Ever considered investing in bonds but were scared off by the high price of buying even a single one? Thought about bond exchange-traded funds (ETFs) but wanted to focus your fixed-income investments on specific bets rather than take a shotgun approach?

You might want to take a look at baby bonds -- affordably priced fixed-income securities that are designed to appeal to a broad range of potential investors. Read more to learn about baby bonds and how you might benefit from them.

What are they?

What is a baby bond?

A baby bond is simply a fixed-income security that's designed to be affordable. Unlike many bonds, which have denominations starting at $1,000, baby bonds can be sold in denominations of $100, $50, or even $25. The idea is to make bonds appealing to retail investors who might not have the funds or the interest to invest in bonds that are priced at $1,000 or more.

Baby bonds have many of the same characteristics as their more expensive siblings. They pay interest over time -- usually annually or semi-annually -- and mature on a specific date, when the borrower repays the face value of the bond to the investor. As with any other type of bond, the coupon rate, or the interest offered on the bond, is generally fixed, but can be variable in some cases.

Like regular bonds, baby bonds are listed on stock exchanges and can be traded on the secondary market. They can be issued by corporations, municipalities, and government-sponsored entities.

Advantages

Advantages of baby bonds

Although the most obvious advantage is affordability, baby bonds also offer a number of potential benefits to their investors. Like regular bonds, baby bonds can provide a steady income stream via regular interest payments.

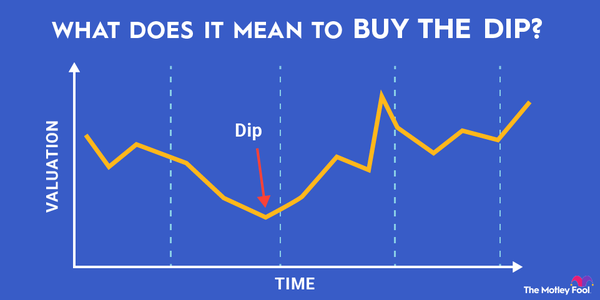

Baby bonds also offer liquidity, an important benefit in volatile markets. If an investor holding one (or more) of the bonds thinks interest rates will increase, it might be a wise idea to sell since the value of a lower-yielding bond will drop as higher-yielding bonds become available.

It's worth noting that many baby bonds sold by governments are among the safest possible investments you can make. Bonds issued by state governments and municipalities are often exempt from federal taxes, as well.

Finally, baby bonds can be an inexpensive method of diversifying portfolios. Their low prices make it easy for individual investors to gradually add fixed-income securities. And while baby bonds aren't likely to increase in value like a classic growth stock, they're a low-risk means of steadily building wealth over time.

Disadvantages

Disadvantages of baby bonds

Baby bonds carry many of the same risks as any fixed-income security. Chief among those risks is the credit rating of the issuer. Junk-grade bonds offer the potential for outsized returns, but could also lead to significant losses.

Baby bonds are generally considered to be unsecured debt. If a borrower defaults, investors holding baby bonds generally have to wait for holders of secured debt to be repaid (although they usually stand to be compensated before holders of preferred stock or common stock).

Interest rates can also affect the value of baby bonds. If interest rates fall, a baby bond with a higher rate will provide a larger interest payment, so it's more valuable. If interest rates increase, baby bonds with lower rates are at a competitive disadvantage since they're offering a smaller interest payment.

Although baby bonds can be sold on the secondary market, investors should be aware that they're not as prevalent to trade as standard bonds. That means the bid-ask spread may not be favorable for a seller.

Baby bonds also face the risk of being callable. If interest rates fall, the borrower that issued the bond may have the right to pay it off immediately so that it can refinance at new, lower rates.

Related investing topics

Examples

Examples of baby bonds

Although fixed-income securities are generally considerably safer than stocks, they're not without risk. Chicken Soup for the Soul (CSSE 0.0%), best known for its acquisition of the once-ubiquitous Redbox video rental kiosks, issued $25 bonds in July 2020 with an extremely generous 9.5% coupon rate. But the company filed for Chapter 11 bankruptcy in June 2024 and converted its plan to Chapter 7 in July 2024.

On the other end of the spectrum, Southern Co. (SO 1.32%) planned to raise $750 million through the sale of $25 investment-grade baby bonds in 2020. The bonds (SOJC 0.54%), which had a 40-year maturity date, offered a coupon rate of 4.2%. They traded between $22.50 and $25 for most of 2024, offering a 5.4% yield.