As one of the world's top software companies, Adobe (ADBE 2.24%) offers a range of products for commercial and personal use, including web design tools, audio and video editing software, animation software, document management software, and photo editing tools. Adobe is known for solutions such as Adobe Creative Cloud, which includes tools like Illustrator and Photoshop.

Creative Cloud also features Firefly, the company's group of generative artificial intelligence (AI) models released in 2023, which can create images and other media elements with simple text prompts entered by the user.

To date, Firefly has been used to generate more than 8 billion images for users. Other popular solutions include Adobe Document Cloud, which allows users to create, share, edit, and sign digital documents, as well as Adobe Experience Cloud, which features tools like data analytics, marketing workflows, and other essential solutions for companies of various sizes to manage their relationships with customers.

Overview

Overview

Adobe was founded in December 1982 by Charles Geschke and John Warnock, who formerly both worked at Xerox (XRX -1.53%). The first product they created was PostScript, a page description language tool that became the global standard for computer printing and was integral to the desktop publishing boom. Apple's (AAPL 1.88%) Steve Jobs tried to buy Adobe the same year it was founded.

Geschke and Warnock ended up working out a deal with Jobs in which Apple's cofounder bought about 19% of the company, paying a premium for the business, as well as a five-year licensing arrangement for PostScript in advance. This deal was integral to Adobe becoming the first company in Silicon Valley's history to reach profitability in its first year of business.

By the middle of the 1980s, Adobe had ventured into consumer software with the launch of Adobe Illustrator, and several years later, the Portable Document Format (known as PDF) was born. The company also became publicly traded, holding its initial public offering (IPO) in August 1986. Since then, Adobe has grown both through its internal launches of new software products as well as through acquisitions. For example, properties in its Creative Suite, like Adobe Dreamweaver, were added through the 2005 multibillion-dollar acquisition of Macromedia, a web development software company.

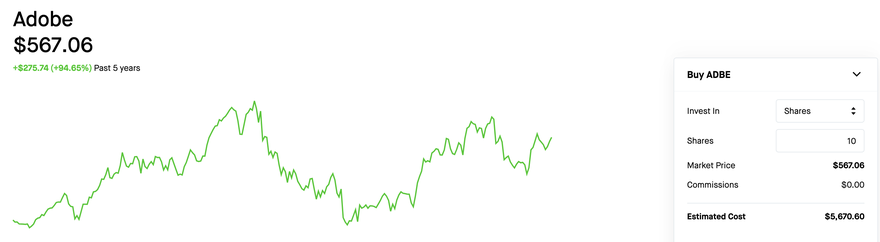

Adobe employs more than 30,000 people worldwide. The company also brought in revenue just shy of $20 billion in 2023. Despite volatility, Adobe has still delivered a total return of approximately 94% to investors over the trailing five-year period, only slightly behind the performance of the S&P 500.

If you're interested in scooping up a few shares of Adobe yourself, you've come to the right place. If you want to know how to buy Adobe stock, whether the stock might be a good use of your investment capital, whether the company is profitable, and much more, read on.

Stock

How to invest

How to buy Adobe stock

Adobe is publicly traded, so the process of buying its stock is much like it would be for any other company trading on a U.S. stock exchange. Here is a step-by-step guide for how to buy Adobe stock.

Step 1: Open a brokerage account

If you don't already have a brokerage account, you'll need to open one before you can buy shares of Adobe stock. Creating an account on popular platforms like Robinhood (HOOD 3.76%) or Fidelity takes just moments. You'll need to provide some key details, including your name, address, Social Security number, and other personal information.

When choosing the brokerage platform that is right for your personal needs, you'll want to consider your long-term financial goals and overall investing objectives. Many of the best brokerages offer access via an online web platform as well as mobile app, convenient linking of your bank and trading accounts, investor resources, and the ability to buy fractional as well as whole shares. You'll also want to consider the features of an individual account -- whether there are account fees and if the brokerage has minimum balance requirements -- and find out about its security and account protection protocols.

Step 2: Figure out your budget

Once your brokerage account is up and running, you'll want to consider how much you want to invest in Adobe stock. Ideally, you should diversify your investment capital across 25 or more stocks representing various industries as well as sectors. You don't need to have a lot of money to invest, and you should only invest cash that you can leave in your portfolio for a minimum buy-and-hold horizon of three to five years.

Many investors find that dollar-cost averaging is an effective method when distributing capital across businesses they want to add to their portfolio. By investing the same amount of money at a regular interval across multiple stocks or securities, you can benefit from the best and worst days in the market while ensuring you're not overly exposed to a particular company.

Step 3: Do your research

Before you buy shares of Adobe stock or any other company, you need to make sure that you do thorough research. You should understand how the business makes money, its competitive advantages, its potential competitive threats, the company's financial history, and whether it aligns with the overall financial objectives you've set for your portfolio.

Step 4: Place an order

If you're ready to buy shares of Adobe stock, then it's time to place your order on your preferred brokerage account. You'll want to search for stock ticker ADBE and enter the number of shares you want to purchase.

There are two primary types of stock orders: market orders and limit orders. A market order is usually the best option since the brokerage will fulfill your order at the current share price.

When you place a limit order, this means that the order will only execute if shares hit a certain price threshold that you specify. It could be some time before shares hit that price (if they do), which means your order might not get filled if you place a limit order with a threshold price that is too low.

Should I invest?

Should I invest in Adobe?

Whether you should invest in Adobe or not will depend on your investing style. If you favor growth-oriented software businesses, Adobe could be a good addition to your portfolio. If you're looking for a less volatile business or prefer value-oriented or income stocks, you might want to take a modest position or look elsewhere.

