If you’re looking to invest in small-cap stocks, the Vanguard Small-Cap ETF (NYSEARCA:VB) could be worth a closer look.

Small caps are known for being riskier than larger companies because of their higher volatility. Finding the hidden gems in this space often means sifting through a lot of duds, especially if you're a beginner.

But why not just buy the whole pile? There’s a good reason to consider it. Research has shown that small caps tend to outperform larger companies over time. Eugene Fama and Kenneth French, two well-known finance experts, discovered the “size” factor, which explains this phenomenon.

Here’s what you should know about this Vanguard ETF and how you can start investing in it today.

What is the Vanguard Small-Cap ETF (VB)?

What is the Vanguard Small-Cap ETF (VB)?

The Vanguard Small-Cap ETF is a passive exchange-traded fund (ETF), meaning it aims to replicate a benchmark index rather than actively picking stocks.

It tracks the CRSP US Small Cap Index, a broad benchmark that includes stocks falling between the 85th and 98th percentiles of the investable U.S. stock market. In simpler terms, this ETF excludes the largest 15% of companies and the smallest 2%.

It uses a free-float market cap-weighting system, which means the weight of each stock in the index is determined by its market capitalization, adjusted for the number of shares available for public trading (free float).

This approach ensures that larger, more liquid small-cap stocks carry more influence in the portfolio. The index is reconstituted and rebalanced quarterly.

Exchange-Traded Fund (ETF)

How to buy

How to buy the Vanguard Small-Cap ETF (VB)

Here’s a step-by-step look at how to buy this Vanguard ETF:

- Open your brokerage app: Log into your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker symbol "VB" or the ETF’s name into the search bar to bring up its trading page.

- Decide how many shares to buy: Think about your investment goals and how much of your portfolio you want to allocate to the ETF.

- Select order type: Choose a market order to buy at the current price or a limit order to specify the maximum price you’re willing to pay.

- Submit your order: Double-check the details, then confirm and submit your buy order.

- Review your purchase: Look over your portfolio to ensure the order was filled as expected, and adjust your investment strategy if needed.

Holdings

Holdings of the Vanguard Small-Cap ETF (VB)

The Vanguard Small-Cap ETF is highly diversified, with a total of more than 1,300 holdings. The ETF’s median market capitalization is $8 billion, fitting comfortably within the small- to mid-cap range.

Its largest sector allocations are industrials (22.4%), consumer discretionary (15.6%), and financials (14.4%). Some of this ETF’s top holdings include:

Should I invest?

Should I invest in the Vanguard Small-Cap ETF (VB)?

This Vanguard ETF is a great option if you want to capitalize on the size factor and the potential for small-cap outperformance but don’t want to pick individual winners. The high level of diversification is a major advantage here.

By holding a wide array of small-cap stocks, you capture the average performance of the segment as a whole. While many small caps may underperform, the few standout winners in the group have the potential to pull the ETF’s returns higher over the long term.

That said, its broad diversification may not work for you if you prefer a more hands-on approach. If your strategy involves picking individual small caps or screening them based on factors like earnings momentum, size, or sector exposure, this ETF's broad reach could dilute those efforts.

Ultimately, this Vanguard ETF shines for investors who want a set-it-and-forget-it approach to small-cap investing. For those who prefer to take a more active role, this ETF might feel too broad.

Does it pay a dividend?

Does the Vanguard Small-Cap ETF (VB) pay a dividend?

Yes, this Vanguard ETF pays a dividend. As of Oct. 31, 2024, it had a 30-day SEC yield of 1.35%, with dividends distributed on a quarterly basis. If you want a higher yield, consider buying a dedicated dividend ETF instead.

What is the expense ratio?

What is the Vanguard Small-Cap ETF (VB)'s expense ratio?

This Vanguard ETF has an expense ratio of 0.05% annually, which translates to just $5 for every $10,000 you invest. You don’t pay this fee directly--it’s deducted on the back end over time.

Expense Ratio

Historical performance

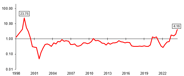

Historical performance of the Vanguard Small-Cap ETF (VB)

Here's a look at how this ETF has performed over various time periods in terms of annualized total returns (i.e. with dividends reinvested).

| 1-Year | 3-Year | 5-Year | 10-Year | |

|---|---|---|---|---|

| VB NAV | 35.94% | 7.51% | 11.46% | 10.06% |

| VB Market Price | 35.98% | 7.52% | 11.47% | 10.07% |

Related investing topics

The bottom line

The bottom line on the Vanguard Small-Cap ETF (VB)

The Vanguard Small-Cap ETF is a low-cost, highly diversified ETF designed for passive investors who want to add a small-cap tilt to their portfolio. With exposure to more than 1,300 small-cap stocks across multiple sectors, it offers a straightforward way to capitalize on the size factor without the need to pick individual winners. It competes comfortably with the best ETFs available.

FAQS

Investing in the Vanguard Small-Cap ETF (VB) FAQs

Is Vanguard VB a good investment?

It depends on your objectives, but this ETF is a good choice for passive investors seeking a low-cost, diversified, small-cap tilt.

What is Vanguard's best small-cap ETF?

Based on recent performance, the Vanguard Small-Cap Value ETF (NYSEARCA:VBR) stands out since it’s essentially the Vanguard Small-Cap ETF (VB) with added value screens.

Is Vanguard Small-Cap Value Index Fund a good investment?

The Vanguard Small-Cap Value ETF (VBR) is a solid option if you want to combine a small-cap tilt with value exposure and don’t mind a slightly higher 0.07% expense ratio and less diversification than the Vanguard Small-Cap ETF (VB).