When you're considering wading into the ocean of dividend-paying stocks, it's important to get a good handle on the terminology. A forward dividend yield is one of a few key metrics you should consider. Understanding this metric can help you make better buying decisions. Read on to learn more.

What is it?

What is a forward dividend yield?

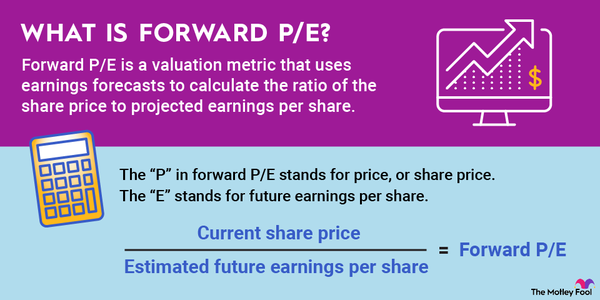

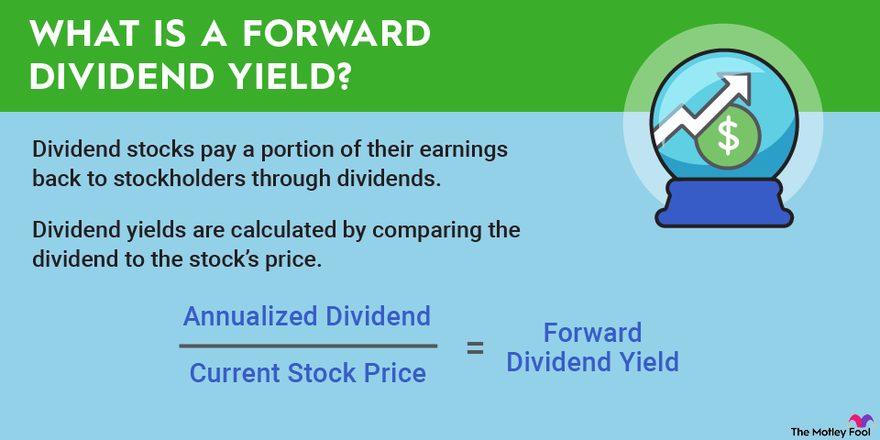

Dividend stocks pay a portion of their earnings back to stockholders through dividends. Dividend yields are calculated by comparing the dividend to the stock's price. For example, a stock might pay $1 per share for the first year you own it at $20, giving you a 5% dividend yield.

A forward dividend yield tries to predict what the future holds for the stock and the future yield that might be compared to the current stock price. This is generally only useful for stocks that are very consistent with their dividends. It can be very difficult to predict the forward yield for stocks with dividends tied to erratic business.

How to determine

How do you determine a forward dividend yield?

Determining forward dividend yield is a bit like looking into a Magic 8-Ball -- the future is uncertain. But if you're familiar with the company's industry and competitors, you can generally anticipate that the forward yield will be stable or may have to become smaller due to current struggles.

If you're confident in the stability of your dividend, it's easy enough to take the most recent dividend (or dividend announcement) and multiply it by the number of dividends paid yearly to get an annualized dividend. Many stocks pay quarterly dividends, and a few pay monthly, so it's important information to know.

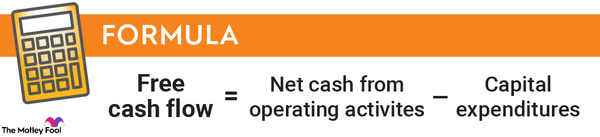

Once you have your number, simply divide it by the current stock price, and there it is -- your forward dividend. So, if your stock is paying $0.50 this quarter, you'd be getting $2 per year if all remains stable; assuming today's price is $50, that's a 4% forward dividend yield. Here's the formula and result:

Annualized dividend / stock price = forward dividend yield

$2 / $50 = 4%

Of course, there are also analysts out there who do a much more thorough analysis to come up with predictions for forward dividend yields that may be helpful to track as you shop for your next stock pick. These guys also don't have an infallible Magic 8-Ball, but they do have loads of experience to help them make a very informed guess.

Forward vs. trailing

Forward dividend yield vs. trailing dividend yield

There are many ways to look at dividend yield, but the most common are forward yield and trailing yield. These may turn out to be the same, but the two terms look at very different things.

Forward yield is a way to anticipate the upcoming dividends for the year based on the company's dividend history and your best guess at how it will perform in the future. Trailing yields, however, are based on solid historical data and are incredibly easy to verify and support.

Both are important when you're thinking about buying a stock. Forward dividend yield, when calculated based on the reality of the stock market and not on an optimistic view, can help you anticipate what you'll earn in the coming year. Trailing yields will tell you what's definitely already happened (and can help you figure out that forward yield).

Why they matter

Why do forward dividend yields matter to investors?

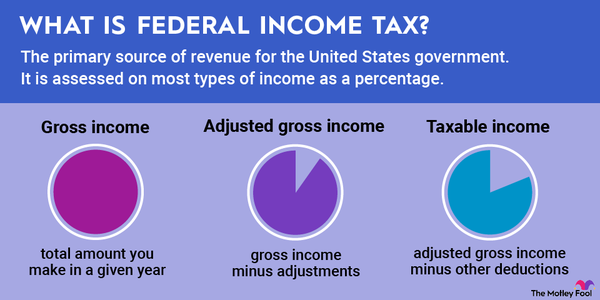

Investors need to see a company from all angles when they're considering investing in it. Buying stock is just like buying a company: You're becoming a partner in the business, even if you have only a small share. So, understanding the potential for dividends in the future also means you understand the potential earnings for your company in the coming year.

Related investing topics

Dividend yields, both forward and trailing, are also a good way to eliminate volatility in your portfolio. A huge dividend sounds great but is often a warning sign of issues to come. So, if your forward dividend rests snugly above about 6%, you should seriously consider skipping the stock unless you know of something that is creating an aberration in the yields for this year.

Forward dividend yields are just another tool to better understand what you're buying, as well as the outlook for you and your new partial ownership in the business.