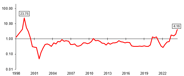

Investing in Bitcoin (BTC -0.95%) may seem daunting, but it's getting easier and more accessible. Still, many potential crypto investors hesitate due to the unfamiliar cryptocurrency trading systems. Let's walk you through the basics of buying Bitcoin on the popular Coinbase (COIN 1.75%) platform, with step-by-step instructions and an exploration of alternative options for investors seeking even simpler methods.

How to invest

How to buy Bitcoin

The basic procedure of buying cryptocurrencies should be fairly familiar to any stock investor. You open a brokerage account, seed it with a few dollars of investable funds, pick a crypto ticker, and exchange some of those dollars for digital coins.

The main difference is that you're dealing with a different type of asset. A cryptocurrency is a form of digital currency managed by a global network of computers in the form of a decentralized transaction ledger. The ledger data can be read by anyone, but the data is encrypted in sophisticated ways to stop bad actors from inserting fake transactions, changing existing ones, or otherwise taking advantage of this transparent financial system.

Buying any crypto is a lot like buying stocks but with a couple of twists. To illustrate, here's a step-by-step rundown of how to buy your first Bitcoin on the Coinbase exchange.

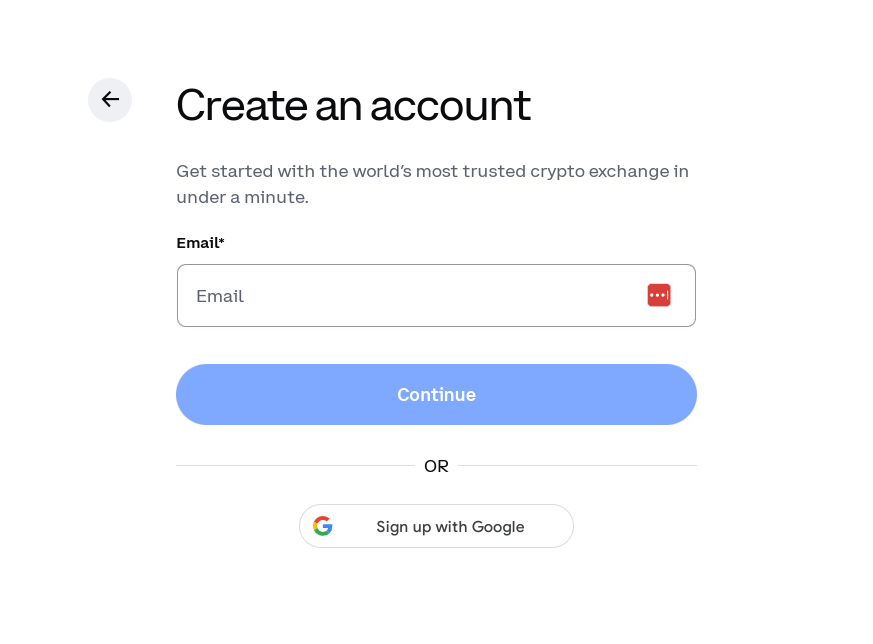

Step 1: Open a brokerage account

In this case, I'll use Coinbase. It's the most popular and well-known cryptocurrency brokerage in North America. Other brokerages may charge lower fees, offer a larger variety of supported cryptocurrencies, or pair crypto trades with stock trading on the same platform, but Coinbase's complete package is famous for a reason.

So, the story starts at Coinbase.com. Find the "Sign Up" button in the top right corner.

On the next couple of screens, you'll provide your email address, contact information, password, and other basic account-starting information. There will be several security-minded steps, such as setting up two-factor authentication, providing a photo ID, and verifying your identity with a selfie video. This may sound like a hassle, but Coinbase will manage real money on your behalf, so you don't want anything less than ironclad security.

The last account setup step is to fund the account -- optional and skippable, but it makes the buying process slightly smoother. This can be done with a wire transfer, an online transfer from a linked bank account, via a debit card, or through your favorite digital payment service.

Step 2: Figure out your Bitcoin budget

Bitcoin shouldn't be your only investment. Ideally, it will be a small part of a broadly diversified portfolio next to other cryptocurrencies, perhaps some stocks, a helpful fund or two, and other investable asset classes.

