Bonds are getting a lot of attention from investors these days, and it's easy to see why. With inflation still elevated and interest rates at their highest levels since the 2007-09 financial crisis, bond yields are as high as they've been in years. The yield on the 10-year Treasury note was hovering above 4% in mid-2024, almost double the yield it offered earlier this decade. In such an environment, it's not surprising that investors have a newfound excitement for bonds.

Bonds

In addition to that guaranteed fixed income return, bonds offer some other advantages in a high-interest-rate environment. For example, if interest rates fall, then the price of a bond goes up and you can make money selling your bond rather than holding it until maturity.

If interest rates continue to rise, more investors are likely to turn to bonds to earn a reliable return on their investment. That includes bond funds and bond exchange-traded funds (ETFs), as well as options such as corporate bonds and municipal bonds. If you want to invest in bonds, keep reading to see some of the best bond and bond funds you can buy today.

Interest Rate

Top bonds

Top 8 bonds to invest in for the long term

| Name | Ticker | Yield | Description |

|---|---|---|---|

| 10-Year Treasury Note | Benchmark | 4.2% | Benchmark Treasury bond. |

| 26-Week T-Bills | N/A | 5.3% | Six months Treasury issued by the U.S. Treasury. |

| iShares iBoxx Investment Grade Corporate Bond ETF | (NYSEMKT:LQD) | 4.3% | Fund holding investment-grade rated corporate bonds. |

| Vanguard Tax-Exempt Bond ETF | (NYSEMKT:VTEB) | 3.5% | An index fund that tracks investment-grade municipal bonds. |

| Vanguard Short-Term Corporate Bond Index Fund | (NASDAQMUTFUND:VSCSX) | 5.1% | Fund that tracks the Bloomberg 1-5 year corporate bond index. |

| Guggenheim Total Return Bond Fund | (NASDAQMUTFUND:GIBIX) | 5.1% | Bond fund that seeks to maximize total return. |

| Vanguard Total International Bond Index Fund | (NASDAQ:BNDX) | 3.2% | Fund that tracks the performance of a Bloomberg index, excluding U.S. assets. |

| Fidelity Short-Term Bond Fund | (NASDAQMUTFUND:FSHBX) | 5.0% | Fund managed to have similar interest rate risk to the Bloomberg Barclays U.S. 1-3 Year Government/Credit Bond Index. |

1. 10-year Treasury note

If you're looking for a straightforward bond investment, it's hard to beat Treasuries. U.S. Treasury bonds are considered the safest in the world and are generally called "risk-free." The 10-year rate is considered a benchmark and is used to determine other interest rates, such as mortgage rates, auto loans, student loans, and credit cards.

Treasury yields are closely tied to the federal funds rate, so they should continue to move higher if the Federal Reserve keeps raising rates.

Currently, short-term yields like the two-year Treasury note yield are even higher than the 10-year, meaning the yield curve has inverted. That shows that investors expect interest rates to come down within a few years.

2. 26-week Treasury bills (T-bills)

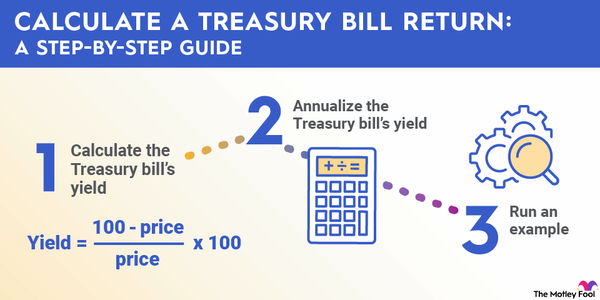

If you're looking for a place to park your cash short-term, T-bills are the gold standard. The U.S. government issues these shorter-duration securities. They differ from Treasury notes and bonds in that they don't pay interest. Instead, the U.S. Treasury sells T-bills at a discount and redeems them at their face value at maturity.

The 26-Week T-Bills were among the most popular among investors in mid-2024. They offered an attractive yield to maturity of around 5.3%.

3. iShares iBoxx Investment Grade Corporate Bond ETF

Investment-grade corporate bonds tend to offer higher interest yields compared to government bonds. While they're not "risk-free" like 10-year Treasury notes, they tend to be lower-risk bonds backed by companies with investment-grade bond ratings.

iShares IBoxx Investment Grade Corporate Bond ETF makes it easy to invest in high-quality corporate bonds. The bond ETF provides access to more than 2,700 investment-grade bonds via a single fund. This bond fund offered a yield of more than 5.2% in mid-2024.

4. Vanguard Tax-Exempt Bond ETF

State and local governments issue municipal bond funds to fund their operations and projects. They offer investors a way to earn interest income with the added bonus that the interest is exempt from federal taxes.

