading platform that allows trading shares listed on the OTC markets.

For those interested in becoming a shareholder, this four-step guide will show you how to invest in stocks.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you. You should also ensure that your broker allows you to buy and sell shares of companies that trade on the OTC markets.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to buy all those stocks at once. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow your portfolio from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, review its balance sheet, find out how it makes money, and consider other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Specific to Fannie Mae, you need to make sure you have a firm grasp of what it means for the company to operate under government conservatorship.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (FNMA for Fannie Mae).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order because it guarantees you buy shares immediately at market price.

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become a shareholder of the mortgage company.

Should I invest?

Should I invest in Fannie Mae?

Fannie Mae is still a publicly traded company despite its troubles during the financial crisis. However, it remains under the conservatorship of the FHFA. So, while you can invest in the company, you need to understand the ramifications of its relationship with the government. The FHFA has the power of the company's management, board, and shareholders. While Fannie Mae operates as a business, the FHFA has the ultimate authority over its operations.

The U.S. Treasury also has a senior preferred stock investment in Fannie Mae, which also gave it warrants to buy almost 80% of its outstanding shares for a nominal price. Because of this arrangement, most of the value the company creates by providing liquidity to the mortgage market accrues to the government in exchange for its continued support.

Given these factors, Fannie Mae is likely not going to be an appealing investment. It will probably not be a compelling investment opportunity until it is in a position where the FHFA can end its conservatorship of the company. There are many better ways to invest in real estate these days than Fannie Mae.

Profitability

Is Fannie Mae profitable?

Fannie Mae lost billions of dollars on its investment portfolios and MBS guarantees during the financial crisis, forcing the government to step in to provide additional financial support. The company has steadily climbed out of that big hole, returning to profitability in 2012. By 2014, it repaid all the money it received and has since poured billions of dollars into the U.S. Treasury.

The company has remained profitable over the past decade. It reported $4.3 billion of net income in the first quarter of 2024. That was a $377 million increase from the fourth quarter of 2023 and up from $3.8 billion in the year-ago period. Fannie Mae's growing income increased its net worth to $82 billion, a significant rise from $25.3 billion in 2020.

The company's strong profitability enabled it to continue supporting the mortgage market. It provided $72 billion of liquidity to the mortgage market in the first quarter of 2024 by purchasing and refinancing loans backed by single-family homes and multifamily rental properties.

Dividends

Does Fannie Mae pay a dividend?

Fannie Mae no longer pays quarterly dividends to its investors. The company suspended its dividend in 2008 when the government put it under the conservatorship of the FHFA. However, the company makes preferred dividend payments to the U.S. government, which has a senior preferred stock position in the company. It retains all the earnings it doesn't pay to the government to provide additional liquidity to the mortgage market.

ETFs

ETFs with exposure to Fannie Mae

While Fannie Mae is a publicly traded company, you can't passively invest in the mortgage financier through exchange-traded funds (ETFs) since it's not a widely held stock among ETFs. However, you can use ETFs to invest in the mortgage market and MBS issued by the company. Here are a few mortgage ETFs to consider:

- iShares MBS ETF (NYSEMKT:MBB): This fund provides investors with exposure to MBS issued by Fannie Mae, Freddie Mac, and Ginnie Mae. It held more than 10,000 MBS investments in mid-2024. The ETF enables investors to generate income from MBS backed by government agencies. It had an income yield approaching 4% and a 0.04% net ETF expense ratio.

- Vanguard Mortgage-Backed Securities ETF (NYSEMKT:VMBS): The fund provides diversified exposure to MBS issued by Ginnie Mae, Fannie Mae, and Freddie Mac. It provided investors with income via more than 1,400 bonds and had an average income yield approaching 4% over the past year. The ETF had a 0.04% expense ratio.

- iShares Mortgage Real Estate ETF (REM 1.9%): The ETF aims to track the investment results of an index comprised of real estate investment trusts (REITs) that hold residential and commercial mortgages. These mortgage REITs use leverage to buy securities backed by Fannie Mae, other agencies, and those tied to commercial mortgages. The fund held 32 of these real estate stocks in mid-2024 and had a dividend yield approaching 10% over the past year. The fund had a 0.48% expense ratio.

Related investing topics

Stock splits

Will Fannie Mae stock split?:

Fannie Mae didn't have an upcoming stock split as of mid-2024. Given its low share price (around $1.50 a share in mid-2024), a reverse stock split is more likely in the company's future. That probably wouldn't happen until it's no longer under the conservatorship of the Federal Housing Finance Agency.

The bottom line on Fannie Mae

Fannie Mae has provided liquidity to the housing market since the Great Depression. Although the company lost billions of dollars during the Great Recession, it has gotten back on its feet thanks to the government's support, which placed it under the conservatorship of the FHFA, where it remains today.

However, even though it's still a publicly traded company and very profitable, investors have better options than Fannie Mae since it's a government-controlled entity. Those who really want to invest in the mortgage finance industry could consider an ETF focused on securities backed by the company instead.

FAQ

Investing in Fannie Mae FAQ

Can I invest in Fannie Mae?

You can invest in Fannie Mae. It's still a publicly traded company on the OTC markets. However, it remains under the conservatorship of the Federal Housing Finance Agency, so the government agency has the ultimate authority over the company's operations.

Is Fannie Mae a publicly traded company?

Fannie Mae has been a publicly traded company since 1968. However, the NYSE removed its listing in 2008 when the government put it under the conservatorship of the Federal Housing Finance Agency. It now trades on the OTC markets.

Does Fannie Mae sell to investors?

Fannie Mae sells loans and MBS to eligible investors, nonprofits, and public sector organizations. Investors can bid to buy these loans and securities from Fannie Mae. They can also purchase loans and securities backed by Fannie Mae through secondary markets or invest in companies that buy MBS and loans, like mortgage REITs.