Stack Overflow operates a popular question-and-answer website for software developers and other professionals. It's one of the top 200 websites in the world, with more than 100 million visitors each month.

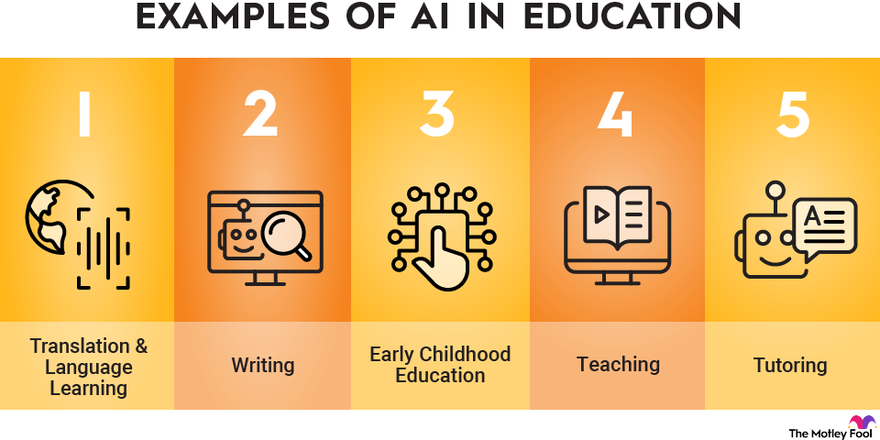

Like many companies, Stack Overflow is seeking to tap into the enormous potential of artificial intelligence (AI). In 2023, it launched Overflow AI to integrate generative AI into its public platform, Stack Overflow for Microsoft's (MSFT -0.1%) Teams, and other new products.

You might be an avid user of Stack Overflow and curious whether you can invest in the educational technology (edtech) company. Here's everything you need to know about investing in Stack Overflow.

Publicly traded?

Is Stack Overflow publicly traded?

Stack Overflow is not a publicly traded company. The leading knowledge-sharing platform for the tech community is a private company owned by Prosus (PROSY 0.73%). The European internet and technology group acquired Stack Overflow for $1.8 billion in 2021.

When will it IPO?

When will Stack Overflow IPO?

As of mid-2024, Stack Overflow doesn't have an initial public offering (IPO) on the calendar. The web community for software developers is a subsidiary of European internet and technology giant Prosus, which acquired it in 2021.

Prosus doesn't have plans to sell a stake in the company via an IPO. Stack Overflow's focus has been on improving its profitability by reducing costs. It would likely need to significantly improve its profitability (and value) before Prosus would consider an IPO of Stack Overflow.

IPO

How to buy

How to buy Stack Overflow stock

You can't buy shares of Stack Overflow directly since it's not a publicly traded company. However, investors have other ways to gain exposure to the company and the trends driving its growth. Here are three alternatives to consider:

Prosus

Prosus is the most direct way to gain exposure to Stack Overflow, which it acquired for $1.8 billion in 2021. Prosus is a leading global consumer internet group and one of the world's top technology investors. The Netherlands-based company's portfolio holds more than 80 investments in the classifieds, food delivery, payments and financial technology (fintech), and edtech spaces.

Udemy

Udemy (UDMY 1.8%) is a global marketplace for learning and teaching online. Prosus invested in Udemy in 2016 and still owns an 11.2% interest through its parent, Naspers (NPSNY -1.58%).

Udemy is part of its edtech business unit, along with Stack Overflow and other investments. In 2023, Udemy generated $729 million in revenue. It has over 16,000 business customers, 75,000 instructors, and 71 million learners taking more than 220,000 courses in 74 languages.

Tencent

Tencent (TCEHY 3.01%) is a Chinese technology company. It's one of the world's top video game publishers and a leading social media platform with more than 1 billion monthly active users. Prosus' parent company, Naspers, is also one of Tencent's top investors. Like Prosus, Tencent owns and invests in many other companies, which gives it a diversified technology portfolio.

People who want to buy one of these technology company alternatives to Stack Overflow can purchase shares in most brokerage accounts. Here's a step-by-step guide on how to invest in stocks.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you still need to open one, here are some of the best-rated brokers and trading platforms.

Take your time researching brokers to find the best one for you. If you want to invest in Prosus, Udemy, or Tencent, you'll also need to make sure your selected broker allows the trading of stocks listed on the OTC markets exchange or a foreign stock exchange.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to decide how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

That might seem like a daunting task for those starting out. However, you don't have to buy all those stocks at once. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across around 10 stocks and then grow your portfolio from there.

Step 3: Research related companies

It's essential to thoroughly research a company before buying its shares. You should learn how it makes money and study its balance sheet and other factors to ensure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

You should also research related companies. Some notable companies related to Stack Overflow are Prosus, Udemy, and Tencent. Investors should take the time to research these and other similar companies before buying shares.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock and its competitors, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill in all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (PROSY for Prosus, UDMY for Udemy, and TCEHY for Tencent).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order because it guarantees you buy shares immediately at the current market price.