Vanguard Tax-Exempt Bond ETF tracks the performance of investment-grade municipal bonds. The fund holds more than 10,000 securities. It offered a yield of about 3.5% in mid-2024.

5. Vanguard Short-Term Corporate Bond Index Fund

Short-term bonds offer some advantages over long-term bonds, depending on your investing needs. Because of the shorter duration of short-term bonds -- considered to have maturities of five years or less -- they have less interest rate risk and are more likely to preserve the principal.

Short-term bonds are especially attractive these days because the yield curve has inverted, meaning short-term bond yields are higher than long-term bond yields. One way to take advantage of this is with the Vanguard Short-Term Corporate Bond Index Fund, one of the best corporate bond funds.

The fund holds a range of bonds from blue chip companies such as Boeing (BA 0.17%) and Bank of America (BAC 1.82%). It aims to track the Bloomberg U.S. Corporate 1-5 Year index. The fund offered a yield of 5.1% in mid-2024.

6. Guggenheim Total Return Bond Fund

A total return bond fund differs from the typical bond fund by generating returns both through coupon payments and rising bond prices. This can happen either because yields fall, which is generally determined by central banks and macroeconomic forces, or because the fund owns bonds whose credit ratings improve, which also leads to falling yields and rising prices.

The Guggenheim Total Return Bond Fund owns a range of bonds, including Treasuries, municipal bonds, and corporate bonds. It paid a yield of 5.3% as of mid-2024.

7. Vanguard Total International Bond Index Fund

If you're looking for diversification from your bonds, there's no reason to stay within U.S. borders. Emerging markets can offer some of the best opportunities for high-yield investors, so it's worth considering international bonds like the Vanguard Total International Bond Index Fund.

The fund's top holdings are European government bonds, although it holds more than 6,800 different bonds, largely investment-grade. It tracks a Bloomberg index adjusted to exclude U.S. bonds, and it offered a yield of 3.2% in mid-2024.

8. Fidelity Short-Term Bond Fund

If you're interested in short-term bonds, you don't have to limit yourself to corporate bonds. The Fidelity Short-Term Bond Fund, one of the best short-term bond funds available, invests in both short-term Treasury bills and corporate bonds from companies such as financial giants Mitsubishi UFJ Financial (MUFG -1.04%), Wells Fargo (WFC 2.16%), JPMorgan Chase (NYSE:JPM), and Barclays (BCS 1.24%).

The fund is managed to have a similar overall interest rate risk to the Bloomberg Barclays U.S. 1-3 Year Government/Credit Bond index and aims for a dollar-weighted average of three years or less. It offered a yield of 4.1% in mid-2024.

Related investing topics

Which bond is right for you?

Which bond is right for you?

Whether you choose high-yield, investment-grade, foreign or domestic, there are a wide range of bonds and bond funds available on the market that can suit the needs of almost any investor looking for fixed income.

In an environment of rising interest rates, bonds are only going to become more attractive. Take the time to learn which type is best for you.

FAQ

FAQ on investing in bonds

What bonds are best to invest in?

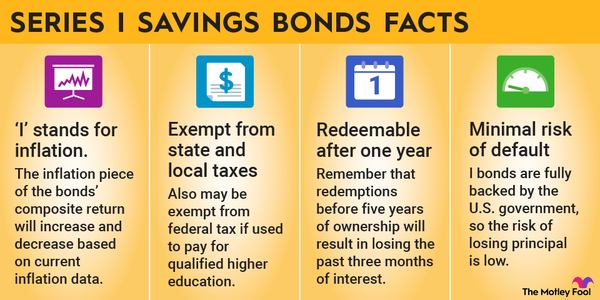

The best bonds to invest in depend on your risk tolerance and desired income level. For example, if you're seeking to protect your money from inflation, federal I-Bonds or Treasury Inflation-Protected Securities (TIPS) are the best bonds to buy. On the other hand, if you're seeking to earn a solid fixed-income payment with minimal risk, then investment-grade corporate bonds would be the best option.

Which bond gives the highest return?

Bonds with non-investment grade ratings (junk bonds) typically offer the highest return potential. They tend to offer a higher fixed-income yield than investment-grade, municipal, and government bonds. In addition, they offer some appreciation potential if the underlying company receives a credit rating upgrade, making the bonds less risky.

Which bonds pay the highest yield?

Bonds with a non-investment grade rating (junk bonds) typically pay the highest yields. These bonds are at a higher risk of default (non-payment), so they offer a higher yield to compensate investors for their higher risk profile.

What bonds make you the most money?

Non-investment grade rated bonds (junk bonds) have the potential of making the most money from their higher yields. However, they have a higher risk of default. In addition, convertible bonds (i.e., bonds that can be converted into stock) can also be big moneymakers if the underlying stock delivers significant price appreciation.