Cash value life insurance is a financial product that combines a death benefit with a savings component. It's a more expensive alternative to term life insurance, which only has a death benefit. Let's explore how cash value life insurance works, its benefits, and whether it is right for you.

What is it?

Understanding cash value life insurance

There are two main categories of life insurance: permanent and term. Cash value life insurance is permanent coverage, and it differs from term insurance in three ways:

- Permanent life insurance remains in force until the insured dies, as long as the premiums are paid as agreed. Term life insurance, however, has an expiration date. Many term policies allow for short-term coverage renewal, but the renewal premiums will likely be much higher.

- Permanent life insurance has a savings feature called cash value, along with a death benefit. Term life insurance has only a death benefit, which is the amount beneficiaries receive when the insured dies.

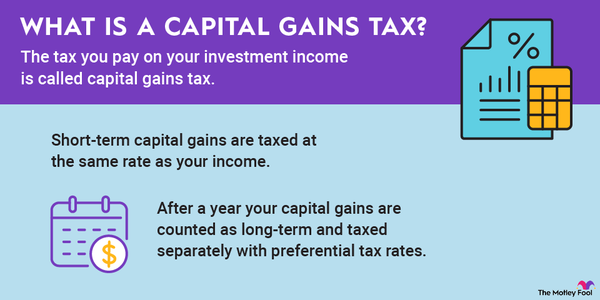

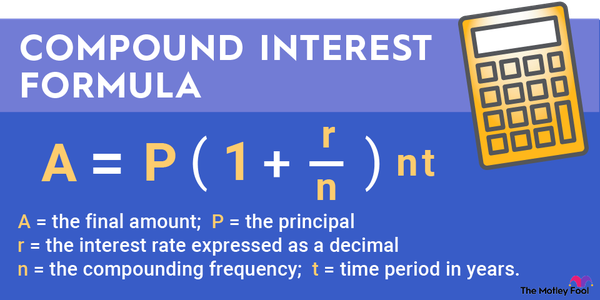

- Permanent life insurance has higher premiums than term life. The higher premiums fund the policy's cash value account, which grows on a tax-deferred basis over time. Eventually, the policyholder can use the cash value as a source of liquidity. If the cash value isn't used, it funds the policy's death benefit.

Types

Types of cash value insurance

The policy type and policyholder elections dictate whether the cash value balance earns interest or is invested. There are four cash value policy types:

- Whole life insurance: Whole life insurance typically offers a guaranteed rate of return on the cash value. This policy type also pays dividends, which can be taken as cash, used to pay premiums, or held in the policy to increase its cash value.

- Universal life insurance: Universal life policies often earn an adjustable interest rate with a guaranteed minimum.

- Variable life insurance: Variable life insurance allows policyholders to invest their cash value in a selection of investment funds operated by the insurance company. This allows for higher return potential than an interest-earning policy, but the risk of loss is also higher.

- Indexed universal life insurance: The cash value earns a rate of return that's tied to a financial market index, such as the S&P 500. The policy may also define maximum and minimum rates of return.

Benefits

Benefits of cash value

Cash value life insurance can carry premiums 8 to 15 times higher than term coverage. The main benefit associated with those higher premiums is the cash value, which can function as a source of liquidity on well-funded policies.

Liquidation options include borrowing against the cash value or withdrawing it, depending on the policy type. Policyholders who no longer need their coverage can also surrender or sell their policies.

- Borrow: Insurers will lend as much as 100% of the policy's cash value balance, often at a competitive interest rate. Interest will accrue and capitalize, but there are usually no repayments required. Any outstanding loan balance will be deducted from the death benefit before it is paid to beneficiaries.

- Withdraw: Some policies allow for tax-free withdrawals as long as the withdrawn amount is less than the total premiums paid into the policy. Withdrawals may reduce the death benefit.

- Surrender: Upon policy cancellation, cash value balances are refunded to policyholders, less any fees. Note that the policyholder must actively cancel the policy to receive a refund. If premiums are neglected, the insurance company will pay them by deducting them from the cash value. Once the cash value is depleted, the policy will lapse, and the policyholder will get nothing.

- Sell: Senior policyholders may have the option to sell their permanent life insurance in a life settlement, which can produce much higher cash proceeds than a policy surrender.

Do you need it?

Do you need cash value life insurance?

Cash value life insurance offers specific benefits, which may or may not apply to your situation and financial goals. Use the following questions to determine whether you could benefit from owning a cash value policy:

Do you want a guaranteed death benefit?

One advantage of cash value insurance over term is its permanency. Term coverage is inexpensive, but it's also easy to outlive. The policy may expire during your 80th year, for example, and be too expensive to renew. Permanent cash value insurance does not expire, assuming you continue paying the premiums.

Can you fund your own death benefit?

Insurance companies charge fees, and fees limit the funds invested in your cash value account. Often, it makes more financial sense to build your legacy over time by investing. If you want financial protection for your family in the meantime, you can get it cheaply from a term policy.

Related investing topics

Do you want a backup plan?

Investing independently can be challenging. Some savers find it easier to pay an insurance premium bill than to send money to a brokerage account voluntarily. For those who struggle to save and invest, a funded cash value policy may provide additional liquidity and financial flexibility in their senior years.

Can you commit?

Purchasing permanent life insurance means committing to pay the premiums indefinitely. Letting the policy lapse due to nonpayment is a win for the insurance company and a big loss for you.

Cash value life insurance is expensive, but it does provide tax-deferred growth, the potential for liquidity, and a guaranteed death benefit for those who commit to paying the premiums.