Created in 1996 by Australian-born media magnate Rupert Murdoch, Fox News is the most-watched television news and opinion channel in the United States. It's been roundly criticized for its blending of news and entertainment, but it's been a massive financial success, accounting for 70% of profits for the Fox Corp. (FOXA 1.41%)(FOX 1.48%).

You can't invest in Fox News directly, but we'll tell you about how it fits into the scheme of things and how you can get exposure to the channel's stock.

Overview

What is Fox News?

Fox News has been the top-rated television news channel every year since 2002, and for good reason. More than 90% of its viewers identify themselves as Republicans or Republican-leaning voters. The channel began life with 17 million cable subscribers, paying distributors as much as $11 per customer to carry the channel. By 2023, it had increased its audience to 72 million subscribers.

Although Fox News is a global organization that's broadcast into more than 40 countries, it's very much a U.S.-focused channel. Its viewership not only skews conservative, but considerably older. A 2019 Pew Research Center survey found that almost 70% of people who said Fox News was their main source of political information were 50 or older.

The news channel has been part of Fox Corp. since 2019. The company was created after the sale of 21st Century Fox to Walt Disney (DIS 0.59%). Unlike other news giants, Fox is controlled by a single family, with the elder Murdoch and his children controlling roughly 40% of all shares.

The Murdoch media empire is roughly divided into two units: News Corp (NWSA 0.91%)(NWS 0.79%), which controls the family-owned newspapers in the United States, United Kingdom, Australia, and New Zealand, and Fox Corp., which includes the broadcast assets such as FOX News Media, FOX Sports, FOX Entertainment, FOX Television Stations, and Tubi Media Group.

Murdoch, 93, stepped down as chairman of Fox Corp. and News Corp in September 2023. He was succeeded by Lachlan, his oldest son from his second marriage who had risen to executive chairman and chief executive officer of Fox Corp. after its 2019 creation in the wake of the Disney deal.

Because Fox News is a subsidiary of Fox Corp., it's not possible to buy stock that focuses only on the broadcast news operation. Although the Fox News Channel is clearly the crown jewel of the Fox Corp., other units account for almost one-third of the parent company's profits.

