The Fortune 100 are the top 100 companies within the Fortune 500, an annual list published by Fortune magazine of the 500 largest U.S. companies. The magazine ranks companies in the Fortune 500 by reported revenue. The list includes public and private companies incorporated and operating in the U.S. and filing financial statements with the government.

The Fortune 100 is not an official list within the Fortune 500 but a subset of the group. It differs from Fortune's 100 Best Companies to Work For and Fortune's 100 Fastest-Growing Companies.

What is the Fortune 100?

What is the Fortune 100?

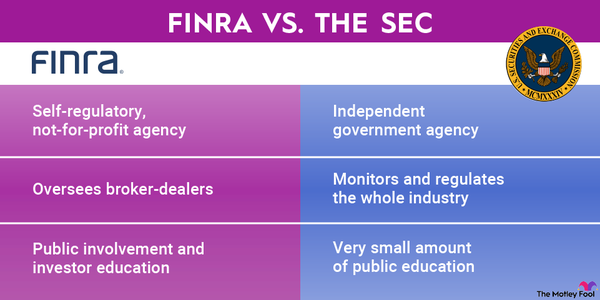

The Fortune 100 are the 100 largest companies in the U.S. ranked by revenue. They’re an unofficial subgroup of the Fortune 500 list published each year by Fortune magazine. Fortune has been posting its list of the 500 largest companies in the U.S. ranked by revenue since 1955. The magazine uses revenue reported by companies to a government agency, such as the 10-K annual reports that publicly traded companies file with the U.S. Securities and Exchange Commission (SEC).

Fortune published its latest Fortune 500 list in September 2024, ranking companies by revenue for the 2023 fiscal year. The top 100 companies on that list were:

