54% view Social Security COLA as insufficient

54% view Social Security Cost-of-Living Adjustment as insufficient

A majority of respondents believe the 2025 Social Security COLA is insufficient.

Thirty-one percent of respondents said the 2025 COLA is completely insufficient, and 24% said it was somewhat insufficient. Twenty percent were neutral on the adjustment. Sixteen percent said it was somewhat appropriate, and 9% said it was completely appropriate.

That’s a slight improvement from how retirees surveyed by The Motley Fool felt about the 2024 COLA. Sixty-two percent believed that adjustment was insufficient and just 23% felt it was appropriate.

| How do you feel about the most recent Social Security cost-of-living adjustment? | 2024 COLA | 2025 COLA |

|---|---|---|

| Completely appropriate | 7% | 9% |

| Somewhat appropriate | 16% | 16% |

| Neutral | 15% | 20% |

| Somewhat insufficient | 26% | 24% |

| Completely insufficient | 36% | 31% |

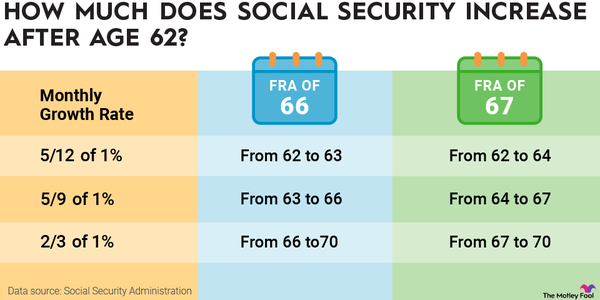

Respondents who first claimed Social Security after 70 are more likely to view the most recent COLA as sufficient. For each year an individual delays receiving Social Security, they increase their monthly benefit, up to age 70. Those who first claimed Social Security at 70 receive a larger payment, which may be why they’re more willing to view the COLA as sufficient.

| Age | Insufficient | Neutral | Appropriate |

|---|---|---|---|

| Younger than 70 | 58% | 17% | 25% |

| 70 and older | 39% | 37% | 23% |

Just 25% of respondents younger than 70 said the COLA is appropriate and 58% said it is insufficient. Seventeen percent are neutral. Among respondents 70 and older, 39% said the adjustment is insufficient and 37% were neutral. A quarter said the COLA is appropriate.

The more respondents rely on Social Security, the less likely they are to view the COLA as sufficient. Roughly 59% of those who rely on Social Security exclusively or heavily see the COLA as insufficient. Among respondents that don’t rely at all on Social Security benefits for their monthly income, 44% see the COLA as insufficient.

81% say the Social Security Cost-of-Living Adjustment will help “very little” or not at all with key expenses

The Social Security COLA is tied to the rate of inflation, but most respondents say that the 2025 adjustment won’t improve their ability to pay for essential living expenses. Sixty-three percent say it will help very little, and another 28% say it won’t help at all.

| How do you think the 2.5% cost-of-living adjustment for Social Security benefits will affect your ability to cover essential living expenses? | ||

|---|---|---|

| It won’t help at all | 28% | |

| It will help very little | 63% | |

| It will make a noticeable difference | 14% | |

| It will significantly improve my situation | 5% |

This may be a reflection of food, energy, and housing costs rising faster at times than the overall rate of inflation. Americans aged 65 and older were already spending around $2,430 per month on those categories in 2023, which was hundreds of dollars more than what they received through Social Security on average each month that year.

62% have cut back on nonessential items due to inflation

In response to inflation, 62% of retirees surveyed said they have cut back on nonessential items. Forty-three percent said they have delayed making major purchases, and 42% have reduced spending on necessities. Only 14% reported making no significant changes to their spending or saving habits.

| How have you adjusted your spending or saving habits in response to inflation over the past year? (Select all that apply) | ||

|---|---|---|

| Cut back on nonessential items | 62% | |

| Delayed major purchases | 43% | |

| Reduced spending on necessities | 42% | |

| Sought additional income sources | 23% | |

| Increased savings for emergencies | 19% | |

| Made no significant changes | 14% |

If respondents felt as though the Social Security COLA was sufficient and keeping pace with inflation, it’s likely that fewer would have reported a decline in both discretionary and required spending in the past year.

