Monthly dividend stocks offer investors the opportunity to generate recurring passive income while aligning that income's timing with real-world expenses. This can be particularly useful for people who are counting on dividends for income today.

With monthly dividend payments in mind, here's a closer look at the top monthly high-yield dividend stocks for 2024. The combination makes these stocks great for earning passive income.

Top dividend stocks

Top monthly dividend stocks for 2024

Dozens of dividend stocks pay monthly dividends in 2024. However, not all of them are worth an investor's consideration. Some don't make the cut because of a below-average dividend yield or slow dividend growth. Meanwhile, others are at a higher risk of reducing their dividends if market conditions deteriorate. That narrows the options considerably.

Here's a list of the best monthly dividend stocks to consider in 2024:

| Monthly Dividend Stock | Ticker Symbol | Dividend Yield |

|---|---|---|

| EPR Properties | (NYSE:EPR) | 8.2% |

| Agree Realty | (NYSE:ADC) | 4.9% |

| Gladstone Commercial Corporation | (NASDAQ:GOOD) | 8.6% |

| LTC Properties | (NYSE:LTC) | 6.7% |

| Realty Income | (NYSE:O) | 5.9% |

| SL Green | (NYSE:SLG) | 5.3% |

| STAG Industrial | (NYSE:STAG) | 4.2% |

Let's take a closer look at each of these top monthly dividend stocks. Each offers a much higher dividend yield than the average stock in the S&P 500 (1.3% as of June 2024).

1. EPR Properties

1. EPR Properties

EPR Properties is a real estate investment trust (REIT) that specializes in owning experiential real estate such as movie theaters, eat-and-play venues, ski resorts, and gaming facilities. It secures these properties by signing triple net leases with the venue operators, meaning the tenants bear the responsibility for building insurance, maintenance, and real estate taxes.

After a brutal period during the COVID-19 Pandemic, EPR is back to growth as consumers have returned to in-person experiences in droves. The company owns properties in a range of experiential businesses, including eat-and-play, casinos, ski, water park, and other themed lodging, amusement and water parks, fitness centers, and others. EPR works with some of the largest and most popular operators in each of these segments, which, combined, make up $100 billion in market opportunity.

If there's a weak spot, it's movie theaters. While business has recovered from the lows, movie ticket sales are still well below pre-pandemic levels. The good news for EPR is that its theater properties are some of the busiest and most valuable for its tenants, helping insulate it from some risk. EPR owns 3% of all North American theaters, but those locations generate 8% of all the box office. Despite that relative strength, EPR is reducing its exposure to this weak segment, divesting theaters as it prioritizes markets where there is growth.

2. Agree Realty

2. Agree Realty

Agree Realty is another REIT. These companies often make for good monthly dividend stocks because they generate recurring rental income.

This REIT owns freestanding retail properties secured by triple net leases. It focuses on owning properties leased to essential retailers, such as grocery, home improvement, dollar stores, and drug stores, which are less susceptible to disruption from e-commerce or a recession. This strategy enables Agree Realty to generate steady rental income to support its dividend.

E-commerce

Agree Realty switched from a quarterly to a monthly dividend payment schedule in January 2021. It has an excellent dividend track record overall. This REIT has increased its dividend at a 5.6% compound annual rate over the past decade, though payout growth has slowed to 3.8% more recently.

Nonetheless, that upward trend should continue as the company keeps expanding its portfolio. The retail REIT acquired a record $1.4 billion of properties in 2021, though it nearly matched that with $1.34 billion spent or committed in 2023. Between that steady portfolio growth and strong tenant relationships (it has over eight years in average lease term under contract), Agree Realty should remain a modest, reliable monthly dividend grower for years to come.

3. Gladstone Commercial Corporation

3. Gladstone Commercial Corporation

Gladstone Commercial is a diversified REIT that owns net leased office and industrial properties in the U.S., focusing on secondary markets because they offer higher investment yields. This strategy enabled Gladstone to generate very stable income for years, but its streak of more than 200 consecutive monthly dividends, either at or above the prior month's level, came to an end in 2023. The culprit -- poorly performing office properties -- led to a 20% dividend cut as the company worked through its portfolio to offload unprofitable properties.

While we can't count out another dividend cut, management seems to have stabilized the business and is back on the offensive. The company is acquiring high-demand industrial properties, ensuring its office properties are well-tenanted for the long term, and offloading the ones that it doesn't expect can perform to its expectations.

As a result, the property mix has changed. Industrial properties now generate 60% of rents, while office space accounts for just 36% of the total.

It's still unclear when the dividend will start growing again. With a yield above 8% at recent prices, the market seems to think another cut could happen first. But if management can keep up the momentum and make this industrial pivot a success, the risk-reward profile makes Gladstone an interesting monthly dividend stock to consider.

4. LTC Properties

4. LTC Properties

LTC Properties is a healthcare REIT. It primarily invests in senior housing and skilled nursing properties secured by triple net leases, mortgage loans, and other cash-generating investment structures. This strategy gives the REIT a relatively steady income to support its monthly dividend.