| Fortune Ranking | Company | Ticker Symbol | Sector |

|---|---|---|---|

| 1 | Walmart | (NYSE:WMT) | Retail |

| 2 | Amazon | (NASDAQ:AMZN) | Retail |

| 3 | Apple | (NASDAQ:AAPL) | Technology |

| 4 | UnitedHealth Group | (NYSE:UNH) | Health Care |

| 5 | Berkshire Hathaway | (NYSE:BRK.A)(NYSE:BRK.B) | Financials |

| 6 | CVS Health | (NYSE:CVS) | Health Care |

| 7 | Exxon Mobil | (NYSE:XOM) | Energy |

| 8 | Alphabet | (NASDAQ:GOOG)(NASDAQ:GOOGL) | Technology |

| 9 | McKesson | (NYSE:MCK) | Health Care |

| 10 | Cencora | (NYSE:COR) | Health Care |

| 11 | Costco Wholesale | (NASDAQ:COST) | Retail |

| 12 | JPMorgan Chase | (NYSE:JPM) | Financials |

| 13 | Microsoft | (NASDAQ:MSFT) | Technology |

| 14 | Cardinal Health | (NYSE:CAH) | Health Care |

| 15 | Chevron | (NYSE:CVX) | Energy |

| 16 | Cigna | (NYSE:CI) | Health Care |

| 17 | Ford Motor | (NYSE:F) | Motor Vehicles & Parts |

| 18 | Bank of America | (NYSE:BAC) | Financials |

| 19 | General Motors | (NYSE:GM) | Motor Vehicles & Parts |

| 20 | Elevance Health | (NYSE:ELV) | Health Care |

| 21 | Citigroup | (NYSE:C) | Financials |

| 22 | Centene | (NYSE:CNC) | Health Care |

| 23 | Home Depot | (NYSE:HD) | Retail |

| 24 | Marathon Petroleum | (NYSE:MPC) | Energy |

| 25 | Kroger | (NYSE:KR) | Food & Drug Stores |

| 26 | Phillips 66 | (NYSE:PSX) | Energy |

| 27 | Fannie Mae | Private | Financials |

| 28 | Walgreens Boots Alliance | (NASDAQ:WBA) | Food & Drug Stores |

| 29 | Valero Energy | (NYSE:VLO) | Energy |

| 30 | Meta Platforms | (NASDAQ:META) | Technology |

| 31 | Verizon Communications | (NYSE:VZ) | Telecommunication |

| 32 | AT&T | (NYSE:T) | Telecommunication |

| 33 | Comcast | (NYSE:CMSCA) | Telecommunication |

| 34 | Wells Fargo | (NYSE:WFC) | Financials |

| 35 | Goldman Sachs Group | (NYSE:GS) | Financials |

| 36 | Freddie Mac | Private | Financials |

| 37 | Target | (NYSE:TGT) | Retail |

| 38 | Humana | (NYSE:HUM) | Health Care |

| 39 | State Farm Insurance | Private | Financials |

| 40 | Tesla | (NASDAQ:TSLA) | Automotive |

| 41 | Morgan Stanley | (NYSE:MS) | Financials |

| 42 | Johnson & Johnson | (NYSE:JNJ) | Health Care |

| 43 | Archer Daniels Midland | (NYSE:ADM) | Food, Beverages & Tobacco |

| 44 | PepsiCo | (NYSE:PEP) | Food, Beverages & Tobacco |

| 45 | United Parcel Service | (NYSE:UPS) | Transportation |

| 46 | FedEx | (NYSE:FDX) | Transportation |

| 47 | Walt Disney | (NYSE:DIS) | Media |

| 48 | Dell Technologies | (NYSE:DELL) | Technology |

| 49 | Lowe's | (NYSE:LOW) | Retail |

| 50 | Procter & Gamble | (NYSE:PG) | Retail |

| 51 | Energy Transfer | (NYSE:ET) | Energy |

| 52 | Boeing | (NYSE:BA) | Aerospace & Defense |

| 53 | Albertsons | (NYSE:ACI) | Food & Drug Stores |

| 54 | Sysco | (NYSE:SYY) | Wholesalers |

| 55 | RTX | (NYSE:RTX) | Aerospace & Defense |

| 56 | General Electric | (NYSE:GE) | Industrials |

| 57 | Lockheed Martin | (NYSE:LMT) | Aerospace & Defense |

| 58 | American Express | (NYSE:AXP) | Financials |

| 59 | Caterpillar | (NYSE:CAT) | Industrials |

| 60 | MetLife | (NYSE:MET) | Financials |

| 61 | HCA Healthcare | (NYSE:HCA) | Health Care |

| 62 | Progressive | (NYSE:PGR) | Financials |

| 63 | International Business Machines | (NYSE:IBM) | Technology |

| 64 | Deere | (NYSE:DE) | Industrials |

| 65 | Nvdia | (NASDAQ:NVDA) | Technology |

| 66 | StoneX Group | (NASDAQ:SNEX) | Financials |

| 67 | Merck | (NYSE:MRK) | Health Care |

| 68 | ConocoPhillips | (NYSE:COP) | Energy |

| 69 | Pfizer | (NYSE:PFE) | Health Care |

| 70 | Delta Air Lines | (NYSE:DAL) | Industrials |

| 71 | TD Synnex | (NYSE:SNX) | Technology |

| 72 | Publix Super Markets | Private | Food & Drug Stores |

| 73 | Allstate | (NYSE:ALL) | Financials |

| 74 | Cisco Systems | (NASDAQ:CSCO) | Technology |

| 75 | Nationwide | Private | Financials |

| 76 | Charter Communications | (NASDAQ:CHTR) | Telecommunication |

| 77 | AbbVie | (NYSE:ABBV) | Health Care |

| 78 | New York Life Insurance | Private | Financials |

| 79 | Intel | (NASDAQ:INTC) | Technology |

| 80 | TJX | (NYSE:TJX) | Retail |

| 81 | Prudential Financial | (NYSE:PRU) | Financials |

| 82 | HP | (NYSE:HP) | Technology |

| 83 | United Airlines | (NASDAQ:UAL) | Industrials |

| 84 | Performance Food Group | (NYSE:PFGC) | Food, Beverages & Tobacco |

| 85 | Tyson Foods | (NYSE:TSN) | Food, Beverages & Tobacco |

| 86 | American Airlines | (NASDAQ:AAL) | Industrials |