Despite cutting back on spending, 44% are having trouble affording groceries, 40% of respondents are having trouble building or maintaining emergency savings, and 40% are facing difficulties paying for their utilities.

| In which of the following categories are you struggling financially? (Select all that apply) | ||

|---|---|---|

| Food | 44% | |

| Building or maintaining emergency savings | 40% | |

| Utilities | 40% | |

| Debt repayment | 31% | |

| Housing | 32% | |

| Healthcare | 31% | |

| Transportation | 25% | |

| Other | 14% |

Those are all fundamental components of financial stability. Emergency savings are crucial for those in retirement because they’re likely to be on a limited, fixed income and have little financial flexibility. Being able to pay for groceries and utilities is a necessity. Falling behind on debt can snowball and create a long-term financial strain.

71% say the COLA formula doesn't reflect their finances

71% say the COLA formula doesn’t reflect retirees’ financial situation

Seventy-one percent of respondents believe the formula to determine the Social Security COLA does not accurately reflect how retirees experience inflation.

The COLA is equal to the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the average for the third quarter of the current year to the average for the third quarter of the previous year in which a COLA came into effect.

Retirees have different spending patterns than younger generations and much less opportunity to earn more income. A higher percentage of their spending goes to food and healthcare, and food has experienced higher price increases than overall inflation in recent years.

Those who are more financially stable are more likely to think the Social Security COLA formula reflects how retirees experience inflation, but it’s not a majority.

| To what extent do you believe the current method of calculating the Social Security COLA accurately reflects the inflation experienced by retirees? | Accurately | Not accurately |

|---|---|---|

| I am financially stable without any significant concerns | 41% | 59% |

| I am doing well, though occasionally encounter financial issues | 34% | 66% |

| I face some financial challenges but generally manage | 26% | 74% |

| I struggle financially on a daily basis | 21% | 79% |

| All respondents | 29% | 71% |

68% think the COLA should be 6% or more

68% of retirees think the Social Security COLA should be 6% or higher

Thirty-two percent of respondents believe that in order to keep up with the cost of living, the Social Security COLA should be between 6% and 9%, and another 34% believe it should be more than 9%. In sum, 68% of respondents think the COLA should be at least 6%.

Those are slight declines from how respondents felt when asked what the COLA should be following the 2024 adjustment of 3.2%, perhaps reflecting cooling inflation.

Data source: The Motley Fool surveys distributed via Pollfish on May 16, 2024 and October 10, 2024.

| In your view, what would be the ideal percentage increase for Social Security COLA to keep up with your current cost of living? | In context of 2025 adjustment | In context of 2024 COLA |

| Less than 3% | 3% | 1% |

| Between 3% and 6% | 30% | 21% |

| Between 6% and 9% | 32% | 42% |

| More than 9% | 34% | 36% |

The Social Security COLA has only exceeded 6% once since 1984. That was in 2023, when beneficiaries received an 8.7% bump.

Financial stability has a significant impact on what the ideal COLA should be. Fifty-one percent of those who struggle financially on a daily basis think the COLA should be more than 9% compared to just 19% of those who have no financial concerns.

Historic Social Security COLA chart

Historic Social Security Cost-of-Living Adjustments

50% are considering going back to work because of low Social Security benefits

50% have considered going back to work due to low Social Security benefits

Fifty percent of respondents are considering looking for work because Social Security does not provide enough income to support their lifestyle. That points to dissatisfaction among Social Security beneficiaries with current benefits and the 2025 COLA.

The average monthly Social Security payment in 2024 after the 3.2% COLA is $1,907, according to the U.S. Social Security Administration. That does not cover even half of what Americans age 65 and older spent per month in 2023: $5,007. Considering only 54% of American households had a retirement account in 2022, it’s not surprising that a significant percentage of retirees surveyed feel as though they need another source of income.

Social Security is only supposed to cover 40% of the average worker’s salary. In reality, however, retirees depend more heavily on Social Security than that.

Here’s how much respondents to The Motley Fool’s 2024 Social Security Cost-of-Living Survey rely on Social Security for their monthly retirement income:

- 28% rely exclusively on Social Security Benefits.

- 32% rely heavily on Social Security benefits.

- 22% rely moderately on Social Security benefits.

- 13% rely slightly on Social Security benefits.

- 4% don’t rely on Social Security benefits at all.

That aligns with a 2023 survey from Gallup, which found that 59% of retirees rely on Social Security as a “major source” of retirement income. A 2024 survey from the Employee Benefit Research Institute found that 62% of retirees consider Social Security to be a major source of income.

