Tencent (TCEHY 3.01%) is one of the world's leading internet and technology companies. The Chinese company operates some of the most widely used communications tools in the world and publishes some of the most popular video games. Tencent also has cloud computing, advertising, and financial technology businesses, among others. On top of all that, it has a large investment portfolio.

More than 1 billion people use Tencent's social media apps each month. They empower users to communicate, share videos, make payments, and shop. However, social media is only part of Tencent's global technology empire.

Here's a closer look at Tencent's massive technology and investment operations. We'll also explore what companies it might seek to acquire in the future. Knowing what Tencent owns and where it might invest next is an important aspect of research when learning how to invest money in a company.

What it owns now

What companies does Tencent own?

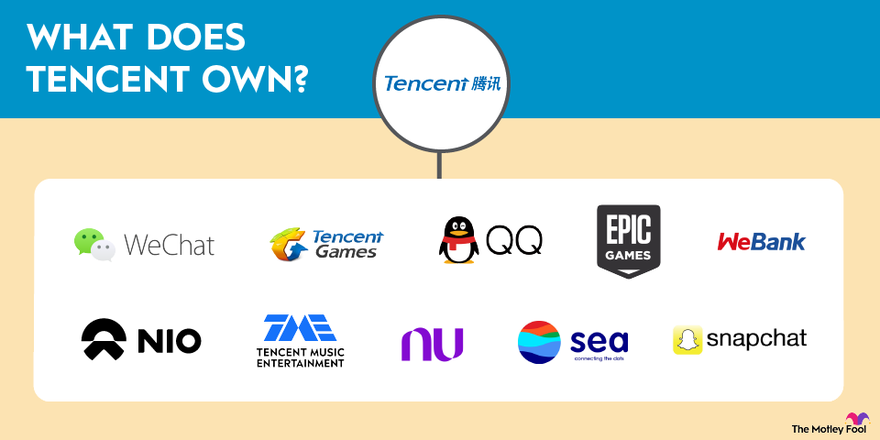

Tencent is a Chinese technology conglomerate and holding company that owns many companies. It has wholly owned subsidiaries and meaningful stakes in many other companies through its large investment portfolio. Here's a closer look at 10 of its most noteworthy subsidiaries and investments.

Weixin/WeChat

Tencent launched the Weixin/WeChat social media app in 2011. It has evolved into a super app with a range of functions, including messaging, payments (Weixin Pay/WeChat Pay), and other financial services. Weixin and WeChat had almost 1.4 billion monthly active users in early 2024.

Tencent launched its instant messaging and social media app QQ in 1999. The platform has grown and evolved over the years. Today, QQ offers a variety of services to its users, including online social games, music, shopping, microblogging, movies, and group and voice chat software. In early 2024, it had more than 550 million mobile device monthly active users.

Tencent Games

In 2003, the company launched Tencent Games, which has grown into one of the world's leading video game publishers. Tencent has acquired several gaming companies, including Riot Games (developer of League of Legends) and Supercell (maker of Clash of Clans).

It also has a large stake in Ubisoft Entertainment (OTC:UBSFT), the European game maker behind the Assassin's Creed and Tom Clancy series, and other game makers, like Larian Studios and Remedy Entertainment. It continues to invest heavily in growing its gaming business. For example, in 2024, the company bought two video game units from TikTok owner ByteDance.

Tencent Music Entertainment Group

Tencent formed Tencent Music (TME 1.36%) in 2016 when it bought China Music Corporation. It has grown into the leading online music and entertainment platform in China. It operates several popular apps, including QQ Music, Kugou Music, Kuwo Music, and WeSing. While Tencent Music is a publicly traded company, Tencent controls its voting rights and remains a majority shareholder.

Epic Games

Tencent made a strategic investment in Epic Games (the developer of Fortnite) in 2012. It holds an estimated 40% stake in the gaming company, which also counts Sony (SONY 1.74%), Disney (DIS 0.59%), and Lego Company owner Kirkbi A/S among its minority shareholders.

Tencent's investment helped Epic fund its growth. In addition to producing popular games, Epic developed the Unreal Engine, a leading game engine technology used by many gaming studios worldwide, including Tencent.

Sea Limited

Tencent is the largest shareholder of Singapore-based consumer internet company Sea Limited (SE -0.9%). As of mid-2024, it owned less than 20% of the e-commerce company's outstanding shares (and less than 10% of its voting power). While Tencent trimmed its stake in Sea in 2022 (it sold about 2.5% of its shares worth $3 billion), it plans to retain most of its remaining shares to participate in Sea's long-term success and continue their existing business relationships.

E-commerce

WeBank

In 2014, Tencent and several other companies founded WeBank, China's first digital bank. The company has a 30% stake in the private bank. Tencent works closely with WeBank to offer loans to consumers on its platforms. WeBank was the world's largest digital bank in 2023, with 362 million users, according to Statista.

Nu Holdings

Tencent initially invested $180 million in Brazilian financial technology company Nu Holdings (NU 0.48%) in 2018. By mid-2024, it owned more than 244 million shares worth about $2 billion, making it the bank's second-largest shareholder, at 6.7% of its outstanding shares. Nu Holdings has grown into one of the world's largest digital banks, with over 100 million customers across Brazil, Mexico, and Colombia.