You can start very small; the smallest Bitcoin unit you can buy costs much less than one cent, and Coinbase's minimum order is $1. On the other end of the funding spectrum, you're more likely to be limited by your bank's wire transfer or online transfer limits than by Coinbase's ability to receive them.

Step 3: Do your research

Read on for some guidance on how suitable Bitcoin might be for your portfolio. It's not a one-size-fits-all investment, and its potential downsides are as serious as the promising upsides. In the end, only you know whether Bitcoin should be a part of your nest egg.

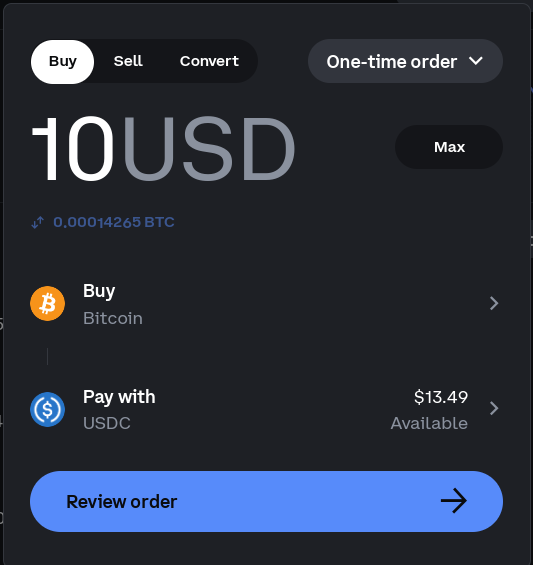

Step 4: Place an order

All roads lead to Rome, they say, and there are many ways to start a Bitcoin transaction on the Coinbase website. It will probably be the first cryptocurrency name you see listed on the site's home page on your first login, for instance. And it comes with a handy "buy" link right there:

Click on that to see a popup window to manage the transaction. The system needs to know how much you're investing, which cryptocurrency you're buying (Bitcoin is prefilled here), and the source of your funds (USD if you already funded the account, or select your favorite money transfer method if the account is empty).

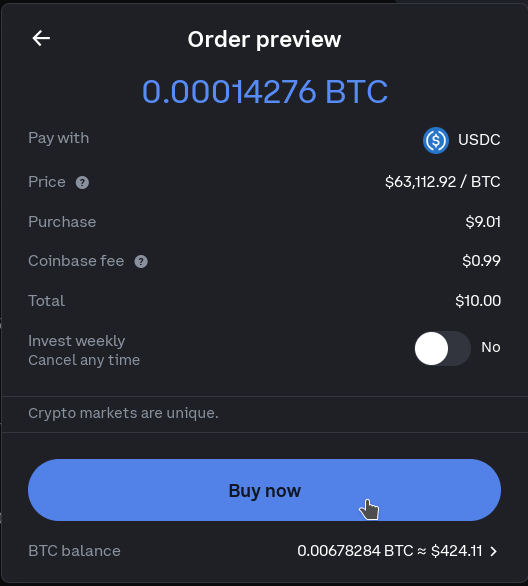

On the next screen, you can review the details of your proposed transaction, including the fee structure and the effective Bitcoin price. You can even ask Coinbase to set up a weekly schedule of automated Bitcoin purchases like this one.

Click the "Buy now" button to set the digital wheels in motion. At this point, you're the proud owner of some Bitcoin.

The coins (or tiny slivers of a coin) you just bought will be kept in Coinbase's digital wallet service on your behalf. You can transfer them to a vault with even more security features, send them to a digital wallet on your smartphone, or leave them in the default wallet. Your first step into the world of cryptocurrencies is now complete.

Profitability

Is Bitcoin profitable?

Bitcoin isn't a business or a company, unlike the organizations you invest in through stocks or bonds. It is a digital currency with a market value and some utility, but it isn't a profitable business. Think of it this way: The U.S. dollar isn't a business, but you can do a lot of business with the dollar. Bitcoin serves a similar purpose in a different way.