Retirees may want to return to work for a variety of reasons: for a sense of purpose, to provide daily structure, to support a charity or other cause, and more. But the survey results suggest that financial stability and maintaining their current lifestyle are driving factors for retirees thinking about finding a new job.

Respondents struggling the most financially are more likely to consider going back to work

Among those who said they struggle financially daily, 65% said they are considering looking for a job despite receiving Social Security. Among respondents that have no significant financial concerns or occasional financial issues, 53% say they are thinking about finding employment.

| Financial situation | Percent considering seeking employment because Social Security does not provide enough income to support their lifestyle | |

|---|---|---|

| I am financially stable without any significant concerns | 14% | |

| I am doing well, though occasionally encounter financial issues | 37% | |

| I face some financial challenges but generally manage | 56% | |

| I struggle financially on a daily basis | 61% |

Those who view the COLA as insufficient are also more likely to consider going back to work. Among respondents who think the 2.5% COLA for 2025 is somewhat or completely insufficient, at least half are considering going back to work.

In another sign that inflation is putting pressure on retirees’ finances, over 40% of those who believe the 2025 COLA is appropriate are also considering going back to work.

Overall, 51% of respondents are considering reentering the workforce because Social Security doesn’t provide them enough income. This marks an increase from 44% when The Motley Fool surveyed retirees in May 2024 about the 2024 Social Security COLA.

| How do you feel about the 2.5% cost-of-living adjustment for Social Security benefits for 2025, which will raise monthly payments by about $50, on average, for beneficiaries? | Percent considering seeking employment because Social Security does not provide enough income to support their lifestyle | |

| Completely appropriate | 45% | |

| Somewhat appropriate | 43% | |

| Neutral | 37% | |

| Somewhat insufficient | 52% | |

| Completely insufficient | 50% |

Among respondents who consider the COLA to be completely insufficient, 50% are considering getting a job. Among those who think the COLA is completely appropriate, 45% -- still a sizable percentage -- are thinking about finding work to support their lifestyle.

43% are confident Social Security will last through their retirement

Nearly half of respondents are confident Social Security will last throughout their retirement

Forty-three percent of respondents are confident that Social Security will provide benefits throughout their retirement. Twenty-six percent are not confident, and 32% are neutral.

| How confident are you that Social Security will continue to provide benefits throughout your retirement period | October 2024 | May 2024 |

|---|---|---|

| 1: Not Confident | 7% | 5% |

| 2 | 19% | 17% |

| 3 | 32% | 30% |

| 4 | 29% | 28% |

| 5: Extremely Confident | 14% | 19% |

That muted optimism is a result of several factors. There are concerns about the sustainability of Social Security as life expectancy increases and more baby boomers enter retirement. Questions remain about long-term funding of the Social Security Trust Fund. Changes in government policy could endanger the program as well.

Those factors are outside of individual retirees’ control, and, as a result, may generate anxiety about the future of Social Security. Those who struggle financially are more likely to be concerned about Social Security providing benefits throughout their retirement.

Forty-eight percent of those who struggle daily are not confident about Social Security lasting for their entire retirement, and just 30% of that group are confident that Social Security will exist for their full retirement. Among respondents who have no financial concerns, 70% believe Social Security will last throughout their retirement, and just 6% are not confident.

Nonretirees are more concerned about their chances of receiving Social Security benefits. Eighty percent of adults under 62 are worried or extremely worried that Social Security will not be available when they become eligible for it, according to a 2024 survey from Gallup.

Sources

- Employee Benefit Research Institute (2024). “2024 Retirement Confidence Survey.”

- Gallup (2023). “Americans’ Outlook for Their Retirement Has Worsened.”

- Gallup (2024). “Rising Concerns Over Future of Medicare and Social Security.”

- Gallup (2024). “Why Americans Are Pleasantly Surprised in Retirement.”

Methodology

On October 10, 2024, The Motley Fool surveyed 2,000 retired Americans who began to receive Social Security benefits in 2024 or later. On May 16, 2024, The Motley Fool surveyed 2,000 retired Americans who began to receive Social Security benefits in 2023 or later. The surveys were distributed via Pollfish. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling, a method that recruits respondents through a randomized invitation process across various digital platforms. This technique helps to minimize selection bias and ensure a diverse participant pool.

The Motley Fool has a disclosure policy.