Cryptocurrency has moved into the mainstream as an investment asset class. If you're looking to add some to your portfolio, it may be difficult to figure out how to get started. Crypto is currently unregulated, and investing in it can feel more Wild West than Wall Street. Read on to learn the basics of cryptocurrency and how to get started investing in it.

What is it?

What is cryptocurrency?

Cryptocurrency is a type of digital currency that doesn't rely on a central authority to verify transactions or create new units. Instead, it relies on cryptography to prevent counterfeiting.

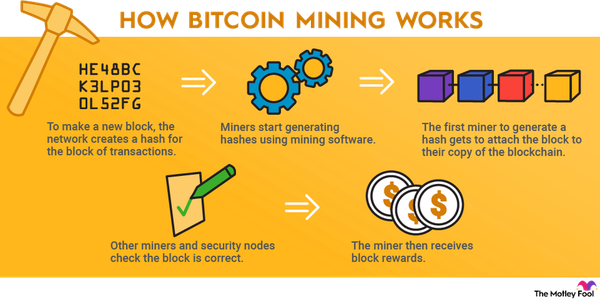

Blockchain technology supports cryptocurrency. A blockchain consists of individual blocks of data that can contain information about anything, such as transactions made in a specific cryptocurrency. Each block of data references the previous block, creating a chain of blocks. The reference uses cryptography to ensure the chain remains immutable so hackers cannot change the data.

There are thousands of cryptocurrencies in existence right now. That's largely due to the ease of creating a new currency by using smart contracts. New coins can simply piggyback on an existing blockchain with a well-established network of computers verifying blocks.

How to pick one

How to pick a cryptocurrency to invest in

Before you jump right in and buy some coins or tokens just because somebody says they're a good investment, it will pay to do some research.

First, it's important to understand that picking a good cryptocurrency is not like picking a good stock. A stock represents ownership in a company that creates profits for its shareholders or at least has the potential to do so. Owning a cryptocurrency represents ownership in a digital asset with zero intrinsic value.

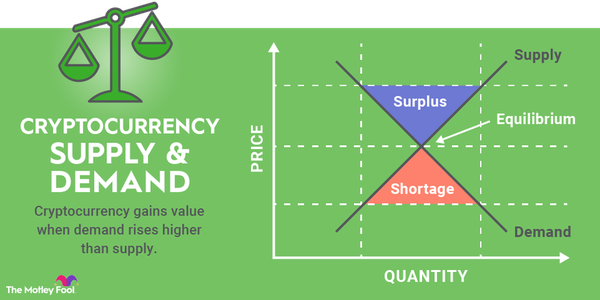

What causes a cryptocurrency's price to increase or decrease is simple supply and demand. If there's increased demand and a limited supply, the price goes up, and vice versa. So, when evaluating a cryptocurrency, the most important questions to answer are how the supply increases and what will drive demand for the coin higher.

You can answer those questions by reading the white paper that a cryptocurrency team publishes to attract interest to their project. Look at the roadmap for a project to see if anything could spark an increase in demand. Research the team behind a project to see whether they have the skills to execute their vision. Try to find a community of people already investing in the cryptocurrency and gauge their sentiment.

It's also important to consider how much money has already flowed into a cryptocurrency. If the market cap is already very high, there may not be much potential growth left. A high price will curb demand and increase supply as early investors look to take money off the table.

How to invest

How to invest in cryptocurrencies

Once you've found a cryptocurrency you think will make a good investment, it's time to start buying. The first step is to open an account with a cryptocurrency exchange.

Most stock brokers don't support trading in cryptocurrency. Coinbase (COIN 1.75%) is one of the most popular and beginner-friendly exchanges in the U.S. Other options include Gemini and newer brokers, such as Robinhood (HOOD 3.76%) and SoFi (SOFI 2.13%), which also support crypto. Just be sure the exchange you want to use supports the cryptocurrency you want to buy.

Once you've funded your account with fiat currency, you can place an order to buy your cryptocurrency. Orders on an exchange work the same way as orders in the stock market. The exchange will match your buy order with someone making a sell order at the same price and then make the trade. Once your trade is complete, the exchange will hold your cryptocurrency in a custodial wallet.

Alternatively, new exchange-traded funds (ETFs) allow you to invest in certain cryptocurrencies through your regular brokerage account. You can buy an ETF just like you would buy a stock in most accounts, including individual retirement accounts (IRAs).

Buying cryptocurrency is the easy part. As a crypto investor, you have to be prepared for volatility. Crypto is generally more volatile than traditional asset classes such as stocks. Price swings of 10% or more in just a few hours are very common.

You should also consider how much of your portfolio you ultimately want to allocate to a specific cryptocurrency and the asset class in general. Given crypto's volatility, you should give yourself wide bands of acceptable allocations. If your investments fall out of those bands, be sure to rebalance.

Pros and cons

Advantages and drawbacks of investing in cryptocurrency

As with any investment vehicle you choose, there are pros and cons, and some depend on the investor's risk tolerance and investment timeline.

