As the problem of steep power demands resulting from artificial intelligence (AI) weighs heavily on data center operators' minds, many people have argued that nuclear power is a viable solution, leading investors to consider investments in nuclear power companies like Kairos Power. Applying a vertically integrated approach to the development of an innovative nuclear power plant, Kairos Power was founded in 2016, and it has lofty ambitions. According to the company, its goal is to "accelerate the development of an innovative nuclear technology that has the potential to transform the energy landscape in the United States and internationally."

Unlike traditional nuclear power plants that use water as a coolant, Kairos Power has designed an advanced reactor that uses molten fluoride salt as a coolant. The company's reactor also uses fully ceramic fuel, which has the advantage of maintaining structural integrity even at extremely high temperatures and will resist damage well above the melting temperatures of conventional metallic reactor fuels.

Data center operators are struggling to find adequate power capacity to compensate for the rapid growth of AI. Business insight firm Gartner, for example, projects that the accelerating pace of AI and generative AI will result in an extensive lack of sufficient power, limiting operations at 40% of AI data centers by 2027.

Artificial Intelligence

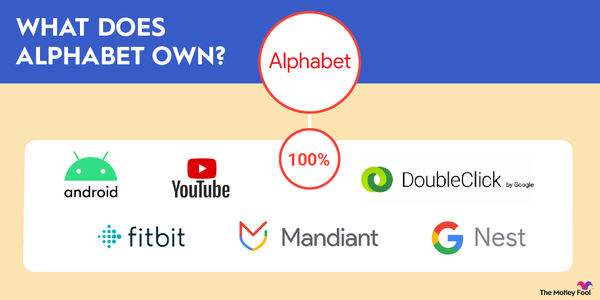

Those with an eye on the nuclear energy industry may have had Kairos Power on their radar for years, but interest in the company soared in October 2024 when it inked a deal with Alphabet's (NYSE:GOOGL) Google to collaborate on a plan to deploy a U.S. fleet of advanced nuclear power projects totaling 500 megawatts (MW) by 2035.

While many may recognize the investment opportunity in Kairos Power enticing, it's important to take a variety of considerations into account. In addition to needing to know when the company will hold its potential initial public offering (IPO), investors should also explore whether any other investment opportunities exist.

IPO

Is it publicly traded?

Is Kairos Power publicly traded?

As of November 2024, Kairos Power wasn't found on public markets, so investors on Main Street will have to look elsewhere for a nuclear energy stock to power their portfolios.

Although the company hasn't been able to raise capital through the issuance of equity, it has grown its coffers through other means. In February 2024, Kairos Power signed a Technology Investment Agreement with the U.S. Department of Energy. According to the agreement, Kairos Power will receive up to $303 million after achieving certain milestones related to the design, construction, and commissioning of the Hermes demonstration reactor in Oak Ridge, Tennessee.

IPO

When will Kairos Power IPO?

While Kairos Power has received funding from venture capital firm Terra Talent and is on the path to gain funding from the U.S. Department of Energy, the company has not revealed any plans to hold an IPO.

Disappointed as investors may be to find that Kairos Power is not on the 2024 IPO calendar, there are IPO stocks that they may be interested in buying.

How to invest

How to buy Kairos Power stock?

Because Kairos Power hasn't held an IPO, most people are not able to power their portfolio with its stock. People who qualify as accredited investors, however, may be able to gain exposure to Kairos Power before its IPO through a platform like Forge Global (FRGE -7.08%).

For those who don't qualify as accredited investors but who are still interested in gaining nuclear energy exposure, there are other opportunities they may wish to consider.

1. Oklo

Like Kairos Power, Oklo (OKLO 2.67%) is another company developing a novel approach to nuclear power reactors. Unlike massive conventional nuclear power plants, Oklo has designed small modular reactors (SMRs) that are capable of using recycled fuel as well, helping to address the problem of nuclear waste. Backed by OpenAI's Sam Altman, Oklo has received considerable interest from data center operators. In the company's third-quarter 2024 financial report, management noted that it has grown its backlog by 200% since it completed its merger with a special purpose acquisition company in July 2023.

The company also parallels Kairos Power in that both are in the pre-revenue phases of their developments, so those who were keen on adding a growth stock to their portfolios with Kairos Power might gain the same thing with Oklo.

Potential investors will want to keep a close eye on the company's advancement of its first Oklo commercial facility, dubbed Aurora Powerhouse, at Idaho National Laboratory in 2027.

2. NuScale Power

Brandishing itself "as the first and only SMR to have its design certified by the U.S. Nuclear Regulatory Commission," NuScale Power (SMR 4.0%) is another nuclear power upstart that will appeal to those interested in Kairos Power. NuScale Power offers its VOYGR SMR Power Plants in a variety of configurations to meet the power needs of its customers.

The company has a variety of projects in the works that can be found on several continents. One of the projects nearest to completion is in Romania, where NuScale Power intends to deploy a VOYGR-6 SMR power plant by the end of 2030. In North America, the company is working with Standard Power to develop two nuclear energy facilities in Pennsylvania and Ohio that have the combined capacity for 2 gigawatts of nuclear-generated energy for powering data centers.

While the company isn't generating substantial revenues, it's still in a strong financial position. At the end of the third quarter of 2024, NuScale Power had a cash position of about $112 million, $45 million in short-term investments, and zero debt.