Nio

Tencent was one of the original investors in Chinese electric vehicle maker Nio (NIO 3.18%) in 2016. In 2022, the two companies agreed to work together on several areas, including autonomous driving and high-definition mapping. While Tencent has trimmed its stake in Nio over the years, it still ranked as its largest shareholder in mid-2024 (2.5% stake worth more than $250 million).

Snap

Tencent bought a 12% stake in social media platform Snap (SNAP 0.89%) in 2017 following a steep decline in its share price. In mid-2024, the company was Snap's largest shareholder, owning almost 17% of the company, worth nearly $4 billion. Tencent's investment in Snap is one of many passive investments it has made over the years in U.S. companies as part of its overall investment strategy.

Future companies

What companies could Tencent buy in the future?

Tencent is an active acquirer, buying companies to enhance its existing businesses. It also has a large investment portfolio. Although it predominantly invests in Asian technology companies, Tencent will also invest in the global fintech, electric vehicle, and social media sectors. So, it could buy a range of companies in the future.

The company has been investing heavily in recent years to buy gaming assets around the world. For example, it has acquired a 30% stake in Larian Studios and bought 15% of Remedy Entertainment. In 2024, it also bought a couple of gaming units from TikTok owner ByteDance.

Gaming is a big part of Tencent's strategy, so it wouldn't be surprising to see the company continue investing in gaming companies. One possibility is to buy Dungeons & Dragons from Hasbro (NYSE:HAS). A report in early 2024 suggested it was looking to buy the game from the toy maker through its investment in Larian.

The company has been disappointed in the recent performance of its gaming business. Tencent has launched several new games that didn't perform as well as expected. Meanwhile, its rivals are doing a better job at launching popular games. That could lead Tencent to be a more aggressive investor in the gaming sector, one of its flagship businesses.

Tencent will also likely continue making acquisitions to bolster its other businesses, such as music. For example, the company and its Tencent Music subsidiary bought a 10% stake in Thailand's GMM Music for $70 million in mid-2024.

That deal will help GMM Music expand its business as it seeks to become a standalone company after its spinoff from its parent company, GMM Grammy. Tencent will likely continue investing in music technology companies to grow that business unit.

In addition to investing to bolster its operating businesses, Tencent will undoubtedly continue investing in innovative technologies through its investment portfolio. For example, Tencent has become the largest shareholder in Lilium (NASDAQ:LILM), a German company developing an air taxi.

Tencent's investment is helping fund the development of the company's eVTOL (electric vertical take-off and landing) jet. It has been steadily buying more shares of Lilium and owned almost a quarter of its outstanding shares in early 2024.

Tencent has also been investing heavily in business technologies, like cloud computing, artificial intelligence (AI), and blockchain. The company unveiled plans to invest $70 billion into new technology and infrastructure in the coming years. It has made several investments in innovative technology companies, including AI chip start-up Enflame and Zhipu, which aims to take on OpenAI.

The company wants to be a top-tier AI company and launched its Hunyuan AI model in 2023. Given its increasing focus on AI, it wouldn't be surprising to see Tencent invest in more AI start-ups.

Finally, Tencent will likely continue diversifying its portfolio by investing in new growth sectors. For example, it has invested in more healthcare start-ups in recent years, including Chinese stem cell therapy developer Bioon. Given China's aging population, healthcare will become an important growth sector for the country and likely Tencent.

Related investing topics

The Bottom Line on Companies Tencent Owns

Tencent is one of China's largest technology companies. Its popular Weixen/WeChat super app has turned it into a social media and payments powerhouse. It's also a leading gaming developer.

The company has reinvested the profits from those businesses into many other companies, turning it into a diversified conglomerate and holding company. Tencent will likely continue to acquire and invest in more companies, most likely in the gaming, AI, and healthcare sectors. Its broad focus makes Tencent a potentially compelling stock to buy and hold for those seeking to invest in faster-growing industries with a geographical focus on Asia.

FAQ

Companies Tencent owns: FAQ

What company owns Tencent?

Tencent is a publicly traded company owned by its shareholders. Its largest shareholder is South African media company Naspers, which owns roughly a quarter of the company through its affiliate Prosus. That entity also owns stakes in several Tencent sister companies.

Does Tencent own ByteDance?

Tencent does not own TikTok owner ByteDance. According to an article by The Information, Tencent bought a less than 2% stake in ByteDance in 2016. However, it has since sold that stake. Tencent did buy two of ByteDance's video game units in 2024 to bolster its gaming business.

How much of Riot Games does Tencent own?

Tencent owns almost 100% of Riot Games. The Chinese technology holding company initially bought a majority stake in 2011 and purchased the remaining stake in 2015. However, in 2022, the company agreed to return partial ownership of Riot to its employees.

![Trump at White House podium. Official White House Photo by D. Myles Cullen. [MConverter.eu]](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F801349%2Ftrump-at-white-house-podium-official-white-house-photo-by-d-myles-cullen-mconvertereu.jpg&op=resize&w=184&h=104)