Advantages

Diversification: A cryptocurrency's value doesn't appear to be correlated with the price of stocks, bonds, or other asset classes. That said, cryptocurrency has existed only for a little over a decade, so the data is limited in this regard. Theoretically, though, it makes sense that the price of crypto is unrelated to the price of traditional assets.

Return potential: Cryptocurrency has produced extremely strong returns as adoption increases. Most people agree that the expected return for a sound cryptocurrency investment is greater than that for stocks.

Additional utility: Unlike stocks, some cryptocurrencies provide utility. Bitcoin (BTC -0.95%), for example, can be used to pay for goods and services. Other tokens may provide access to projects or discounts on a project's services.

Disadvantages

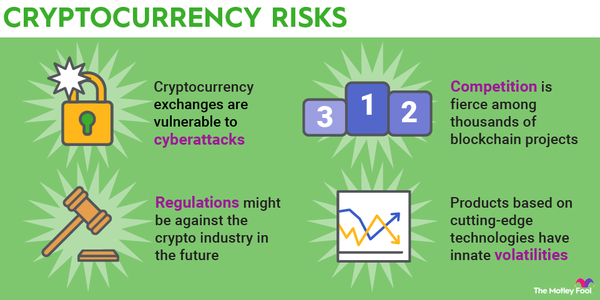

Limited regulation: There's limited regulation in the cryptocurrency industry, which means you don't have the same protections you do when investing in the heavily regulated stock market. If your account gets hacked, for example, you could find your investment completely gone without any recourse.

If the coin you invest in turns out to be a scam, there's nothing you can do. Furthermore, increased regulation may decrease the demand for some cryptocurrencies, adding risk to the investment.

High volatility: Cryptocurrency prices can swing wildly on a day-to-day basis. Such massive volatility can be hard for some investors to stomach.

Top cryptos

Top cryptocurrencies to consider as a beginner investor

As a beginning cryptocurrency investor, you shouldn't try to find a diamond in the rough. First, you should get your feet wet with more established cryptocurrencies that have built-out networks to support them. That will allow you to get more familiar with the mechanics of cryptocurrency investing and how it fits into your portfolio.

Bitcoin is an easy place to start. Every cryptocurrency exchange will support trading in Bitcoin. You can also buy a Bitcoin ETF through your brokerage account. It's well-established, and you know what you're getting with Bitcoin.

It's nothing fancy -- just digital cash -- but Bitcoin's first-mover advantage has made it widely adopted. That gives it a competitive advantage when it comes to actually being usable as a medium of exchange.

Ethereum (ETH -1.18%) is also a good choice for beginner investors. There are several ETF options, and almost every exchange will support Ether. Ethereum's technology is behind most decentralized finance (DeFi) projects, which use the Ethereum blockchain to execute smart contracts and provide financial services without a central authority.

Anytime a user wants to write a smart contract to the blockchain, they'll have to pay Ether to do so. Increased adoption of DeFi applications will lead to greater demand for Ether.

A third option for beginner investors is Solana (SOL -0.53%). Solana is a growing alternative to Ethereum's blockchain. The team behind Solana aims to offer faster speeds and lower transaction costs.

It's climbed in recent years due to meme coin transactions taking place through decentralized exchanges operating on Solana's blockchain. While that might not be a sustainable force, the technology behind Solana is strong enough to compete with Ethereum long term.

Related investing topics

Making money

Making money by investing in cryptocurrencies

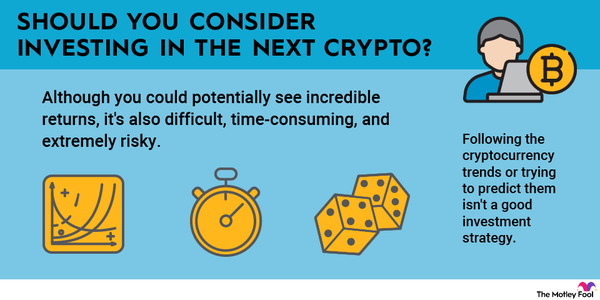

Investing in crypto requires you to do your research and be confident enough in your investment to hang on during what's sure to be a wild ride. The payoff could be worth it if you can do that since the expected returns are higher than most other asset classes.

FAQ

Investing in cryptocurrency FAQ

Is crypto a good investment?

As with most things in personal finance, the answer is, "It depends." Crypto may be a good investment for those who can stomach the volatility and understand what they're buying. It's important to research the cryptocurrency you're looking to invest in to avoid big losses.

What is the best cryptocurrency for beginners?

The best cryptocurrency for beginners to invest in is Bitcoin. It's one of the most simplistic cryptocurrencies in the market, and its wide adoption gives it staying power. It can be a great introduction to learning more about cryptocurrency and testing how much volatility you can stomach.

How much money do you need to invest in crypto?

Most cryptocurrency exchanges require a minimum deposit of $5 or $10. You can buy a tiny fraction of most cryptocurrencies, but you must also be aware of transaction fees that could eat into your principal investment. Some brokerages will allow you to buy a fractional share of a cryptocurrency ETF with as little as $1 and no commission.

Adam Levy has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Cardano, Coinbase Global, and Ethereum. The Motley Fool has a disclosure policy.