Mainly, the cryptocurrency should gain value over time as the number of available coins stays rather constant, while other currencies experience inflation. More on this will follow in the sections below.

However, like all investments, Bitcoin's value can also fluctuate over time, influenced by market trends, investor sentiment, and global economic factors. Only time will tell exactly how reliable Bitcoin will be as a holding platform for long-term asset value.

Dividends

Does Bitcoin pay a dividend?

You won't collect dividends from a Bitcoin investment. Dividends are a method for companies to share surplus cash profits with their shareholders, typically funded by their business operations. But Bitcoin is not a business. The digital coin does not represent ownership of an organization that makes a profit.

Some cryptocurrencies offer a dividend-like payout. Staking rewards are available to holders of proof-of-stake cryptos who "stake" their digital holdings. Besides playing an important role in the operation and/or governance of that cryptocurrency, staking is rewarded with regular issuance of the same digital asset. The rewards range from largely symbolic percentage yields to double-digit percentages. But Bitcoin is a proof-of-work blockchain network, and staking is not a feature in this world.

It's not impossible to earn interest on a Bitcoin holding, though. Some Bitcoin-holding platforms provide a modest interest yield on the coins you store in their digital wallets in return for letting that decentralized bank reinvest your idle Bitcoin in other ways. It's a lot like money market accounts in the traditional cash-based banking industry.

If you prefer to do your Bitcoin investing by proxy, stocks may occasionally offer a combination of significant Bitcoin interests and decent dividend yields. It's a short list at the time of writing. Asset management giant BlackRock (NYSE:BLK) owns a handful of Bitcoin, runs the iShares Bitcoin Trust ETF (IBIT 0.16%), and holds a small amount of that spot-price Bitcoin fund in its own vaults. However, other banks may very well join the Bitcoin bandwagon in time, giving investors new ways to earn dividends while increasing their Bitcoin exposure.

ETFs

ETFs with exposure to Bitcoin

BlackRock's iShares Bitcoin ETF is one of the most popular exchange-traded funds (ETFs), mirroring the market value of Bitcoin. Other leading names include the Grayscale Bitcoin Trust (GBTC 0.2%), the Fidelity Wise Origin Bitcoin Fund (FBTC 0.08%), and the ARK 21Shares Bitcoin ETF (ARKB 0.14%).

Each one of these ETFs manages a trove of Bitcoin holdings, either directly or through an intermediary service. There are subtle differences between them, but they generally serve as a stock-like interface to the cryptocurrency market. Investment accounts and financial managers who don't have access to cryptocurrencies can invest almost directly in Bitcoin this way.

Other Bitcoin ETFs don't hold the coins at all, but invest in futures and other financial instruments that are related to Bitcoin. The largest name here is the ProShares Bitcoin Strategy ETF (BITO 0.0%). This is one step away from simply owning Bitcoin assets, and the futures-based funds can stray further from Bitcoin's pricing chart than the direct spot-price Bitcoin ETF do.

Stock splits

Will Bitcoin split?

Bitcoin was designed to max out at 21 million digital coins. New coins are produced by a process known as mining, which also confirms Bitcoin trades. The rate of new coins issued as a reward for mining activities will decrease over time, and the reward halvings should occur roughly once every four years. The 30th and final halving should take place near the year 2140, dropping the mining rewards below one Satoshi (the smallest, nondivisible unit of a Bitcoin).

Changing this scheduled process of tightly controlled inflation would require approval from more than half of the mining community. While anything is possible in theory, it would take a massive investment to reach that majority, and then the move would undermine the value of Bitcoin as a whole. In other words, it's not a likely event and the hard ceiling of 21 million Bitcoins looks immovable.

As of this writing in May 2024, there are 19.7 million Bitcoin in circulation. That's roughly 94% of the lifetime maximum, leaving very little room for inflation.

Given this structure and the finite nature of Bitcoin's supply, the oldest and largest cryptocurrency will probably never experience anything like a traditional stock split.

Should I invest?

Should I invest in Bitcoin?

Bitcoin may be a robust long-term investment for several reasons:

- There will never be more than 21 million coins, and the vast majority of them have already been minted. In theory, this should make Bitcoin a solid hedge against inflation in other assets and currencies.