Once you complete the order page, click to submit your trade and become a shareholder in a company related to Stack Overflow. Investors would follow a similar process to buy an IPO stock like Stack Overflow if it ever goes public. Once shares become available, fill in your brokerage account's order page with the company's selected stock ticker and submit your trade.

Shareholder

Profitability

Is Stack Overflow profitable?

Stock Overflow's owner, Prosus, provides some financial information on the company in its annual report. In its 2023 annual report, Prosus noted that Stack Overflow had contributed $84 million in revenue since it acquired the company in its 2022 fiscal year.

The report also highlighted that total bookings had increased 37% while annual recurring revenue had surged almost threefold. By early 2023, Stack Overflow was generating $55 million in annual recurring revenue. However, Prosus noted that Stack Overflow was losing money, including contributing $84 million in trading losses since its acquisition.

It pointed out that the company's trading losses had increased due to investments in engineering and product development initiatives, sales headcount and marketing expenses, and administrative costs related to growing the business. These losses and a decline in technology company valuations caused Prosus to write down $560 million of its investment in Stack Overflow.

Stack Overflow took steps to address its lack of profitability in 2023. It reduced its spending, including cutting 28% of its workforce in late 2023. The company hopes that the spending reductions and its investments in product innovation, like Overflow AI, will drive robust revenue growth and improved profitability in the future.

Should I invest?

Should I invest in Stack Overflow?

You can't invest directly in Stack Overflow because it's not a publicly traded company. However, you can buy shares of its owner, Prosus. Here are some reasons you might want to invest in Prosus or a similar company:

- You're an avid user of Stack Overflow's site and want to invest in the company that owns it.

- Investing in Prosus would help diversify your portfolio by adding an international stock.

- You think Stack Overflow will continue to grow its user base and revenue at high rates in the future.

- You like that Stack Overflow is embracing AI and believe it could become an important growth driver for the company.

- You see lots of growth potential in the edtech sector, which Prosus sees growing into a $7.4 trillion addressable market by 2025.

On the other hand, here are some reasons you might not want to invest in Stack Overflow's owner or a similar company:

- You don't understand what the company does or how it makes money.

- You don't want to invest in a company, like Prosus, listed on a foreign exchange.

- You're concerned about Stack Overflow's losses and its impact on Prosus' bottom line.

- You're concerned that AI will affect Stack Overflow's usefulness.

ETF options

ETFs with exposure to Stack Overflow

Since Stack Overflow is a subsidiary of a larger company, you can't get passive exposure to its stock through exchange-traded funds (ETF). However, you can use ETFs to invest in Prosus and similar companies. Here are a couple of notable ETFs to gain some exposure to the European internet and technology company:

- iShares MSCI Netherlands ETF (EWN 0.22%): This ETF focuses on stocks listed in the Netherlands. It held 52 companies in mid-2024, including Prosus (third-largest at 6.3%), and had a 0.5% ETF expense ratio.

- iShares Europe ETF (IEV -0.15%): This fund focuses on European-listed companies. It held 364 stocks in mid-2024, including Prosus (0.5% of its net assets), and had a 0.67% expense ratio.

Related investing topics

The bottom line on Stack Overflow

While you can't invest directly in Stack Overflow, you can buy shares of its parent, Prosus. You could also consider investing in related companies (like Udemy or Tencent) or an ETF to gain exposure to the same trends driving its growth. With lots of growth ahead for edtech, AI, and other technologies, these investments could pay off in the coming years.

FAQ

Investing in Stack Overflow FAQ

Can I make money from Stack Overflow?

Stack Overflow doesn't pay users to post on their site. However, you can earn reputation points by posting. Sharing your expertise could help you land new job opportunities as you showcase your knowledge and expertise, network with other users, and apply to jobs employers post on the platform.

What company does Stack Overflow belong to?

Stack Overflow is a wholly owned subsidiary of Prosus. The European technology company acquired It for $1.8 billion in 2021.

Is Stack Overflow publicly traded?

Stack Overflow is not a publicly traded company. It's a privately held company owned by European technology giant Prosus, which acquired it for $1.8 billion in 2021.

Can I buy Stack Overflow stock?

You can't buy shares of Stack Overflow. It's a private company owned by Prosus, which bought it for $1.8 billion in 2021. However, you can invest in Stack Overflow through Prosus, which is a publicly traded company. It trades on the OTC markets under the stock ticker PROSY and on the Amsterdam Stock Exchange (Euronext Amsterdam) under the ticker PRX.

![Trump at White House podium. Official White House Photo by D. Myles Cullen. [MConverter.eu]](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F801349%2Ftrump-at-white-house-podium-official-white-house-photo-by-d-myles-cullen-mconvertereu.jpg&op=resize&w=184&h=104)