Americans invest billions each year in U.S. savings bonds. Are these low-risk, interest-earning assets right for you? Make an informed decision by learning the nuances of savings bonds now, including how they work, how to manage them, and how to collect your interest earnings.

Understanding them

Understanding savings bonds

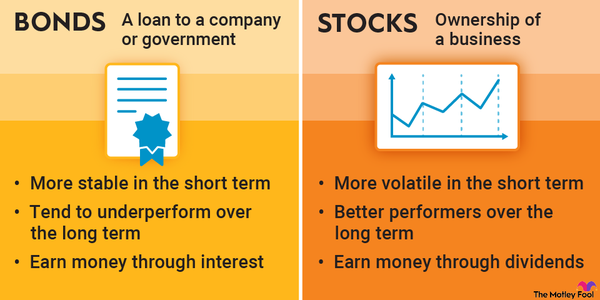

Savings bonds are debt securities issued by the U.S. government. When you buy a savings bond, you are loaning your money to the government. The government, in turn, promises to repay the funds plus interest.

There are no periodic interest payments on savings bonds. Instead, the principal and accrued interest are paid out when you redeem the bond. Redemption is the process of turning the bond in for cash.

Notable features of U.S. savings bonds include:

- Long-term maturity: There are two types of U.S. savings bonds currently available for purchase, Series I bonds and Series EE bonds. Both mature in 30 years. After maturity, the bond no longer earns interest. Since non-earning bonds can lose value to inflation, it's smart to redeem them at maturity.

- Compound interest: Accrued interest is added to the bond's principal value every six months. This results in higher interest earnings.

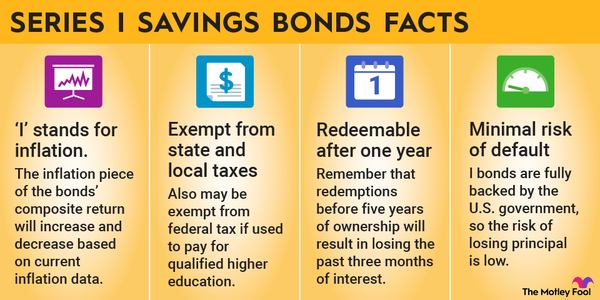

- Choice of fixed or variable interest rate: Series I bonds have a variable interest rate, which serves as inflation protection. When inflation rises, so does the rate on your I bonds. Series EE bonds have a fixed rate but are guaranteed to double in value after 20 years.

- Safety: Backed by the full faith and credit of the U.S. government, savings bonds are considered safe assets.

- Liquidity: You can redeem U.S. savings bonds after 12 months. Holding them to maturity will maximize your earnings, however. Redeeming a bond within five years of issuance will result in forfeiture of three months' worth of interest.

- Tax efficiency: Savings bonds are exempt from state and local taxes. They are subject to federal taxes, however. The federal taxes are deferred until redemption or maturity, though you could pay taxes annually on accrued earnings if you prefer.

- Co-owner and beneficiary rights: You can assign co-owners and beneficiaries to your savings bonds.

Managing

Managing savings bonds

You can buy and manage electronic savings bonds online using the TreasuryDirect website. As of Jan. 1, 2025, the sale of paper savings bonds is discontinued.

The minimum savings bond purchase is $25. The maximum is $10,000 per bond series, per calendar year when you are buying for yourself. This means you could buy yourself $10,000 in I bonds and $10,000 in EE bonds every 12 months.

You can also purchase additional bonds as gifts for others. The amount of those gifts applies to the recipient's allowed annual total, but not yours.

The bonds you buy for yourself remain in your TreasuryDirect account, where you can manage them. Available actions within TreasuryDirect include:

- Updating your name and address.

- Changing the bond owner or managing beneficiaries.

- Viewing interest earned to date.

- Redeeming electronic bonds.

You can also use TreasuryDirect to convert paper bonds to electronic form and to report bonds as lost, stolen, or destroyed.

Redeeming

Redeeming savings bonds

As noted, you can redeem electronic savings bonds through TreasuryDirect. If the bonds are already in your account, the process is straightforward.

Paper savings bonds, on the other hand, may be more complicated to liquidate. If you have the bond in your possession, first try converting it to an electronic bond within your TreasuryDirect account.

Alternatively, you can find a bank that will cash paper bonds. You will need to verify your identity in the process. This is simpler when you are working with your own bank. If you are not an account holder, however, the bank may decline to help or may require multiple identifying documents.

Note that you will receive a 1099-INT upon redemption or maturity of your bonds. This document outlines your interest earnings and helps you prepare your next tax return.

Related investing topics

Savings bonds for diversity

U.S. savings bonds are low-risk, low-yield investments. They can provide diversification to any portfolio, from simple to complex.

Since the purchase limits for savings bonds are relatively low, it's wise to identify complementary assets to consider as your wealth grows. A diversified portfolio can include savings bonds alongside equities, other types of bonds, and alternative assets.

![Trump at White House podium. Official White House Photo by D. Myles Cullen. [MConverter.eu]](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F801349%2Ftrump-at-white-house-podium-official-white-house-photo-by-d-myles-cullen-mconvertereu.jpg&op=resize&w=184&h=104)