If you're considering where to park your cash safely while still earning interest, you might initially think about a money market mutual fund. However, a more liquid and equally safe option is available: Treasury bill (T-bill) exchange-traded funds (ETFs), like the iShares 0-3 Month Treasury Bond ETF (SGOV 0.02%). This ETF offers a stable share price and monthly income based on prevailing interest rates.

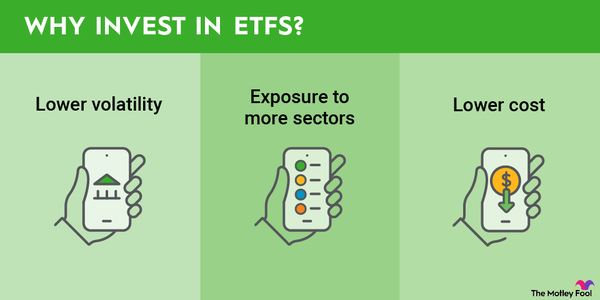

Exchange-Traded Fund (ETF)

In this article, we'll go over how the iShares 0-3 Month Treasury Bond ETF operates, what it includes in its holdings, and a few peculiarities you should be aware of before investing.

What is it?

What is the iShares 0-3 Month Treasury Bond ETF?

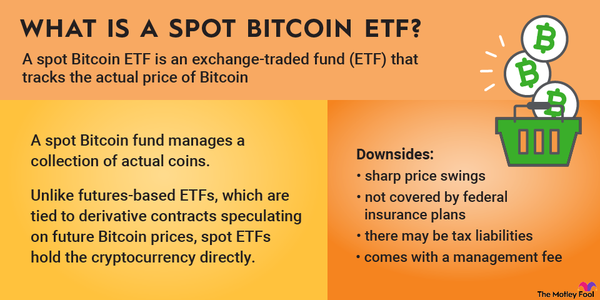

The iShares 0-3 Month Treasury Bond ETF is a fixed-income ETF that follows the ICE 0-3 Month US Treasury Securities Index, which tracks U.S. Treasury bills with maturities ranging from zero to three months. The ETF's price tends to be very stable, reflecting the short-term nature of its holdings.

Every month, it distributes the yield earned from these T-bills, which are purchased at a discount to face value and paid out at par upon maturity. This difference represents the yield investors receive.

The iShares 0-3 Month Treasury Bond ETF stands out as one of the most popular T-bill ETFs, boasting more than $26 billion in assets under management. It's highly liquid, featuring a minimal 0.01% 30-day bid-ask spread, making it easy to buy and sell like a stock.

How to buy

How to buy the iShares 0-3 Month Treasury Bond ETF

To buy shares of the iShares 0-3 Month Treasury Bond ETF, follow these simple steps as you would when investing in most ETFs:

- Open your brokerage app: Log into your brokerage account where you handle your investments.

- Search for SGOV: Enter "SGOV" into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings

Holdings of the iShares 0-3 Month Treasury Bond ETF

The iShares 0-3 Month Treasury Bond ETF's holdings will mirror the ICE 0-3 Month US Treasury Securities Index, which consists of U.S. Treasury bills maturing in 0 to 3 months. Due to the short maturity of these T-bills, the iShares 0-3 Month Treasury Bond ETF experiences high turnover. It is constantly purchasing new T-bills as old ones mature to maintain its portfolio alignment with the target exposure.

With an average duration of only about 0.11 years, the iShares 0-3 Month Treasury Bond ETF also shows minimal sensitivity to changes in interest rates. Unlike longer-maturity bond ETFs, this ETF's share price will not fluctuate with rate changes.

However, the yield to maturity of the ETF, which reflects the expected total return, varies directly with the current short-term interest rates, offering investors a clear view of potential income relative to the market environment.

Should I invest?

Should I invest in the iShares 0-3 Month Treasury Bond ETF?

Investing in the iShares 0-3 Month Treasury Bond ETF is ideally suited for low-risk investors who want to safeguard their cash while earning interest at current rates or as a stable, low-risk component within a diversified portfolio.

The iShares 0-3 Month Treasury Bond ETF offers several advantages. It distributes income monthly, maintains a very stable share price, boasts high liquidity for easy buying and selling, and provides transparency in its operations and holdings.