How to invest

How to invest in Fox News

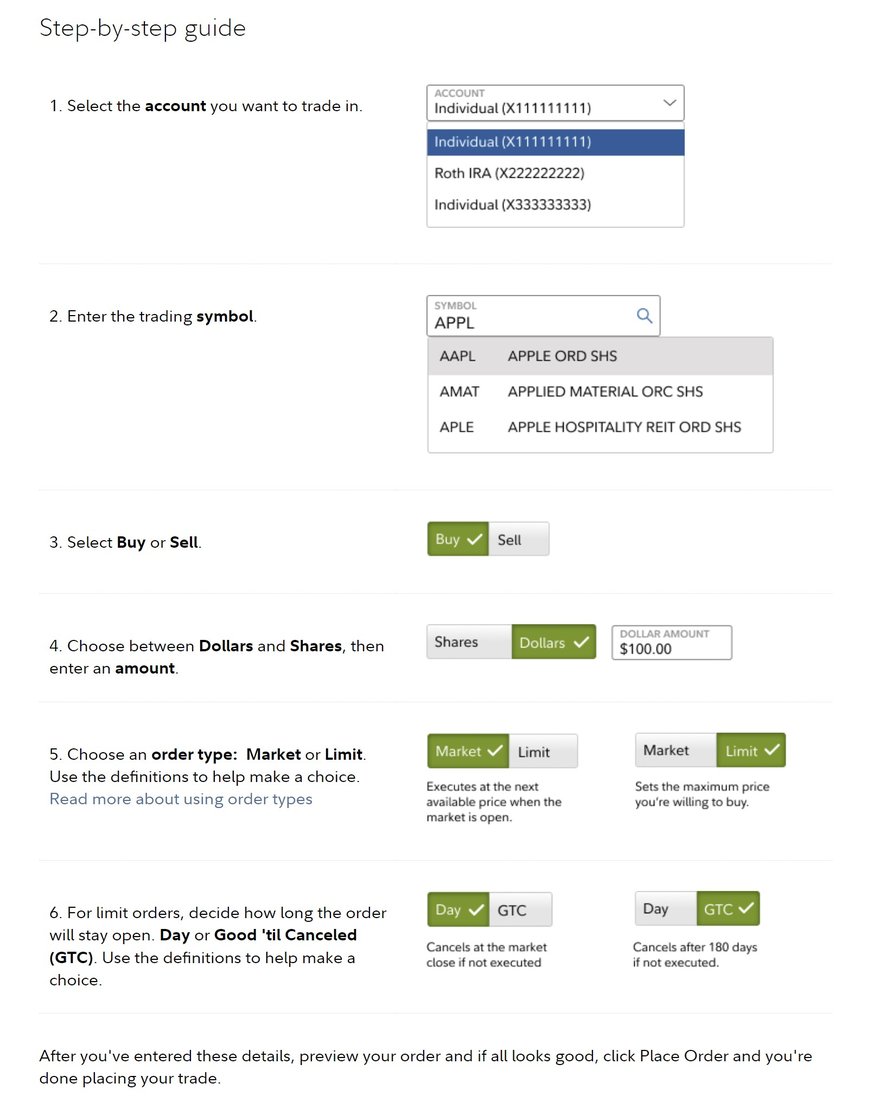

To buy shares of Fox Corp., you'll need a brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Fox stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

Stock

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The ticker symbol (FOX or FOXA for Fox Corp.).

- Whether you want to place a limit order or a market order. Know the difference between a market order and a limit order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Before you hit the "Place Order" button, figure out your budget. Are you in a position to invest in the market? Have you paid down high-interest credit card balances and created an emergency fund? How much can you spend? Do you want to buy all your Fox shares at once or periodically with dollar-cost averaging?

If you've decided the pros of investing in the company outweigh the cons, then complete the order page, click the "Place Order" button at the bottom, and become a Fox Corp. shareholder.

Should I invest?

Should I invest in Fox News?

Here are some reasons you might consider passing on Fox News stock:

- You don't agree with the company's political views.

- You think the company faces a decline because of the average age of its Fox News viewers.

- You believe television news will continue to decline as an information source.

- You doubt the ability of a second generation of Murdochs to succeed.

- You think Fox Corp. shares are trading at unrealistically high prices

- Your portfolio already has enough media stocks.

On the other hand, you may want to go ahead and buy Fox Corp. stock if:

- You think U.S. television news viewers are becoming more conservative.

- You believe it's essential to have a conservative television news channel.

- You think television news will continue to be a major source of political information.

- You'd like to balance your portfolio with a media stock.

- You think Fox Corp. stock is undervalued.

As with any other investment, there's a short answer to why you might consider investing in this stock: It depends. Factors that might affect your decision include the level of your portfolio diversification, personal risk tolerance, company and industry knowledge, and your assessment of Fox Corp.'s competitive position.

Profitability

Is Fox News profitable?

Fox Corp. reported $704 million in net income during its third quarter of 2024, a significant increase from the $50 million loss recorded during the third quarter of 2023. The improvement, however, pointed to an important issue for Fox News -- litigation costs.

The company handed over $800 million to Dominion Voting to settle defamation claims in April 2023, tacitly acknowledging that its news arm made false election fraud claims in the aftermath of the 2020 presidential election. A lawsuit by Smartmatic, also a voting machine manufacturing company, is still pending; the company is seeking $2.7 billion in damages.

The company posted $3.45 billion in revenue for the third quarter, which ended March 31, 2024. The figure was a decline from the $4.08 billion in revenues posted during the third quarter of 2023; the company blamed the fall on the lack of 2024 advertising revenue from the National Football League's Super Bowl.

Fox is attempting to recoup the lost revenue through a joint streaming sports service with Disney's ESPN and ABC networks, as well as Warner Bros. Discovery (WBD 1.91%) channels TNT and TBS. The U.S. Department of Justice is reviewing the deal for antitrust concerns; analysts have estimated the venture would control about $14.4 billion of the $26.7 billion spent on U.S. sports rights.

Dividends

Does Fox pay a dividend?

Fox pays a semiannual dividend. As of July 2024, the trailing-12-month dividend was $0.52 per share, a dividend yield of 1.62% that was slightly better than the 1.35% for the S&P 500.

The company also has an aggressive $7 billion share repurchase program. Since beginning the buybacks in 2019, the company has spent $5.4 billion, snapping up 26% of its total shares outstanding.