The COVID-19 pandemic hit the senior housing sector hard, impacting LTC Properties' tenants. Several struggled to pay rent, leading some to file for bankruptcy. However, this REIT's financial strength helped it weather the storm and offset some of the lost income with new investments, allowing it to maintain its monthly dividend. Yet, LTC has been unable to increase its payout since 2016. It's notable, though, that most of its peers have had to cut their dividends in recent years.

LTC faces some good long-term trends but operates in a tough industry. In 2030, the number of Americans 65 and older will be double 2010's 65-and-up population, a positive tailwind for the company. However, it must continue to stabilize its tenants and align itself with the best operators for the big-picture tailwind to reward patient shareholders. Meanwhile, investors can earn more than 6% in yield for being patient.

5. Realty Income

5. Realty Income

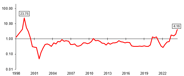

When it comes to monthly dividend stocks, Realty Income is the clear leader. It bills itself as The Monthly Dividend Company, having paid 647 consecutive monthly dividends as of May 2024. Since its initial public offering (IPO) in 1994, Realty Income has increased its dividend more than 100 times while raising the payout at a 4.3% compound annual rate, giving this REIT more than 30 years of dividend increases.

Realty Income has lots of room to grow despite most of its tenants being relatively slower-growth businesses. The company estimates the global market opportunity for the single-tenant net lease real estate it targets to be $13.9 trillion. That's a big opportunity to continue consolidating its tenants' properties under its ownership, growing the payout, and generally rewarding patient investors monthly, year in and year out.

6. SL Green

6. SL Green

SL Green is another REIT and the largest office landlord in New York City. For years, owning Manhattan office buildings -- some of the most highly demanded, irreplaceable real estate assets on Earth -- was a huge strength.

But the pandemic and the acceleration in changes to how and where people work continue to weigh on the office REIT. SL Green's management is adapting to the new reality by selling its least-desirable and non-core assets and focusing on tenanting its vacant properties at competitive, profitable rates.

Since 2020, a combination of asset sales and cash flow has funded a 31% reduction in debt and stock repurchases that has reduced shares outstanding by 13%. The company has also started to go back on offense with its real estate investments.

The bad news for longtime investors is these moves didn't happen quickly enough to save its status as a Dividend Achiever. SL Green lowered its monthly payout by 13% at the beginning of 2023. Another payout cut followed just before the start of 2024.

While the office environment remains a bit fluid, the worst is likely over for SL Green. Even with that anticipated dividend cut, its shares surged 34% in 2023 and are off to a strong start in 2024.

7. STAG Industrial

7. STAG Industrial

STAG Industrial, another REIT, focuses on owning industrial real estate, such as warehouses and light industrial facilities, which are in high demand. The pandemic accelerated e-commerce adoption and increased manufacturing in the U.S. to combat supply chain issues. That has kept occupancy levels high while pushing up rental rates, enabling STAG to generate steadily rising rental income.

STAG has boosted its dividend over the years, with growth driven largely by the REIT's ability to consistently expand its portfolio. STAG has added more than 400 properties to its portfolio since its IPO a decade ago, increasing its portfolio to more than 500 buildings.

This industrial REIT expects the steady expansion to continue. It's targeting $1 billion to $1.2 billion of property purchases each year. Add that to the growing rental income from its existing properties, and STAG should be able to continue increasing its monthly dividend, so long as you're not expecting big raises. Its most recent increase was less than 1%, and over the past five years, the payout has only risen 3.5%.

Related investing topics

Earning recurring income

Invest in monthly dividend stocks for recurring income

Monthly dividend stocks make it easy for investors to earn passive income. They can use that money to cover their monthly expenses or reinvest their dividends and set themselves up to generate even more recurring cash flow in the future when they need it.

While dozens of companies pay monthly dividends, these monthly dividend stocks stand out as either stable and safer dividend stocks or, in a few cases, riskier -- but potentially more rewarding -- investments in their potential to turn things around.

FAQ

Dividend stocks FAQ

What stock pays the highest dividend yield?

This is a tricky question, as the answer can change from one day to the next. Often the highest-yield stocks are the riskiest because investors have sent share prices lower on expectations of a dividend cut. Annaly Capital Management (NYSE:NLY) is one recent example, with a dividend yield above 13% at recent prices, following a 26% dividend cut in 2023 that could be matched by more cuts in 2024.

Investors are often better off finding high-quality yields from companies that can maintain or even raise the payout than chasing high yields that could be a dividend trap.

Of the stocks in this article, Gladstone Commercial pays the highest yield at this writing. But as we note, the company may be forced to lower its payout.

What stocks pay more than 6% dividend?

Of the stocks featured in this article, Gladstone Commercial (8.7%), EPR Properties (8.2%), and LTC Properties (6.7%) all pay yields above 6% at recent prices, while Realty Income (5.9%) is very close to a 6% yield and has a long history of growing its payout.

How do I make $1,000 a month in dividends?

Let's use the seven stocks in this article as an example. On average, they yield 6.3% in dividends on a yearly basis. So, if you invested $27,211 in each of these stocks ( that's a $190,477 total investment), you would generate about $1,000 per month in dividends.