An Ethereum (ETH -1.25%) exchange-traded fund (ETF) is a publicly traded, open-ended investment fund that holds Ether (ETH) as its underlying asset. Publicly traded means that the ETF can be bought and sold on major stock exchanges just like a regular stock.

Ethereum (ETH)

Open-ended refers to the fund's ability to issue and redeem shares on an ongoing basis, allowing investors to easily enter and exit their positions based on the market price of the ETF.

What are they?

Understanding Ethereum ETFs

Ethereum ETFs operate by having the ETF issuer work with a custodian to store Ether securely. When the ETF is launched, the issuer uses initial investor capital to purchase actual Ether, which the custodian safely holds. Based on the amount of Ether in storage, the ETF issuer creates shares of the ETF, each representing fractional ownership of the Ether held in custody.

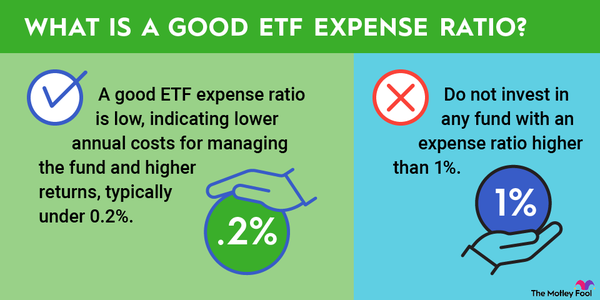

Just like regular stocks, these shares are traded on exchanges under a specific ticker. You can buy and sell them during market hours through most brokerage accounts. Like other ETFs, Ethereum ETFs charge an expense ratio, which is a percentage fee deducted over time, expressed annually, to cover the fund's operational costs.

Importantly, Ethereum ETFs have both a market price and a net asset value (NAV). You buy shares at the market price, and behind the scenes, the ETF issuer works with authorized participants to create or redeem shares, ensuring the market price stays close to the NAV.

History

History of Ethereum ETFs

The journey of what we know today as an Ethereum ETF began in 2017 with the launch of the Grayscale Ethereum Trust (ETHE 1.94%). However, when it debuted in December 2017, it was not an ETF but rather a closed-ended trust.

Unlike ETFs, closed-ended trusts can trade at significant premiums or discounts to their NAV because they lack the open-ended creation and redemption mechanism that keeps an ETF's market price aligned with its NAV. However, at the time, the Grayscale Ethereum Trust was the only way for investors to gain exposure to Ether without the need for self-custody.

The next milestone in Ethereum ETF evolution came in October 2023 with the launch of the ProShares Ether Strategy ETF (EETH 1.85%). This ETF was a true open-ended ETF. However, it came with a limitation: At the time, ETFs were not yet allowed to hold spot cryptocurrency.

To work around this, it held Ethereum futures contracts rather than actual Ether. These are derivatives that allow investors to speculate on the future price of an asset or hedge existing positions.

The ProShares Ether Strategy ETF provided exposure to Ethereum's price movements without holding physical Ether, making it a liquid and easy-to-package ETF. It wasn't until January 2024 that the Securities and Exchange Commission (SEC) finally approved true spot Ethereum ETFs, giving investors nine different options to gain direct exposure to Ether.

Before buying

What you need to know before buying an Ethereum ETF

If you're thinking about adding a spot Ethereum ETF to your investment portfolio, there are a few key things to consider before making your move.

- Be aware of the high volatility. Like most cryptocurrencies, Ether's price can experience significant swings, even more than typical stocks. Since Ethereum ETFs directly hold Ether, their share prices will also be highly volatile.

- Expect price discrepancies between the Ether spot price and the ETF's market price. This can happen due to the drag from expense ratios and because Ether trades 24/7; Ethereum ETFs are limited to trading during market hours.

- Many Ethereum ETF providers are offering fee waivers, but these may be temporary. The waivers often come with time limits (e.g., for only the first month), assets under management (AUM) caps (e.g., on only the first $1 billion in AUM), or both. Be sure to read the fine print before investing.

Related investing topics

An example

An example of an Ethereum ETF

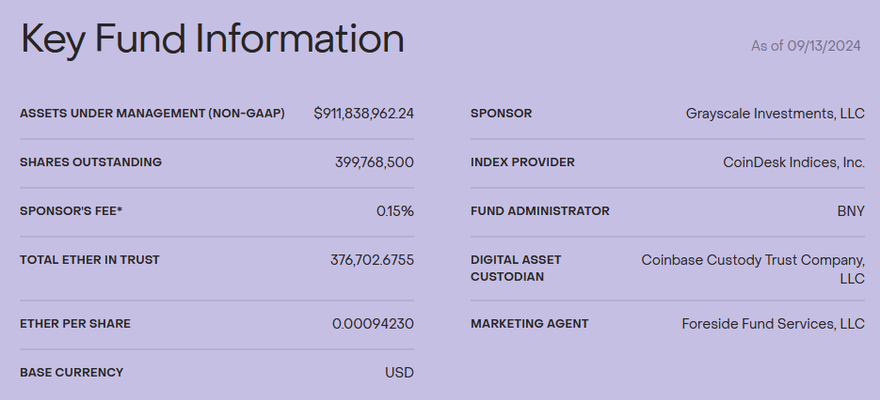

In July 2024, investors in Grayscale Ethereum Trust received a tax-free spin-off in the form of shares of the Grayscale Ethereum Mini Trust (ETH 1.85%). The new ETF was a lower-priced version with a significantly more affordable expense ratio, making it more accessible to a broader range of investors. As seen below, prospective investors can easily review important details provided on its webpage.

Vital information includes the sponsor fee, the AUM, the amount of Ether held in the trust, the Ether-to-share ratio, and the fund's custodian, ensuring transparency for anyone considering an investment.