Cryptocurrency investing can be a wild ride. For the best chance of success, it's important to think not just about buying but also when to sell crypto. Despite the popular advice to "hodl" (hold on for dear life), there are situations when selling is the best option.

When investing in stocks, a good rule is to buy and hold for at least five years. Crypto is an entirely different and much more volatile market, so the traditional rules don't always apply. Keep reading to learn how to know when to sell crypto and the factors to consider in this decision.

When to sell

When should you sell crypto?

Here are the situations when you should consider selling a cryptocurrency investment:

The value has doubled or tripled since you bought it

If your investment has shot up in value, you should probably sell at least a portion of it. For example, you can sell what you originally invested, and then play with house money.

Because of crypto's volatility, profits can disappear quickly. Take at least some of your profits as a hedge against potential losses in the future.

You no longer believe in its long-term success

Part of investing in crypto is knowing when to cut your losses. This can be difficult since people are often very passionate about the cryptocurrencies they buy. That's why it's important not to get overly attached to any project. Here are a few signs that a cryptocurrency may be on the way down:

- Development has slowed down or stopped entirely.

- There has been a recent string of negative news about it.

- You have doubts about the management team.

- The community that supports it is getting smaller and smaller.

You've found better investment opportunities

Cryptocurrencies and blockchain technology are advancing rapidly. When Litecoin (LTC -0.32%) launched in 2011, it was a dramatic improvement on Bitcoin (BTC -0.95%) in terms of transaction processing. Since then, plenty of new cryptocurrencies have left Litecoin in the dust.

If other cryptocurrencies have surpassed one of your current crypto holdings in a key area, it makes sense to sell. You can get out before it loses too much ground and free up cash to invest in something better.

You want to rebalance your portfolio

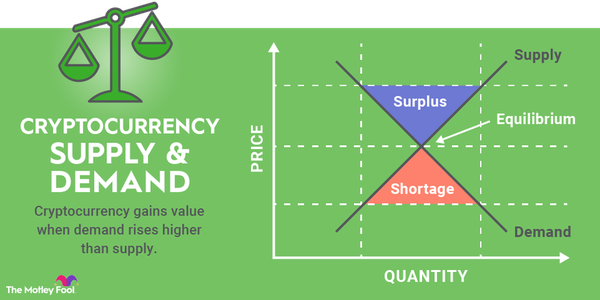

Because of its volatility, cryptocurrency shouldn't make up too much of your portfolio. A good rule of thumb is to have no more than 5% to 10% of your investments in crypto.

If your portfolio has gotten too crypto-heavy, it could be time to pull back. You may also want to sell some of it if you simply want to shift your investments to more conservative assets.

When to hold

When you shouldn't sell crypto

Selling crypto shouldn't be an emotional decision. While this is true with any type of investment, it's especially important to remember with cryptocurrencies, since they can go through such massive ups and downs.

One of the most common mistakes that crypto investors make is panic selling when prices have dropped. It's often a decision they regret later. They buy when a cryptocurrency is at a high, sell when the price plummets, and then miss out if it bounces back.

Before you make any rash decisions, consider why the price has dropped. Is it a serious issue with that crypto or just the whims of the market? It's certainly fine to sell if you no longer believe the cryptocurrency is a good investment. But if you still think it has long-term value, hang on to it.

Things to consider

Things to consider before selling crypto

Here are the most important things to consider before selling crypto:

How much will you sell? You don't need to sell everything, especially if it has increased in value. You can sell a portion of your holdings to rebalance your portfolio and hang on to the rest if you still think the cryptocurrency will be a winner.

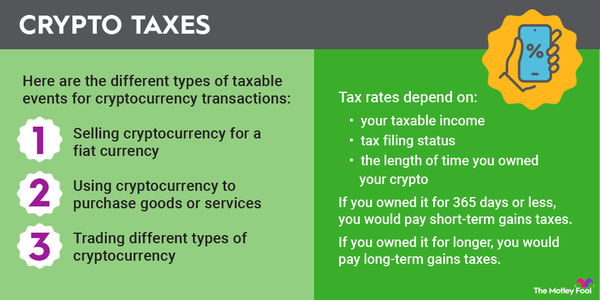

What are the tax implications? If the cryptocurrency has increased in value, you'll owe crypto taxes. It's taxed as long-term gains if you hold the crypto for more than 365 days.

Long-term capital gains have lower tax rates than short-term gains, which are taxed as ordinary income. If you're close to the year mark, consider waiting to sell your crypto until after it passes that long-term gains threshold.

Things to consider before buying crypto

Here are the most important things to consider before buying crypto:

What makes this cryptocurrency a good investment? It's easy to get swept away by the hype surrounding a popular cryptocurrency. Whenever you invest in a cryptocurrency, make sure you've researched it thoroughly and that you believe it's a sound long-term investment.

How much will you invest? Putting your entire life savings in crypto is a bad move. To avoid taking on too much risk, stick to the guideline of 5% to 10% of your portfolio in crypto at most. Start by figuring out how much you'll put into it as a whole, and then decide how much money you'll allocate to specific cryptocurrencies.

What are your long-term plans with your crypto portfolio? You may decide to hold anything you buy for at least five years to see what happens. Another popular strategy is setting price targets for when you sell. For example, you could sell 20% of your holdings if the price reaches a certain target, 40% at another price target, and so on.

Related investing topics

Should I buy?

Is now a good time to buy and hold cryptocurrency?

Yes, now is a good time to buy and hold cryptocurrency. The key is to pick quality cryptocurrencies with legitimate uses because they have the best chance of long-term success.

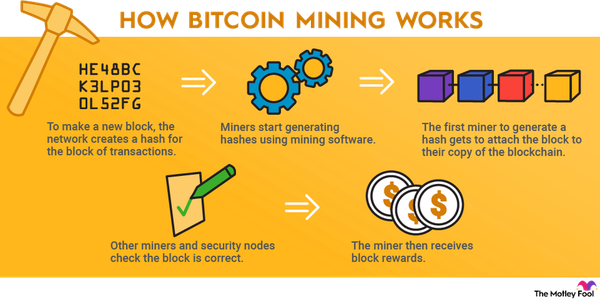

Two recommendations for new investors are the two coins at the top of the market, Bitcoin and Ethereum (ETH -1.18%). Bitcoin leads the crypto market as a whole and has become popular as a digital store of value. Ethereum launched the first programmable blockchain. It's now the most popular option for decentralized finance (DeFi) platforms that provide an alternative to traditional financial services.

If you're looking for cryptocurrencies that aren't quite as well-known, here are a few more options:

- Solana (SOL -0.53%) is a high-performance blockchain that competes with Ethereum. It's built for speed and is reportedly capable of processing more than 50,000 transactions per second.

- Thorchain (RUNE -0.56%) is a decentralized liquidity protocol. It allows users to connect their crypto wallets and trade digital assets with no centralized exchange required.

- Artificial Superintelligence Alliance (FET -1.03%) is a collaboration among three cryptocurrency projects that leveraged artificial intelligence (AI) technology: SingularityNET, Fetch.ai, and Ocean Protocol.

There are plenty of other worthwhile cryptocurrency investments available, including other coins and cryptocurrency stocks. If you spend some time researching, you can find quality investments to buy and hold.