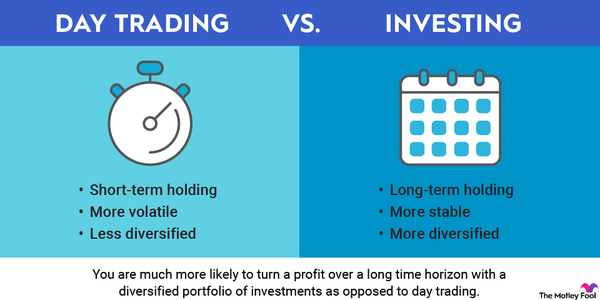

Investing is one of the best ways to increase your money over the long term and achieve your financial goals, but you shouldn't approach investing with the expectation of getting rich quickly. History shows that the most dependable way to create wealth is to take a long-term approach.

The stock market can gain and lose value in unpredictable ways, but the best way to cope with volatility is to have patience. A patient investing approach prioritizes buying and holding quality companies for the long term. This is how long-term investors accrue significant monetary gains -- without spending overwhelming amounts of time sweating over their portfolios.

Strategies

Long-term investment strategies

Taking a buy-and-hold approach to investing is both the simplest and most dependable way to achieve substantial portfolio returns. While most investors are best served by buying and holding stocks for the long term, the approach still leaves plenty of flexibility regarding which individual companies and investment themes to prioritize. Here's a breakdown of core long-term investing strategies you can implement.

1. Growth investing

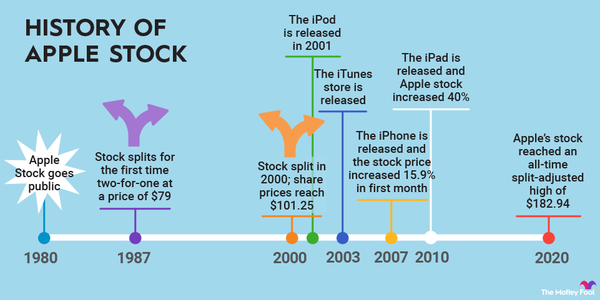

This approach focuses on companies that are expanding their businesses at fast rates and appear primed to continue generating impressive results. Sometimes, growth-oriented companies aren't yet profitable or post small earnings, but the best companies display signs of substantial momentum and have high potential to increase their sales and earnings over time. Outsized growth can translate into big gains for a company's share price.

2. Value investing

This investing strategy centers on buying the stocks of companies that seem undervalued based on fundamentals such as revenue, profit margin, and competitive strength. Value-oriented strategies concentrate on buying stocks priced at low multiples of earnings or sales or those that pay attractive dividends. These tactics can reduce your investment risk while still creating opportunities for impressive portfolio gains.

3. Dividend investing

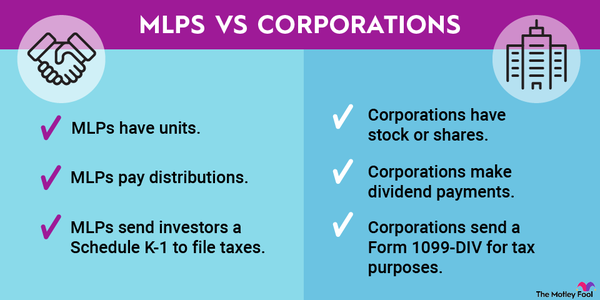

This investing approach prioritizes owning stocks that return value to shareholders in the form of regular cash dividends. A dividend-oriented strategy is often associated with value investing because it's less common for growth stocks to pay dividends. However, as a dividend investor, you can still choose to take a growth-focused approach by investing in companies that seem likely to continue increasing their dividends.

Dividend investing can be strongly oriented toward long-term investing by having all dividend payments automatically reinvested. Most brokerages can automate a dividend reinvestment plan (often abbreviated as DRIP), enabling you to harness the power of compounding. Using dividend payments to purchase more stock creates a virtuous cycle by increasing the number of shares in your portfolio that pay dividends. In turn, this increases the amount of dividends you receive. Over time, you can purchase more shares using only dividends.

