Buying bonds can give you a solid source of fixed income over a long period of time, but you don't always have to hold those bonds for them to pay off. Sometimes, people trade bonds on the secondary market, and if you're thinking about doing that, metrics like bond convexity will come into play. Read on to learn more about this and how it works.

What is it?

What is bond convexity?

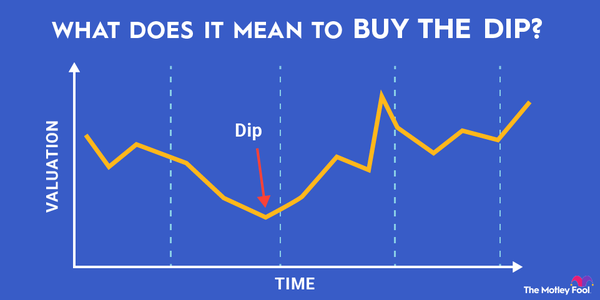

When it comes to bonds on the secondary market, values aren't fixed like they are when you buy them directly from the issuer. Their values change over time, based on a variety of market conditions, including changing interest rates for other investments, including other bond issues. If a new bond issue is more attractive than an existing one, then it only makes sense that the older bond issue will not be worth as much due to a lack of demand.

Bond convexity is a way of explaining the sensitivity of a bond's secondary market price as it moves with changing interest rates. Convexity isn't fixed, and it also isn't linear, so in some cases, a bond's secondary market price may move very dramatically; in others, it might not respond as quickly.

In other words, bond convexity is sort of like a yield curve in that the relationship between the bond's yield and the prevailing bond rate for new issues is related, though it's not a direct relationship. The values of bonds with positive convexity move in the opposite direction to the direction of rates (increasing or decreasing); those with negative convexity move in the direction of rates.

Convexity vs. duration

Bond convexity versus bond duration

Another way to represent secondary market bond price sensitivity is via a linear relationship called bond duration. Although understanding duration is important to help understand convexity, they are not the same. Bond duration assumes the relationship between secondary market prices and prevailing interest rates is fixed, so no matter how much interest moves, the price of the bond will move in lockstep.

However, we know that's not true through real-world observation, and that's why convexity is important. Bond duration is an easy, back-of-the-napkin way to estimate risk, but convexity is vital to truly understand what you're getting into with any bond purchase you don't intend to hold to maturity.

Positive and negative convexity

Positive and negative convexity

There are two kinds of bond convexity that are possible: positive and negative. Positive convexity happens when the duration of the bond rises with a declining interest rate, meaning that an existing bond is worth more as current interest rates decline. That's kind of an obvious one, but there's a lot of accounting language that makes it tricky to decipher.

Negative convexity works the other way, and existing bonds on the secondary bond market are worth more as current interest rates rise.

A few examples of bonds that tend to exhibit positive convexity include non-callable bonds or those with make-whole calls. Bonds that tend to exhibit negative convexity include bonds with traditional calls, preferred bonds, and mortgage-backed securities.

Related investing topics

Why it matters

Why does convexity matter to investors?

For many investors, convexity doesn't matter. They'll buy their bonds and hold them to the end of their life, then cash them out, only to do this again and again. And there's not a thing wrong with managing bonds like this. There's no need to make bond investing complicated for small-scale investors.

But, if you want to do something more with your bonds, or are considering rebalancing your bond portfolio, convexity is important because you need to understand how the value of your bond is changing before you determine which, if any, are better to sell than to continue to hold. If your existing bond has positive convexity and prevailing interest rates are up, you're less likely to do better selling it since its value will likely drop.

However, if it has negative convexity and rates go up, your bond might well be worth a whole lot more, so it could be a good idea to sell now rather than to hold it until you can cash it out at maturity.