ETFs

ETFs with Fox exposure

Exchange-traded funds (ETFs) allow investors to acquire the equivalent of a large, diversified stock portfolio through a single ticker that behaves like a stock. ETFs are excellent options for people who don't have time to research individual stocks to buy for a portfolio and would prefer a passive investment approach. As a member of the S&P 500, several exchange-traded funds hold Fox Corp. stock.

Exchange-Traded Fund (ETF)

Top ETFs holding Fox stock include:

Communications Services Select Sector SPDR Fund (XLC 0.54%) has $19.2 billion in assets under management (AUM). Top holdings include Meta Platforms (META -1.73%), which makes up 22.7% of the fund; Alphabet Class A (GOOGL 1.54%), at 12.8% of holdings; and Alphabet Class C (GOOG 1.72%), which accounts for 10.7% of fund assets. Fox shares amount to 1.2% of the ETF's 23 holdings. The fund has a reasonable expense ratio of 0.09%; investors would pay $9 in fees for every $10,000 of shares purchased.

SPDR S&P 500 ETF Trust (SPY 1.2%), launched in 1993, was the first ETF listed in the United States. It has $548.5 billion in assets under management and is designed to track the performance of the S&P 500. The fund is weighted by market capitalization, so Fox -- with a market cap of roughly $15.6 billion -- barely amounts to a rounding error among its holdings. The ETF has an expense ratio of 0.0945%.

iShares Core S&P 500 ETF (IVV 1.11%), with assets of $502.7 billion, offers an ultra-low expense ratio of 0.03%, meaning that investors will only pay $3 in fees on a $10,000 purchase. Like other funds tied to the S&P 500 market caps, its top holdings will include Microsoft (MSFT -0.1%), Apple (AAPL 1.88%), and Nvidia (NVDA 3.08%). Since its inception in May 2000, the fund has posted a 497.4% gain, compared to the 505% gain by the broader market.

Vanguard S&P 500 ETF (VOO 1.13%) is a behemoth among ETFs, with $1.1 trillion in total net assets. The fund, which also is weighted by market cap, has a low 0.03% expense ratio. The fund is quite accessible to beginning investors, with a minimum investment of $1.

LeaderShares AlphaFactor Tactical Focused ETF (LSAT 0.59%) has a bigger stake in Fox than any other fund, with 3.3% of its $149.4 million in assets committed to the company. As an actively managed ETF, it has an expense ratio of 0.99%, which is a lot higher than what the funds tied to the S&P 500 charge. That amounts to $99 in fees for a $10,000 investment. During the first six months of 2024, the ETF's shares had gained about 9.7%, much less than the 16.72 year-to-date gain posted by the broader market.

Stock splits

Will Fox News stock split?

Fox Corp., the owner of Fox News, was only established in 2019. Its stock currently hovers around $35 per share, which usually would not be high enough to discourage retail investors from taking a stake in the company.

As a general rule, companies split their stock to bring high share prices down, encouraging more people to buy their stock. So, while it's possible, there doesn't seem to be any groundswell of support for a split.

Related investing topics

Bottom line on Fox

Investing in Fox isn't exactly for the faint of heart. The news channel has been criticized for its devotion to former President Donald Trump. Its future success is also heavily dependent on a second generation of leadership and its ability to compete for lucrative sports rights.

Despite its issues, Fox News may still emerge as a decent financial investment, especially during hotly contested election cycles. Its share buyback program will continue to benefit investors, and its sports-focused streaming deal with Warner and Disney might still be approved by the U.S. Justice Department.

As with any other stock, investors who are interested in Fox shares should consider their personal risk tolerance, portfolio diversification strategy, and whether Fox fits into their own investment thesis. As always, a buy-and-hold strategy is the wisest course of action.

FAQ

How to invest in Fox News stock: FAQ

Is Fox News a good stock?

You can't buy shares of Fox News, but you can acquire stock in Fox Corp., its parent company. Whether it's a good stock for you depends on your portfolio composition, personal risk tolerance, and familiarity with Fox products.

Does Fox News have a stock?

Fox News doesn't have a stock, but you can buy stock in its parent, Fox Corp.

What is the dividend on Fox News stock?

Fox News isn't traded publicly, but its parent, Fox Corp., pays a semiannual dividend. In July 2024, its trailing 12-month dividend was $0.52 per share, yielding 1.62%.

Who owns the most Fox News stock?

The Murdoch family owns roughly 40% of shares in Fox Corp., the parent company of Fox News.