Many investors opt for a mixed approach to portfolio construction, choosing to add a combination of growth, value, and dividend stocks. Each of these categories has something to offer a balanced portfolio.

Compound Interest

4. Dollar-cost averaging

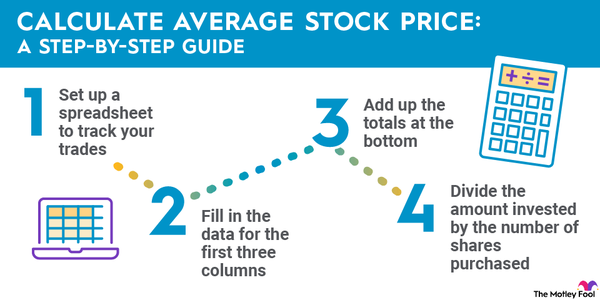

In addition to using growth, value, and dividend investing strategies for portfolio construction, investors can also take strategic approaches to how they buy stocks. A dollar-cost-averaging strategy involves making stock purchases at regular intervals over a long period of time instead of making large purchases all at once. As opposed to trying to precisely time the broader market or base purchases around specific stages or events in a company's business cycle, dollar-cost averaging offers a way to minimize exposure to volatility and risk.

5. Let winners keep winning

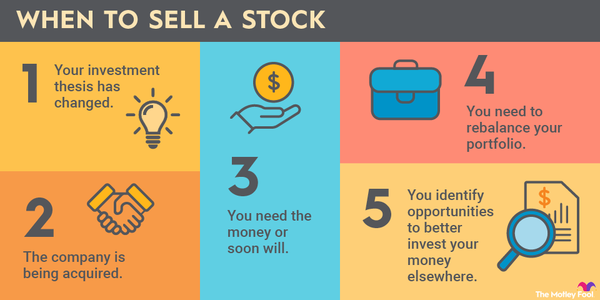

Knowing when to sell a stock is important even with a long-term approach to investing, but you shouldn't be too eager to take profits on strong performers. Just because you've achieved strong returns with a stock over a five-year holding period doesn't mean you should sell it. The next five years could be even better.

All companies will have their ups and downs, but strong businesses tend to keep winning over time, and competitive advantages and market opportunities can become even more pronounced and profitable if given time to flourish. Not every stock you buy will be a winner, but holding on to just a handful of strong performers will often more than make up for disappointments along the way. As famously successful investor Warren Buffett has said, "The weeds wither away in significance as the flowers bloom."

Let your winners run. High.David Gardner, co-founder of The Motley Fool

Being a Foolish investor

Being a Foolish investor

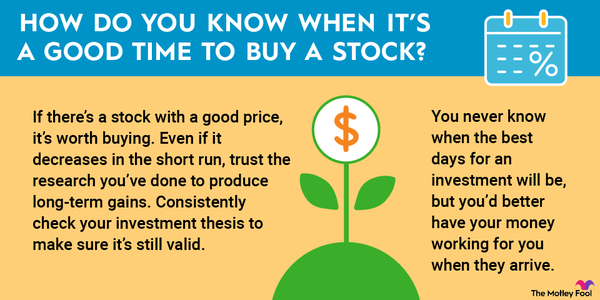

Market values always fluctuate and are essentially impossible to predict with certainty. As such, The Motley Fool's investing philosophy eschews attempting to time the market and instead focuses on finding investments that can stand the test of time. Instead of trying to predict when the next crash or big bullish run is coming, investors are best advised to invest in companies with meaningful competitive advantages, strong management teams, and viable paths to long-term success.

Realistically assessing your risk tolerance is another Foolish component of long-term investing success. Some investment strategies may take longer than expected to generate profits -- and not every stock you buy will be a winner. If you're a younger investor, you might be comfortable investing in many relatively risky growth-oriented stocks. However, if you are retired or getting ready to retire, your risk tolerance is likely quite different.

If you depend on your investment portfolio to help support you in your nonworking years, then any sharp declines in your portfolio's value are much more significant. Younger investors are more often growth investors, while older investors are more often value or dividend investors.