For investors considering a position in Adobe, there's a lot to like about this storied business and where it's going. The company has capitalized on the AI boom by rapidly integrating generative AI into its various media-centric tools, like Photoshop and Premiere Pro.

Adobe has long been at the forefront of innovation in its industry and was one of the first to adopt the subscription-based software-as-a-service model rather than charging customers one-time fees for software usage. In fiscal 2023, subscriptions made up 94% of the company's overall revenue. Subscription revenue is derived mostly from recurring fees that individual and enterprise customers pay to access solutions like Document Cloud, Adobe Experience Cloud, and Creative Cloud.

The small remainder of Adobe's revenue is derived from products revenue, as well as services and other revenue. Products revenue includes sources like licensing fees for software, while services and other revenue includes fees for solutions like training, maintenance, support, and consulting offered to Adobe customers.

If you want to buy Adobe stock, you should know that the software stock has a robust balance sheet with a steady history of revenue growth and positive cash flows. Over the trailing five-year period, Adobe has grown its annual revenue by about 74%, while operating cash flow has soared by roughly 65%.

In the company's fiscal 2023, total revenue rose 10% to $19.4 billion. While operating cash flow was down by single digits from 2022, the company still brought in $7.3 billion. Broken down by revenue source, products as well as services revenue were down in 2023 from 2022. However, subscription revenue, the bread-and-butter of Adobe's business, remained strong as ever, increasing 12% in 2023 compared to the prior fiscal year.

Fast-forward to the second quarter of 2024, and Adobe delivered 10% year-over-year revenue growth at $5.3 billion. Operating cash flow totaled $1.9 billion, and Adobe ended the quarter with approximately $18 billion in remaining performance obligations, which included deferred and backlogged revenue.

Profitability

Is Adobe profitable?

Adobe has experienced fluctuating profitability according to generally accepted accounting principles (GAAP) throughout its history, but it's been consistently delivering on the bottom line in recent financial reports. In the second quarter of 2024, Adobe brought in just shy of $2 billion in operating income, along with net income of $1.6 billion.

In fiscal 2023, Adobe's net income rose by a generous 14% year over year to $5.4 billion. Taking a step back to look at the trailing-five-year period, Adobe has increased its annual net income by an eye-popping 84%.

Dividends

Does Adobe pay a dividend?

Adobe does not pay a dividend, and management has not indicated any plans to initiate one. The company previously paid a dividend starting in 1989 but discontinued it in 2005.

Many tech stocks like Microsoft (MSFT -0.1%) and Apple pay dividends, although yields are quite low compared to the average stock trading on the S&P 500. Often, investors seek returns from growth-oriented software stocks primarily through share price appreciation and share buybacks, and Adobe is no exception.

In addition to Adobe's solid share price performance over the last several years despite persistent volatility, the company regularly buys back shares from investors. In March 2024, management authorized a $25 billion stock repurchase program, which continues until 2028.

Buybacks not only achieve near-term share price increase, but decrease the amount of outstanding shares. Share buybacks also enable a tax-favorable means of bolstering investor returns, while also boosting a company's earnings per share.

ETFs

ETFs with exposure to Adobe

Instead of buying Adobe shares directly, you can also opt to purchase shares through an exchange-traded fund (ETF). By investing in an ETF, you can gain exposure to a wide variety of companies including Adobe, which provides instant diversification to your portfolio. A few examples include the SPDR S&P 500 ETF Trust (SPY 1.2%), the iShares Core S&P 500 ETF (IVV 1.11%), and the Invesco QQQ Trust, Series 1 ETF (QQQ 0.87%).

Index funds, which seek to track the performance of a particular index, can also be a great way to invest in a basket of companies at once. Index funds with exposure to Adobe include the Vanguard Total Stock Market Index Fund (VTSAX 1.11%), the Vanguard 500 Index Fund (VFIAX 1.09%), and the Fidelity 500 Index Fund (FXAIX 0.74%).

Exchange-Traded Fund (ETF)

Stock splits

Will Adobe stock split?

Adobe has split six times in its company history. All were 2-for-1 stock splits. The first five splits occurred in March 1987, November 1988, August 1993, October 1999, and October 2000. Adobe's most recent split occurred in May 2005.

Related investing topics

The bottom line on Adobe

Adobe has plenty of attractive qualities that one hopes to see in a software stock. The company is growing revenue steadily, most of its revenue is recurring, and the business is consistently profitable. Its cash position is also shored up and its broad global footprint in a competitive industry signals well for future growth.

While growth-oriented businesses like Adobe can be more vulnerable to changing spending patterns among larger enterprise customers when macro conditions tighten, the company still looks well positioned over the next five to 10 years. Investors might find that this company looks like an attractive option to bet on the future of AI in software-as-a-service stocks as well as to become part-owner of a trailblazing software businesses that has been around for more than 40 years and counting.

FAQ

Investing in Adobe FAQ

Is Adobe worth investing in?

Adobe is an established software stock with a profitable history and a steady track record of growing revenue. This could make it a smart pick for long-term investors with an appetite to put cash into this space.

Is Adobe stock a good way to make money?

Adobe has consistently outperformed competitors and shares have roughly doubled over the last five years. While past performance isn't a promise of future gains, the business retains a strong foothold in a lucrative, expanding addressable market.

Does Adobe stock pay a dividend?

No, Adobe does not pay a dividend. The company previously paid a dividend starting in 1989, but discontinued its dividend in 2005. Management has not indicated any plan to restart its dividend.