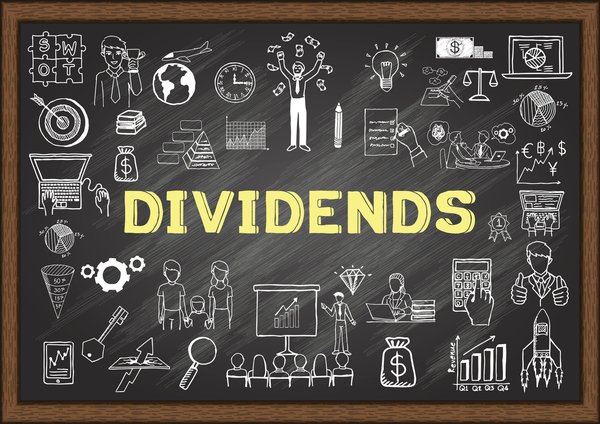

Dividends

Does the iShares 0-3 Month Treasury Bond ETF pay a dividend?

The iShares 0-3 Month Treasury Bond ETF pays monthly distributions like some dividend ETFs. These payments are technically considered income for tax purposes but are exempt from state taxes because they are sourced from U.S. Treasury securities, though they are subject to federal tax.

As of Oct. 11, 2024, the 30-day Securities and Exchange Commission (SEC) yield on the iShares 0-3 Month Treasury Bond ETF was 5.03%. This yield is calculated based on the average income paid over the past 30 days, annualized based on the fund's share price at the end of the period. It's important to remember that this yield will fluctuate with short-term interest rates.

Expense ratio

What is the iShares 0-3 Month Treasury Bond ETF's expense ratio?

The iShares 0-3 Month Treasury Bond ETF is one of the more cost-effective Treasury ETFs available, with an expense ratio of just 0.07%. This translates to a modest annual cost of $7 for every $10,000 invested. Remember, you don't pay this fee directly; it's deducted from the fund's assets over time, subtly reducing the return on your investment.

Expense Ratio

Historical record

Historical performance of the iShares 0-3 Month Treasury Bond ETF

Here's how the iShares 0-3 Month Treasury Bond ETF's market price and net asset value (NAV) have historically performed on an annualized basis over trailing-one-year and trailing-three-year periods. All figures indicated are total returns, reflecting both the ETF's share price and the compounding from reinvested distributions.

| Metric | 1-Year | 3-Year |

|---|---|---|

| Net asset value | 5.46% | 3.58% |

| Market price | 5.42% | 3.57% |

The bottom line

The iShares 0-3 Month Treasury Bond ETF stands out as one of the safest ETF options available. It is immune to stock market fluctuations and exhibits minimal interest rate sensitivity. The fund invests in U.S. Treasury bills, some of the most secure assets available.

Benefits of the iShares 0-3 Month Treasury Bond ETF include monthly distributions reflecting current short-term interest rates, low fees, exemption from state and local taxes, and high liquidity -- making it easy to buy and sell shares.

Related investing topics

However, it's important to note that the long-term expected returns from the iShares 0-3 Month Treasury Bond ETF are relatively low, typically aligning with the risk-free rate. The fund will not consistently outpace inflation or yield long-term returns comparable to riskier asset classes like stocks.

FAQ

Investing in iShares 0-3 Month Treasury Bond ETF: FAQ

How can I buy SGOV ETF?

Search your brokerage app for the ticker symbol SGOV, decide how many shares you want to buy, choose your order type (market or limit), and submit your order.

How does iShares SGOV ETF work?

The iShares 0-3 Month Treasury Bond ETF tracks the ICE 0-3 Month US Treasury Securities Index, which consists of short-duration T-bills. The ETF buys these T-bills, providing monthly income to investors.

What is the SGOV investment strategy?

The ETF employs a passive management strategy by mirroring the holdings of its benchmark index. There is no active bond picking by the fund manager.

Is SGOV ETF a good investment?

For investors who seek low-risk opportunities and want to keep their cash safe while earning some income, iShares 0-3 Month Treasury Bond ETF can be a good investment.

![Trump at White House podium. Official White House Photo by D. Myles Cullen. [MConverter.eu]](https://g.foolcdn.com/image/?url=https%3A%2F%2Fg.foolcdn.com%2Feditorial%2Fimages%2F801349%2Ftrump-at-white-house-podium-official-white-house-photo-by-d-myles-cullen-mconvertereu.jpg&op=resize&w=184&h=104)