| 87 | Liberty Mutual Insurance Group | Private | Insurance |

| 88 | Nike | (NYSE:NKE) | Apparel |

| 89 | Oracle | (NASDAQ:ORCL) | Technology |

| 90 | Enterprise Products Partners | (NYSE:EPD) | Energy |

| 91 | Capital One Financial | (NYSE:COF) | Financials |

| 92 | Plains GP Holdings | (NYSE:PAGP) | Energy |

| 93 | World Kinect | (NYSE:WKC) | Energy |

| 94 | American International Group | (NYSE:AIG) | Insurance |

| 95 | Coca-Cola | (NYSE:KO) | Food, Beverages & Tobacco |

| 96 | TIAA | Private | Financials |

| 97 | CHS | (NYSE:CHS) | Retail |

| 98 | Bristol-Myers Squibb | (NYSE:BMY) | Health Care |

| 99 | Dow | (NYSE:DOW) | Chemicals |

| 100 | Best Buy | (NYSE:BBY) | Retail |

The top 100 companies in the Fortune 500 include publicly traded companies and privately held businesses. The list also features companies from almost all sectors of the economy.

Why is it important?

Why is the Fortune 100 important?

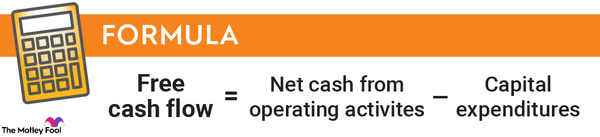

The Fortune 500 comprise a significant percentage of the U.S. economy. In 2024, the group generated $18.8 trillion in revenue, representing about two-thirds of the U.S. gross domestic product (GDP). The Fortune 100 represent the top 100 revenue generators in the U.S. economy, making them the country’s most important economic drivers.

The Fortune 100 is a prestigious list. Many companies will highlight their ranking in the Fortune 100 to showcase their size and importance to the economy. Others will use the list to show their success in securing high-profile clients. For example, a smaller company might highlight that a large percentage of the Fortune 100 utilizes its solutions or that it recently signed a contract with a company on the Fortune 100.

What can investors learn from it?

What can investors learn from the Fortune 100?

As an important list of large companies ranked by revenue, the Fortune 100 can help investors see which companies generated the most revenue in the previous fiscal year compared to other companies in their sector and in different industries. Investors can also compare the current year's list to prior years to see which companies are rising or declining.

However, the list has its shortcomings. Investors value revenue growth and earnings growth over having lots of revenue. The largest publicly traded companies by market cap differ (materially in some cases) from their ranking on the Fortune 100 list. Here's how the top 10 companies in the S&P 500 Index compare to their order in the Fortune 100:

| Company | S&P 500 Ranking | Fortune 100 Ranking |

|---|---|---|

| Nvidia | 1 | 65 |

| Apple | 2 | 3 |

| Microsoft | 3 | 13 |

| Amazon | 4 | 2 |

| Meta Platforms | 5 | 30 |

| Alphabet | 6 | 8 |

| Tesla | 7 | 40 |

| Berkshire Hathaway | 8 | 5 |

| Broadcom | 9 | NR |

| JPMorgan Chase | 10 | 12 |

As the table shows, one of the 10 biggest companies by market cap (Broadcom) didn't produce enough revenue in 2023 to rank in the Fortune 100, while others rank much lower on the Fortune 100 than their weighting in the S&P 500.

Related investing topics

How has it changed over the years?

How has the Fortune 100 changed over the years?

The Fortune 100 list can change from year to year. Companies move up the Fortune 100 list as their revenue grows or drop down in the ranking (or off the list) as it declines or others increase their revenue faster, so the Fortune 100 list can see dramatic changes over the years. For example, a decade ago, the top 10 companies on Fortune's list were:

- Walmart

- ExxonMobil

- Chevron

- Phillips 66

- Berkshire Hathaway

- Apple

- General Motors

- General Electric

- Valero Energy

- Ford

The list featured four energy and two automotive companies in the top 10, with only one technology company and none from the healthcare sector. Fast-forward a decade, and the top 10 from 2024 featured four healthcare and three technology companies (if you count Amazon as tech). The change shows the tremendous revenue growth of healthcare and technology companies over the past 10 years and the decline in autos and energy as the world shifts to cleaner alternatives.

Investors can glean some important insights by watching how the list changes over the years. Focusing on companies rising up the list (and avoiding declining ones) could help boost returns since it suggests risers are increasing revenues at an above-average pace.