- Cryptocurrencies can serve many of the same purposes as old-school fiat currencies but with the benefits of an all-digital infrastructure. Transactions tend to be faster and carry lower fees, contracts can be automatically managed by computer systems, anyone can read the encrypted transaction ledger, but the transaction record can never be altered, and more. These upsides should inspire rising Bitcoin demand in the long run.

- Financial giants like BlackRock are only dipping their toes in the crypto waters so far. If and when digital assets become a standard tool in the financial tool belt, institutional investors could add a ton of price-boosting demand to the Bitcoin market.

- Some of the top names in investing see fantastic price gains in Bitcoin's future. ARK Invest leader Cathie Wood, for example, set her "Bitcoin in 2030" price target at $1.5 million in December 2023 and $3.8 million five months later.

But there are no sure-thing gimmes in investing, and especially not in the volatile cryptocurrency sector. There are risks aplenty in this newfangled asset class.

The crypto-driven economy might never take off. When it does, another digital currency might have stolen Bitcoin's throne. This blockchain has a perfect security record so far -- but what if future innovations can crack that cryptographic shield? And even investing giants like Cathie Wood can be wrong. Warren Buffett wants nothing to do with Bitcoin and cryptocurrencies, and it's hard to argue with the greatest investor in modern times.

So, there are solid reasons to buy Bitcoin today, but they're balanced against equally reasonable reasons to stay away. The more you read up on how Bitcoin works, the better you'll know where you stand on that scale of enthusiasm and skepticism.

Related investing topics

The bottom line on Bitcoin

Investing in Bitcoin represents a unique opportunity in the evolving landscape of digital currencies. As you've seen throughout this guide, Bitcoin combines the familiarity of traditional asset trading with the novel benefits and challenges of a decentralized digital currency. From its capped supply, making it a potential hedge against inflation, to the increasing interest from institutional investors, Bitcoin offers several appealing financial dynamics.

However, as with any investment, it comes with its share of risks. The volatile nature of cryptocurrencies, potential regulatory changes, and technological threats to security are factors that must be carefully considered. The diverging opinions of leading investors -- ranging from Cathie Wood's optimistic forecasts to Warren Buffett's skepticism -- illustrate the broad spectrum of perspectives on Bitcoin's viability as an investment.

Before deciding to invest in Bitcoin or any other cryptocurrency, you should do thorough research, considering your financial goals and risk tolerance. The digital currency market is still maturing, and while it promises significant returns, it also entails risks that are not present in more traditional investments. Many investors will simply be happier owning stocks instead.

As the digital world continues to evolve, Bitcoin remains at the forefront of the financial revolution, offering both opportunities and challenges. Whether Bitcoin is the right investment for you depends on your willingness to engage with this complex but promising market.

FAQ

Investing in Bitcoin FAQ

How do beginners invest in Bitcoin?

It's easy to start a crypto-trading account on platforms like Coinbase. After that, the first trade is just a couple of clicks away. If that's too much work, you can get an almost identical exposure to Bitcoin by investing in spot Bitcoin ETFs through your stock brokerage account instead. That way, it will work just like buying a stock that just happens to be 100% invested in owning Bitcoin.

How much do I need to start investing in Bitcoin?

Not much. For example, Coinbase doesn't require any funding when you open a new account, and the minimum trade it will handle is $1. Meanwhile, the smallest slice of Bitcoin you can buy, called a Satoshi, is worth a fraction of a penny.

What is the ticker for Bitcoin?

In financial data systems and crypto trading platforms, Bitcoin's official ticker symbol is BTC.

Where can I buy Bitcoin?

There are many cryptocurrency trading platforms available these days. The leading brokerages include Coinbase, Robinhood (NYSE: HOOD), Binance, Kraken, and Uphold. For spot Bitcoin ETFs, any stock-trading brokerage will do the job.

Do I need a crypto wallet to buy Bitcoin?

Yes, but the wallet is created automatically when you open a new account with any respectable crypto brokerage. You can take more direct control over your crypto wallet in many ways, though most settle for the default digital wallet option.