3. Cameco

For investors interested in broader exposure to the nuclear energy industry, Cameco is certainly a stock worth further investigation. As one of the world's largest producers of uranium, Cameco has several premier assets that have the capacity to annually produce more than 30 million pounds of uranium concentrates. Questions about Cameco's future uranium production are assuaged when recognizing that the company has 485 million pounds of proven and probable mineral reserves.

Besides uranium production, Cameco keeps the lights on through its uranium processing services, which include refining, conversion, and fuel manufacturing. Plus, the company has a 49% ownership position in Westinghouse -- Brookfield Renewable Partners (BEP 1.59%), which is an original equipment manufacturer of nuclear reactor technology and a provider of aftermarket products for nuclear power plants, has the remaining 51% equity stake.

Investors seeking a more conservative nuclear energy investment will also find Cameco appealing as it consistently generates ample free cash flow. After generating $360 million in free cash flow in 2021, Cameco generated $161 million and $535 million in free cash flow for 2022 and 2023.

While accredited investors may access platforms that allows them access to pre-IPO stocks, retail investors who aren't accredited and find themselves motivated to pick up shares of Oklo, NuScale Power, or Cameco need to only take a few steps to become shareholders.

- Open your brokerage app: Log into your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected, and adjust your investment strategy accordingly.

Profitability

Is Kairos Power profitable?

Since Kairos Power hasn't held its IPO, it isn't subject to the same financial reporting regulations as those companies that are publicly traded. Investors, consequently, don't have much insight into Kairos Power's financial situation, but it's fairly safe to assume that since the company hasn't commenced commercial operations, it's not generating revenue, let alone booking a profit.

It's possible -- though it's questionable how probable -- that Kairos Power can begin generating a profit as soon as 2030. According to the agreement that it signed with Google, Kairos Power will have an advanced reactor plant deployed and operational by 2030 to supply one of Google's data centers with electricity under power purchase agreements.

Should I invest?

Should I invest in Kairos Power?

Unfortunately, for the majority of retail investors, investing in Kairos Power is not currently an option since the company hasn't held an IPO. Should the company proceed down the path of becoming a publicly traded company, though, it will be required to submit regulatory filings, providing investors with a better perspective on its financial situation. This, in turn, will allow investors to make informed decisions about whether the stock is appropriate for them.

On the other hand, accredited investors may presently have the ability to add exposure to Kairos Power. With the company still not generating sales and its financial situation poorly known, an investment in Kairos Power should only draw interest from those undaunted by the prospect of substantial risk.

Exchange-Traded Fund (ETF)

ETF options

ETFs with exposure to Kairos Power

Because Kairos Power isn't a publicly traded company, investors won't find exchange-traded funds (ETFs) that provide exposure to the stock. That's not to say that investors have no ETF options; there are some nuclear energy ETFs that they may find apt choices to charge up their portfolios.

- Global X Uranium ETF (URA -0.28%): Investors looking for broad exposure to the nuclear energy industry will find this ETF -- and its 51 holdings -- quite alluring. In addition to nuclear energy industry stalwarts like Cameco, the fund's largest position, representing about 25% of its net assets, the Global X Uranium ETF includes upstart SMR companies like Oklo and NuScale Power, and it has a 0.69% total expense ratio.

- VanEck Uranium and Nuclear ETF (NLR 0.1%): For investors interested in powering a stronger passive income stream with a nuclear energy investment, this ETF is an excellent option. Providing a 12-month yield of 3.6%, the VanEck Uranium and Nuclear ETF has diverse exposure to the industry thanks to utilities with robust nuclear power assets like Constellation Energy (NYSE:CEG) and Public Service Enterprise Group (PEG 2.25%) as well as uranium producers like Cameco and Denison Mines (DNN -2.58%).

- Invesco WilderHill Clean Energy ETF (PBW 4.48%): Granted, this ETF doesn't have exposure to nuclear energy stocks, but it does include a variety of leading renewable energy stocks that may tempt those who appreciate Kairos Power as a clean energy solution. From fuel cell specialists like Bloom Energy (BE 5.42%) to lithium producers like Lithium Americas (NYSE:LAC) to electric air taxi developer Archer Aviation (ACHR 12.71%), the Invesco WilderHill Clean Energy ETF includes broad exposure to varying sectors and renewable energy types, making it a leading clean energy ETF opportunity.

Related investing topics

The bottom line on Kairos Power

As AI accelerates in popularity and data centers find themselves hard pressed to keep up with the necessary power demands, it's unsurprising that growth investors are considering nuclear energy stocks like Kairos Power -- especially after it inked a noteworthy agreement with Google.

Since the company hasn't held an IPO, it, unfortunately, is not an investment option for a majority of investors. Fortunately, there are other interesting nuclear energy options to consider, such as Cameco, Oklo, and NuScale Power as well as several ETF possibilities.

FAQ

Investing in Kairos Power FAQ

How do I buy a pre-listed IPO?

Accredited investors may have the ability to buy shares of companies before they hold an IPO through a platform such as Forge Global.

How to invest in a company pre-IPO?

Most investors are likely unable to gain equity in companies before they hold their IPOs. Accredited investors may be able to gain exposure to pre-IPO companies through trading platforms such as Forge Global.

Is Kairos Power publicly traded?

As of November 2024, Kairos Power wasn't a publicly traded company.

What is the ticker for Kairos Power?

Because Kairos Power hasn't held an IPO, the company doesn't have a stock ticker.