Portfolio diversification can be beneficial no matter how much money you're investing, but it becomes increasingly important as you invest larger sums. Putting most or all of your money into a single stock can be catastrophic for your portfolio's value if the stock's price plummets. It could take years to recover the money you lose, or it may never be recovered. Spreading your investment dollars among many different assets in many different industries is key to reducing your investment risk.

Any company in which you invest should have a high-quality business and trade at a valuation that leaves room for long-term growth. If you understand a particular sector well and are knowledgeable about the current developments in the space, then it makes sense to invest more of your money in the sector. Investing in industries that you deeply understand makes you more likely to identify relevant developments ahead of most other investors.

Foolish

Retirement planning

Investment strategies for retirement

A patient, well-informed approach to investing can put you on the path to financial freedom and significantly improve your quality of life in retirement. Specialized retirement accounts are some of the most popular investment funds that can help you achieve your financial goals.

Money that you contribute to tax-deferred retirement accounts, like most 401(k)s and individual retirement accounts (IRAs), reduces your taxable income for the year, although you must pay taxes on distributions received in retirement. Roth retirement accounts don't confer immediate tax breaks but, instead, enable you to receive tax-free distributions in retirement.

Both types of retirement savings accounts have tax advantages. Tax-deferred accounts are best suited for people who expect to be in a lower tax bracket in retirement than they are today, while Roth accounts are preferable if you expect to be in a higher tax bracket when you retire.

Some employers offer contribution matching programs for 401(k)s and other retirement accounts. Taking full advantage of employer matching as early in your career as possible can significantly improve your investing performance over time and put you in a much better financial position in retirement. If you can afford to invest money to benefit from your employer's retirement matching program, then your goal should be to maximize the matched contributions -- e.g., the free money received from your employer.

Even if you follow all of the above advice, you always accept risk when you invest money in the stock market. But it's worthwhile because not doing so actually guarantees that you lose money as inflation erodes the value of your cash. Don't delay -- make today the day you start increasing your wealth and building a path to long-term financial prosperity.

Related investing topics

Long-term investment strategies simplify the stock market

An incredibly vast range of factors can shape pricing trends for individual stocks and the broader market. In the short term, it's possible that a company will deliver great business performance but still see its share price decline due to pressures shaping the stock market at large. However, if the company continues to serve up strong results, chances are good that its stock will eventually cut through market volatility and post strong returns. Long-term investment strategies help minimize the significance of the unknowable, and using these simplification tools can mean less stress and better performance for your portfolio.

Long-term investing FAQ

Which strategy is best for long-term investment?

There's no single, one-size-fits-all approach that is definitively the best strategy for long-term investing. For most investors, taking a balanced approach that focuses on identifying high-quality businesses and incorporates both growth and value investing strategies is the best bet.

Using tools and approaches, including dividend-reinvestment plans and dollar-cost averaging, can also help you find success with long-term investing. Additionally, investors should calibrate their approach with their stage of life in mind. For example, it will usually make sense to pursue lower-risk strategies if you are investing in or for retirement.

How to get 10% return on investment?

Achieving a 10% return on an investment will hinge on how quickly you aim to hit that target and how much risk you are willing to take on.

If you own a diversified portfolio of stocks backed by high-quality businesses, your chances of reaching and exceeding a 10% return on investment over time are quite good. Similarly, buying an exchange-traded fund (ETF) that tracks the S&P 500 will also give you a good chance of hitting that target, given enough time.

The average annual return for the S&P 500 index over the last 100 years is actually above 10%. But investors should keep in mind that past performance does not dictate future results. It's possible that the broader market or your own portfolio of stocks will go through periods of poor performance after you have made your investments. The potential for near-term market volatility is one of the reasons why it's best to approach investing with the long term in mind.

Which type of investment is best for the long term?

While there's no clear-cut answer for which type of long-term investment will perform best in the future, the U.S. stock market has outperformed virtually all other investment categories over the last century.

What is a long-term investment strategy?

A long-term investment strategy is an approach to investing that prioritizes long-term performance over the potential for short-term gains. Rather than trying to predict how an investment will perform over days, weeks, or months, long-term investing strategies pan out over years and prioritize opportunities that have the potential to deliver strong returns even if there is substantial valuation volatility in the near term.